Technical Edge —

NYSE Breadth: 7.8% Upside Volume (!!)

Advance/Decline: 15% Advance

VIX: ~$20.75

What a weird session we came into yesterday. Despite a 92% downside day on the NYSE, the SPX declined just 1.8% on Monday. That’s hardly catastrophic, although some areas of the market were under more pressure than others.

Bonds fell, while the dollar and yields rose. The S&P lost active support in the process and now we move to our next set of downside levels.

We had a few stop runs yesterday on our open positions. It’s why we

Take profits along the way — aka, pay ourselves for taking the risk

Pay attention to the “change in tune” from the market when we go from having great setups and trimming into profit zones to having several stop-losses trigger in a row.

Traditionally, when I have several stops triggered on the same day, it’s a day for me to “listen to what the market is saying.” Maybe the S&P will find its footing and we’ll rotate higher. But it’s possible conditions will become choppier ahead of next week’s CPI reading and the Fed.

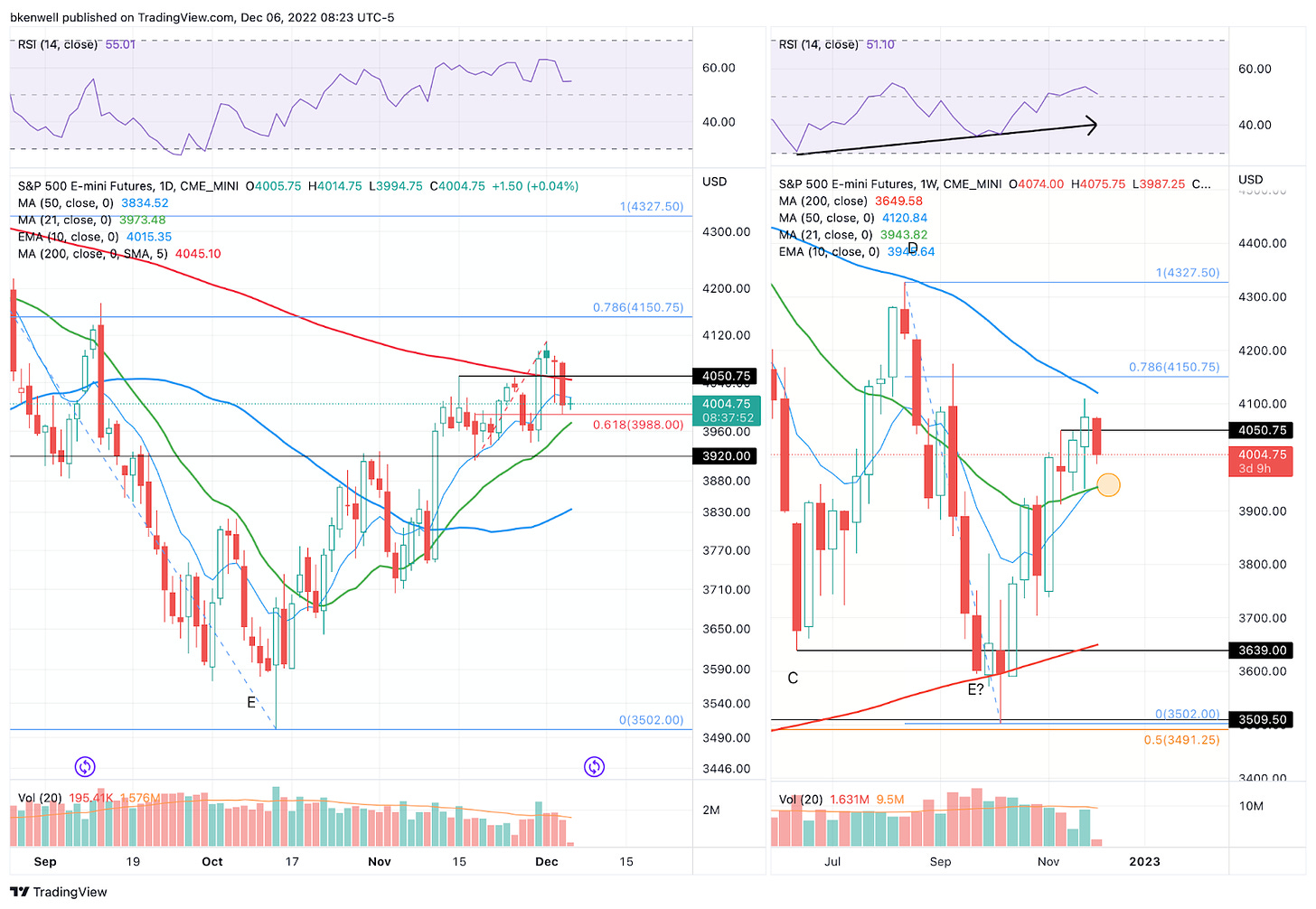

S&P 500 — ES

3988 is the 61.8% retrace of the current range, which held as support late yesterday.

You may notice how nicely the 3940 to 3950 buoyed the ES from mid-November on. So if the ES breaks 3988 and doesn’t hold the 21-day moving average, then this area could be back in play.

If you are a multi-timeframe trader like me, you’ll also notice that ~3940 is where the 10-week moving average is crossing up through the 21-week sma and both are advancing rather than declining.

On the upside, I think we need to consider 4050 as potential resistance (again), which is a multi-week resistance mark (excluding a few days last week). It’s also where we find the 200-day.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.