Technical Edge —

NYSE Breadth: 22% Upside Volume

NASDAQ Breadth: 31% Upside Volume

VIX: ~$28.50

Now it’s Q3, July 1 and the day before a three-day holiday weekend. Everyone, please take these three next three days to recharge and get ready for a new quarter.

“You do you” and enjoy some extra time this week. Take today off if you want. It’s important to recharge the trading batteries.

Game Plan: S&P 500 (ES & SPY), Nasdaq (NQ & QQQ), Dollar

S&P 500 — ES

The ES overshot our 3705 “sell” zone a bit, but ultimately, the bears held where they needed to. Now it kinda looks like it’s in no man’s land.

On the plus side, it continues to hold the 61.8% retrace, near 3755, which was our downside target area yesterday. If we lose 3755, the 3741 to 4745 area is in play (which is yesterday’s low and the Globex low).

A break of this zone that isn’t reclaimed puts 3705 in play.

On the upside, the bulls need to reclaim 3800, then 3820 to 3825. The latter zone is where we’ll find the 10-day moving average and that has been resistance over the past few days. Above it puts 3845 in play.

It’s been a chop-fest the last four days, making it tough to “lean” one way or the other. The bulls keep preventing the ES from completely rolling over, but they are not doing so in convincing fashion. So be sure to just go level to level.

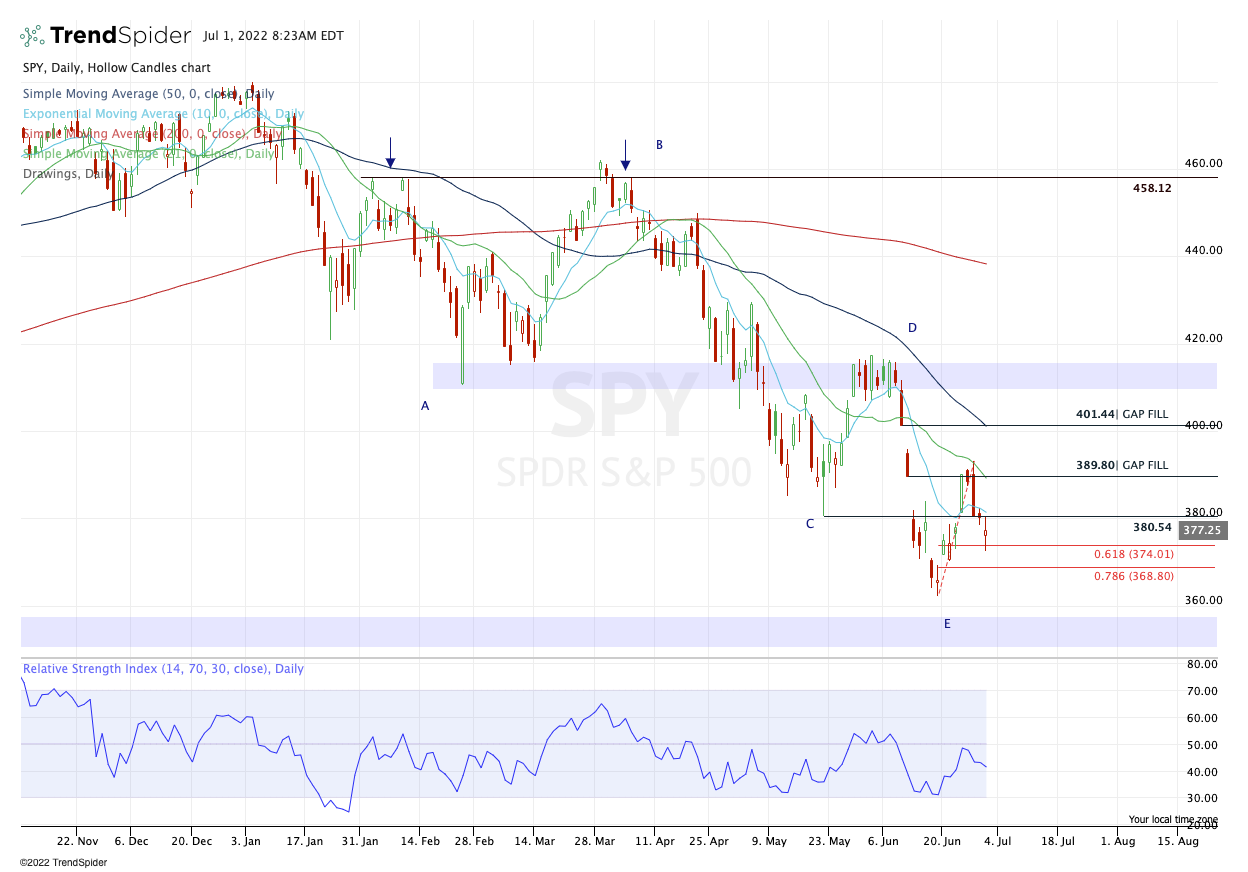

S&P 500 — SPY

After four choppy days, there’s not much actionable insight on the SPY at the moment. It’s a crystal clear setup on the daily chart though.

Bulls need $380.50+ and bears need sub-$374.

The one thing I will say is that, if the bulls can actually hold the 61.8% retrace of the recent rally (like they did on Thursday) and rotate higher, we could be looking at a larger move to the upside.

Of course, that flies in the face of this year’s trend though, so I’m not holding my breath. It’s something to be aware of, though.

Nasdaq — NQ

The NQ has been dancing all around 11,564.

Now acting as a ceiling in the Globex session, continue to keep an eye on this mark. A move above that could open the door up to the 10-day, near 11,700.

On the downside, 11,350 to 11,380 is critical support. A break and failure to reclaim it could open the door to more downside.

MRK

The next two names are off the individual stock post I sent out yesterday.

I’m not trying to get too cute with the individual stock trades, but with a VIX that continues to persist near $30 and amid a bear market…yeah, I’m being picky. I’m trying to thread the needle and am fine with walking away from a setup if it’s not good enough.

For MRK, the stock is set to open below yesterday’s low of $90.91. I hope it does and I hope it tags the 10-day.

If it can do that, I will be long on a move back up through $91.

If the setup triggers, conservative bulls will use a stop-loss around $90 or the LOD. Aggressive bulls can use a stop as low as $88.75.

On the upside, I would like to see $94 to $95 as the first target.

DG

$243 has been clear support the last three days. A dip below and tag of the 10-day could get us the same setup as MRK.

Ideally, DG will hold $240.

$250 is the first upside target.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

The VIX remains stubbornly high, which really creates a tough situation for trading individual stocks. Despite that, we continue to carry two “stress-free” trades and have had some luck with others by securing some profit and getting stopped out at our entry (break-even).

DXY / UUP — Still carrying ¼ of the original trade (cost basis: $27.20). On the upside, I’m still looking for $28.20+ to trim more.

$28.50 to $28.65 is the next meaningful upside target.

On the downside, we will operate against a B/E stop-loss

MCK — We have hit two trim zones so far on MCK. Feel free to cash the last ⅓ of the position as you see fit. $335 to $340 is a potential upside target if it continues higher. Moving stop-loss up to $315

Relative strength leaders (List is cleaned up and shorter!) →

*Look at the strength in health care*

BMY

MRK

ABBV

UNH

JNJ

XLE

CLR

VRTX

DG

IBM

MCK