A Day of Potential Reversals: AMD, NVDA, PYPL

I don't like to fade strength, but these charts are worth watching.

Monday’s execution was pretty similar to what our game plan had outlined. The indices were sluggish and choppy, as we had several Fed speakers in the morning and with stocks up so much over the month. Breadth was choppy too, at slightly better than 50/50 for both the NYSE and the NASDAQ.

The S&P 500 is now up in 17 of the past 19 sessions and continues to grind higher. It was pointed out on Twitter that growth is beginning to outperform value. That has me wondering if growth stocks are about to make a bit of a comeback, especially with so much recent underperformance.

If that’s the case — and it’s a notable “if” — it could give us the next leg higher in the current bull market.

That said, some potential reversals are setting up on the charts after some rather large moves. Perhaps that could get us a much-needed rest in the broader market before a year-end push.

A Day of Potential Reversals

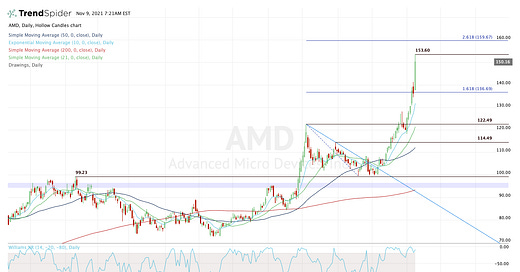

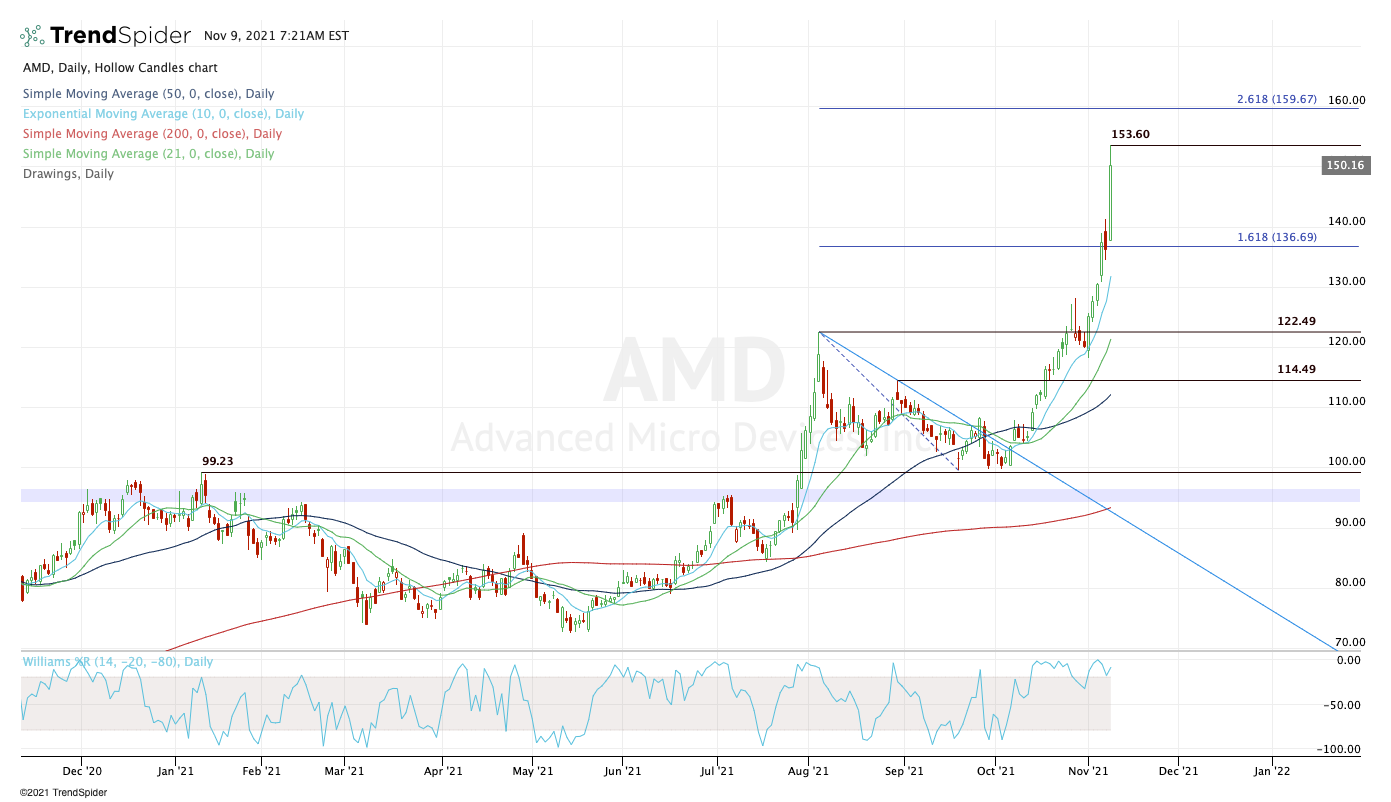

AMD

Both Nvidia and AMD have exploded higher and if we’re being honest, if the only thing any of our subscribers did was hit the AMD trade, they would be set for the quarter.

However, with shares trading ~$154+ in the pre-market, we do face the risk of a reversal.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.