A Lot to Juggle: Jobs Report, Earnings, Bonds, Weekly Options Expiration

We’ve got Apple and Amazon’s earnings out of the way, but it’s a bit of a mixed bag. Apple was slightly lower after its print, while Amazon is catching a nice pop. Earnings across the board remain mixed, but that discussion will be on the back burner Friday morning as the July jobs report comes into focus.

With the jobs report on deck and the weekly options expiration here, could we be setting up for some sort of rally? Can the 0DTE traders fuel an upside squeeze?

Down three days in a row on the S&P and with buyers showing their willingness to step in yesterday at some key levels has me thinking we could see a bounce.

While it’s too early to say the decline is over — after all, we’re still on a losing streak! — there are reasons to be on the look for a bounce.

As we spelled out earlier this week, I think we could have an intermediate-term decline/consolidation period. That’s as we take stock of all the mixed earnings reactions and pair it with the rising 10-year yield (which hit a new 2023 high yesterday) and seasonal weakness we tend to get from August and September.

Even if that’s the case, it doesn’t mean it will be a straight-down development.

The S&P has suffered a three-day peak-to-trough decline of ~103 points or 2.25% and the sellers look to be getting exhausted in the short term. Let’s see if the buyers can take advantage.

We have been talking about the pain in the bond market for a little while and now we see that Bill Ackman is betting against long-term bonds. Bonds may be short-term oversold, but could still have further to fall — particularly if yields keep rising.

Can we go down further? Of course we can. But there should be trade-able bounces along the way.

Technical Edge

NYSE Breadth: 42% Upside Volume

Advance/Decline: 36% Advance

VIX: ~$16 (hit $17.48 yesterday, it’s highest level since June 1)

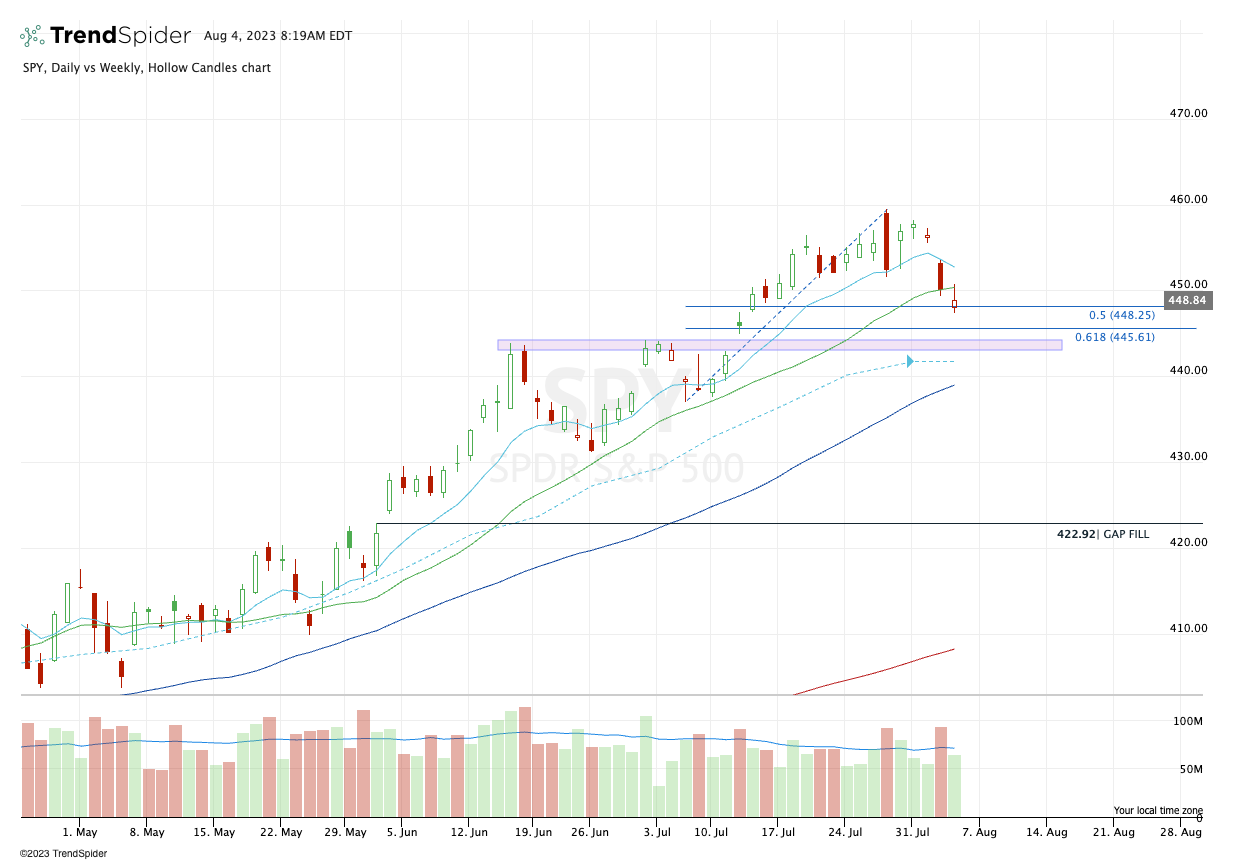

SPY

On the downside, bulls need to defend yesterday’s low at $447.37. On the upside, they want to take out yesterday’s high at $450.79, then ideally run the SPY up to the $451.50 level.

If the SPY can’t hold yesterday’s low, it could set up for some weakness down into the mid-$440s, as shown on the daily chart below:

Upside Levels: $450.75, $451.50, $453.50, $455.50

Downside Levels: $447 to $447.50, $444 to $445

SPX

Pivot: 4505

Upside Levels: 4520, 4528.50, 4545, 4546-50, 4565-67t

Downside Levels: 4480-85, 4470, 4555-60

S&P 500 — ES Futures

Below is the 1-hour chart, then the daily chart to zoom out and give a bit more perspective.

The 1-hour chart shows how the 4545 area has been resistance over the last two days, but how that zone sits just below the more vital area between 4550 and 4560.

If the ES can power through this area, it will be an impressive feat (especially once we look at the daily). If it can do so, it puts 4570+ in play.

On the downside, bulls would love to hold the 4515 to 4521 area. If they can’t, yesterday’s low could be on the table.

As we look at the daily chart, look at where resistance is coming into play and where support could come into play if we break yesterday’s low:

Upside Levels: 4548, 4550-60, 4570, 4582-85

Downside levels: 4515-20, 4506, 4493-4503, 4450-60

NQ

Bulls would love to break the NQ up over 15,562, potentially opening the door to 15,625, then ~15,700. Unless Apple plays ball though, that may be difficult today.

(If you look closely, look at that strong wick action from yesterday at the 200-unit moving average, prior breakout level and uptrend support (blue line)).

Upside Levels: 15,540-560, 15,625, 15,700

Downside levels: 15,450, 15,350, 15,275-300

TLT

The $95s held yesterday. If we can get a daily-up, maybe the TLT can make up some of these losses and put together a short-term bounce. If yields continue higher though, the TLT will see more pressure.

XOM

Still watching that monthly-up over $108.50. Note the 200-day moving average just above.

ARKK

Looking to re-engage ARKK if we get a dip into the $44.50 to $45.50 area. That’s a retest of the Q1 and Q2 highs, as well as the 10-week and 50-day moving averages.

~$47.50 would be the first trim spot. $42.50 is a wide stop, but perhaps the best one to use for traders who size small. For “right or right out” traders, $43.50 to $44 could be used as a stop.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

(Lack of updates here but these names remain my top focus list!)

Growth stocks ARKK — DKNG, DOCN, UPST, SHOP

LLY, CAH

Energy stocks — VLO, SLB, EOG

AI stocks — NVDA, AMD, AVGO, ADBE, SMCI

Mega cap tech — MSFT, AAPL, META, CRM

Select retail — CMG, ELF, LULU, COST

Homebuilders ITB — TOL, KBH, DHI

BRK.B

ABEV, DXCM

Cruise stocks — RCL, CCL, NCLH

DAL, DT, AMAT

Relative weakness leaders →

DIS → new 52-week lows

CF, MOS

PFE

EL, FL, DG

Open Positions

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.