Technical Edge

NYSE Breadth: 34% Upside Volume

NASDAQ Breadth: 33.5% Upside Volume

We need to keep perspective of two things: The trend and the environment.

The trend has gone from “buy the dips” to “sell the rips.” That won’t always be the case and we shouldn’t be bearish at every turn. But my point is rather simple. We have enjoyed a 10+ year bull market where each dip was gobbled up.

For the time being and as I have been saying, that trend is nowhere to be found right now. They are selling the notable rallies and until that changes, we won’t either.

On the other side of things, the environment is a mess. We mentioned oil and gold, but the VIX is consistently above $30, which means the moves can continue to be wild and unpredictable. To counteract it, understand these four things:

Take smaller position sizes

Cut your losses when wrong

Have a plan

Only focus on A+ setups

Game Plan

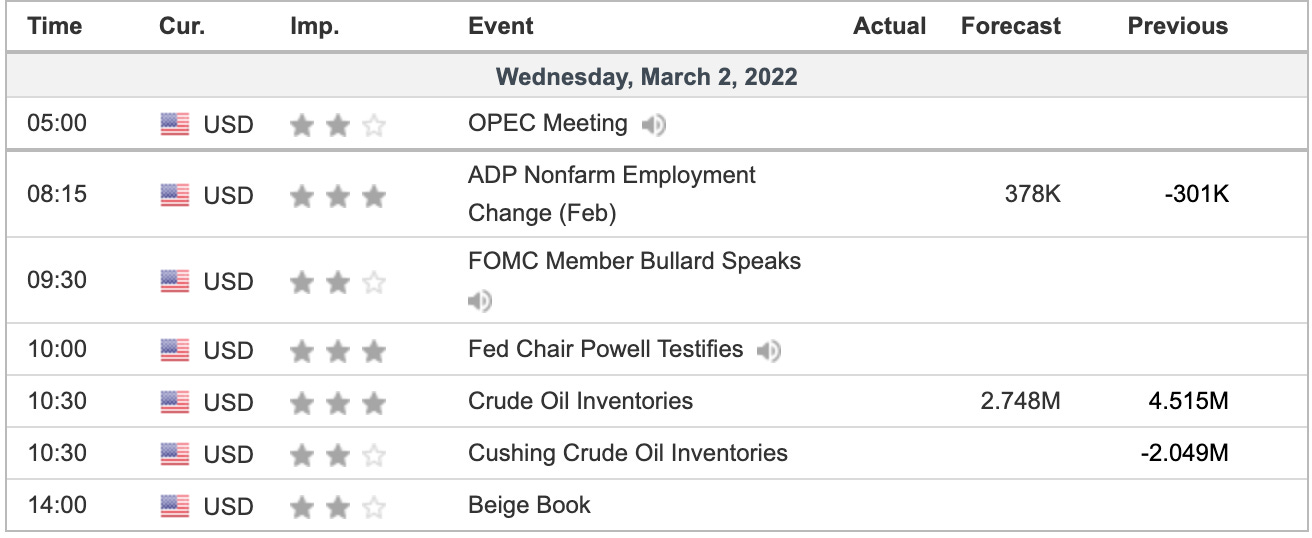

Today we have the ADP jobs report and the Powell testimony at 10:00. That testimony will continue tomorrow and we’ll also get the ISM report that day. On Friday, it’s the jobs report.

In other words, combine these reports/events with a $30+ VIX and these next few days will surely have some wide ranges.

My focus remains on two things: Gold and the S&P 500.

We have been navigating both pretty well and for now, they are my top focus over anything else. There’s one key level I’m watching the S&P and gold has paid out many dollars-per-ounce at this point. Let’s look.

S&P 500, Nasdaq, Gold, Individual Setups & Go-To Watchlist

Feel free to extrapolate this layout to the SPY.

Want to see ALL of the technical layouts?

Easy.

Just take a free trial.

Gain access with a free two weeks.