Technical Edge —

NYSE Breadth: 39% Upside Volume

NASDAQ Breadth: 23% Upside Volume

VIX: ~$22.25

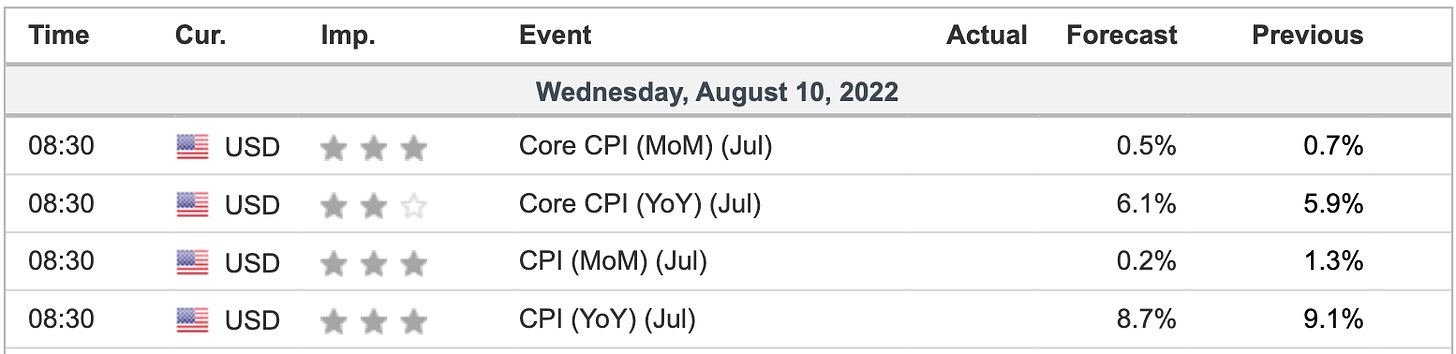

Today, this week and maybe the rest of this month really boils down to the CPI report. At 8:30 ET, these are the only numbers that will matter:

Inflation should at least back down from June’s results, given the decline in oil and gas prices. Still, a hot reading will not bode well, while the Fed has not really been talking down the idea of higher rates.

As of Aug. 3rd, the market is pricing in:

A 50 basis point hike in September (no hike in August)

No hike in October and a 25 basis point hike in November

A 25 basis point hike in December

No hike or a cut in February (76% odds of no action or dovish action)

If the CPI reports continue to come in hot, you better believe the Fed is going to become more hawkish.

***In-line or below expectations on today’s report gives the market the opportunity to continue its upside move. Above-consensus results increase the odds we pull back from here.***

Remember, it is the reaction to the report we are looking for, not for the report itself. We are traders, not economists.

Game Plan: ES Futures, SPY, QQQ, NQ Futures

I’ll look at some individual trades after the CPI report is out of the way. For now, just the indices. Also, keep an eye on bonds (TLT and ZB) today.

S&P 500 — ES

Bulls need a sustained move above 4170 to 4175. Bears need a break of 4080. It’s as simple as that.

In June, we had similar action as the 4150 to 4200 area was resistance. The ES was consolidating ahead of the CPI print, then broke lower following the release. I don’t know if the same pattern is setting up, but it’s something to watch.

Dialing in more specifically,

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.