Technical Edge

NYSE Breadth: 44% Upside Volume

Advance/Decline: 39% Advance

VIX: ~$14.50

The market is enduring a much-needed pullback. While we’re only looking at a two-day decline so far, it’s the reprieve that the S&P needed. A runaway bull doesn’t work well for most traders, IMO.

I wanted to make a note about the Fed and rates, seeing as though Chair Powell speaks today at 10 a.m. ET.

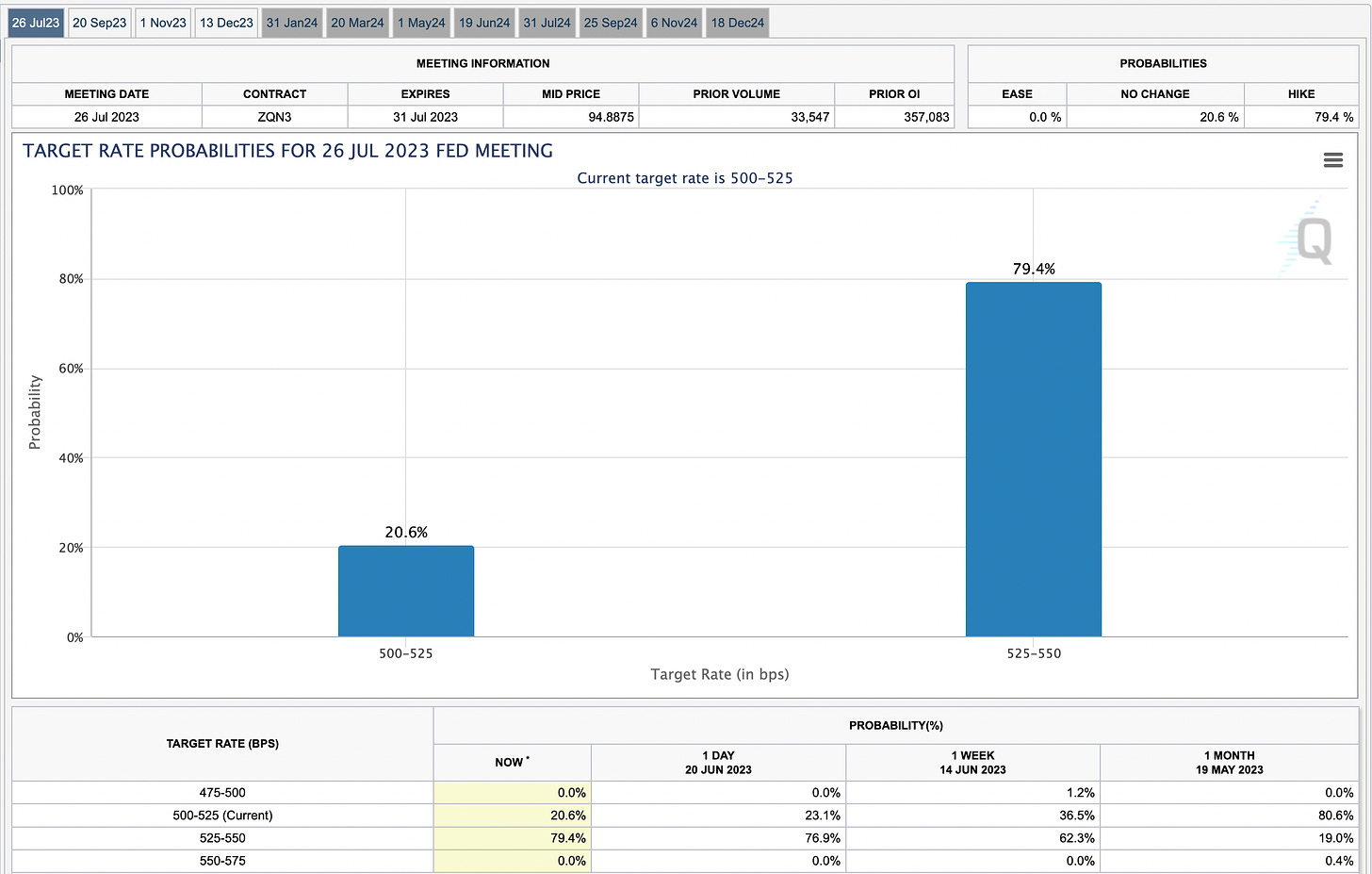

While many investors seemingly don’t believe the Fed at this juncture, the market is still pricing in an upside move for rates. For the July meeting, odds currently suggest a ~80% chance of a 25 basis point rate hike.

A week ago, that figure stood at just 62%. A month ago, just 19%.

The bigger question isn’t whether the Fed raises rates another quarter point. Instead, it’s are we nearly done with the rate hikes? Even if there’s one or two left, the consensus seems to be yes.

The way I see it is, the main risk is stubborn inflation/recession. If inflation is stubborn, it will force the Fed’s hand and “higher for longer” will persist, leaving us with a potential recession in the future. That said, the macro stuff is easy to get tripped up on, which is why I prefer to stick to the price action and the trends.

Not crazy to be on the lookout for an undercut of yesterday’s low to run some stops, then a potential bounce if we can reclaim that low.

Let’s look at the S&P, then some individual setups.

S&P 500 — ES (September Contracts)

Still looking for that 50% to 61.8% retrace zone and the 10-day ema as a dip-buy spot. Seems so simple, but it’s a test in patience.

Upside Levels: 4450-55, 4462, 4476, 4500-05

Downside levels: 4400, 4378-83

SPX

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.