Technical Edge —

NYSE Breadth: 84% Upside Volume (!)

Advance/Decline: 79% Advance

VIX: ~$17 (easy come, easy go)

It’s Friday and the last trading day of April. We’ve had a pretty solid run in terms individual stocks lately, while the two driving factors for the S&P 500 — regional banks and mega-cap tech — continue to run the show.

Last night, indices spiked higher as AMZN initially ripped higher. Now they are bobbing around with Amazon down slightly in the pre-market.

Don’t try to force any trades today that aren’t good candidates. That should be the case everyday really, but particularly today as the end-of-month trades can get a little tricky.

S&P 500 — ES

The S&P blew through yesterday’s high and ripped higher on the day.

Upside Levels: 4170, 4200, 4242

Downside levels: 4118, 4100-05, 4090, 4065

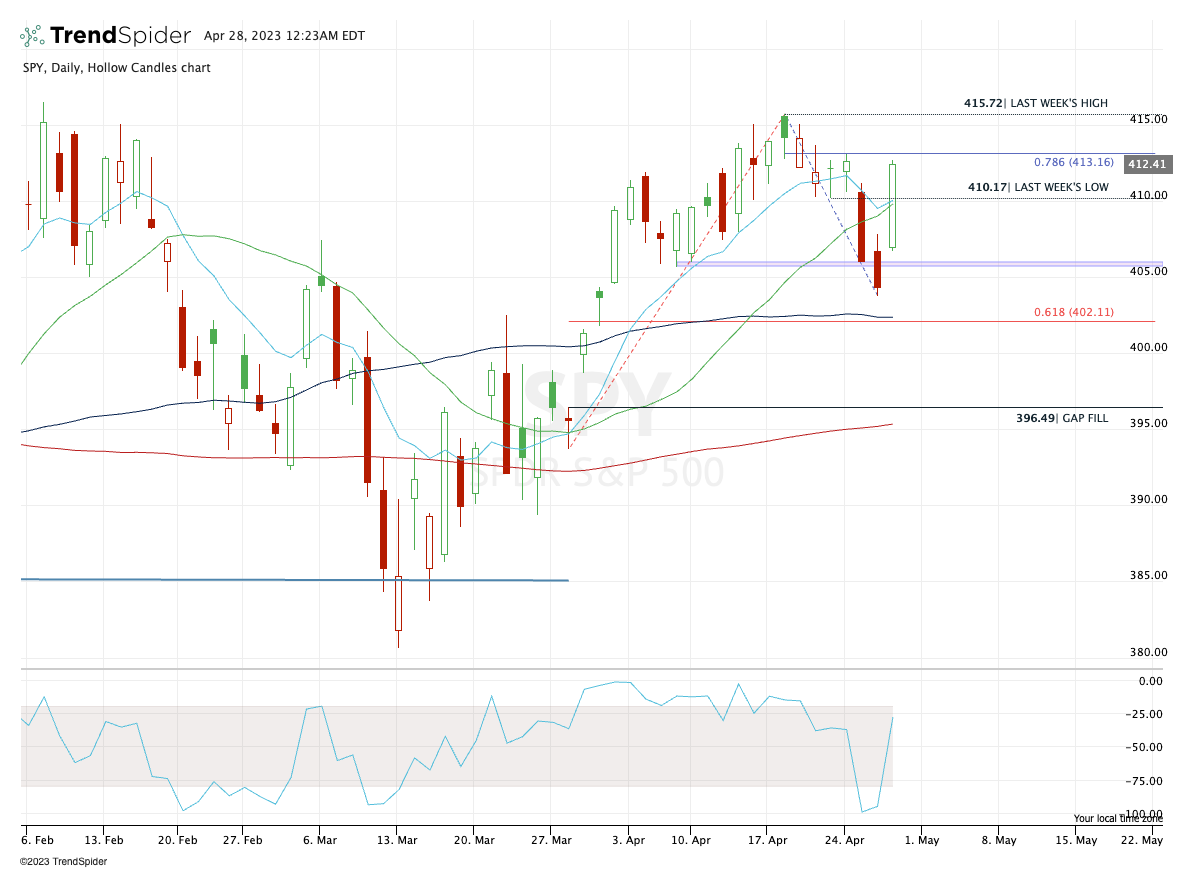

SPY

“Needs to regain $406 and hold above it to see a further boost.” — well we got our boost all right as the SPY blew through all of our upside targets.

Upside Levels: $413, $415-$416

Downside Levels: $410, ~$407, $404

SPX

Upside Levels: 4143, 4165-70

Downside Levels: 4115, 4095, 4083, 4070

QQQ

We got our $317+ after the QQQ cleared two days worth of highs. But no one should be surprised where it ran out of steam, as $321 again kicked in as resistance.

If AMZN is a dud today like it was late in the AH’s session yesterday, then $321 could very well hold as resistance into the weekend.

Downside levels: $315, $313, $310

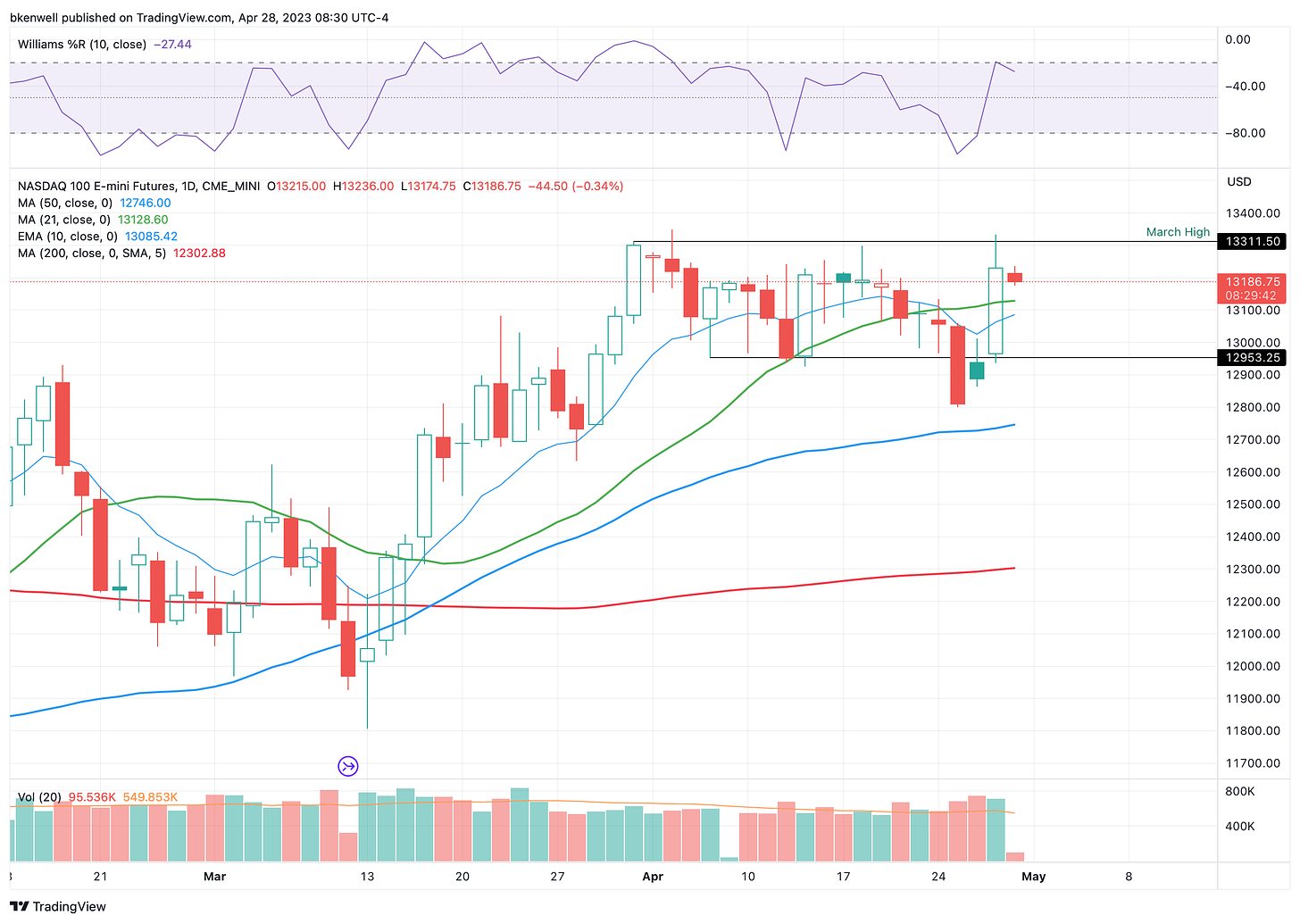

NQ

Very similar situation to the QQQ, with the NQ being rejected right from ~13,300 resistance.

Upside Levels: 13,300

Downside levels: 13,135, 13,085, 13,020, 12,950

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

Down to Runners in GE, CAH, LLY and ABBV.

AAPL — for those that were swinging AAPL for the longer timeframe, we got our $165 area to trim into and as we continue to tip-toe higher, I’d say down to ½ size here or even less.

Boom! There’s our $168.50+ on AAPL to get down to ⅓ or less. Add another runner to our list. Congrats to holders, this one took a little time.

For runners, raise stops to $163 for aggressive bulls, $165 for conservative players.

BRK.B — long from $319-ish as per the plan — Down to ½ at $325 to $325.25+ as per plan.

Down to ⅓ if we see $327+ Raise Stop-losses to Break-even

MCD — Ring ‘em up! Long from $291.50 & trimmed ⅓ at $292.50+. Down to ½ or less as MCD pressed $295 yesterday. I did not have the second levels in here, but a trim was warranted into that strength.

Break-even stop on remainder.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

MCD, PEP & KO, WMT, PG — XLP

LLY

NVDA, CRM

MSFT, AAPL, META

PANW, FTNT (10-week/50-day combo & prior breakout level)

ULTA & LULU

GE

FSLR

HCA

DKS

WYNN

MELI

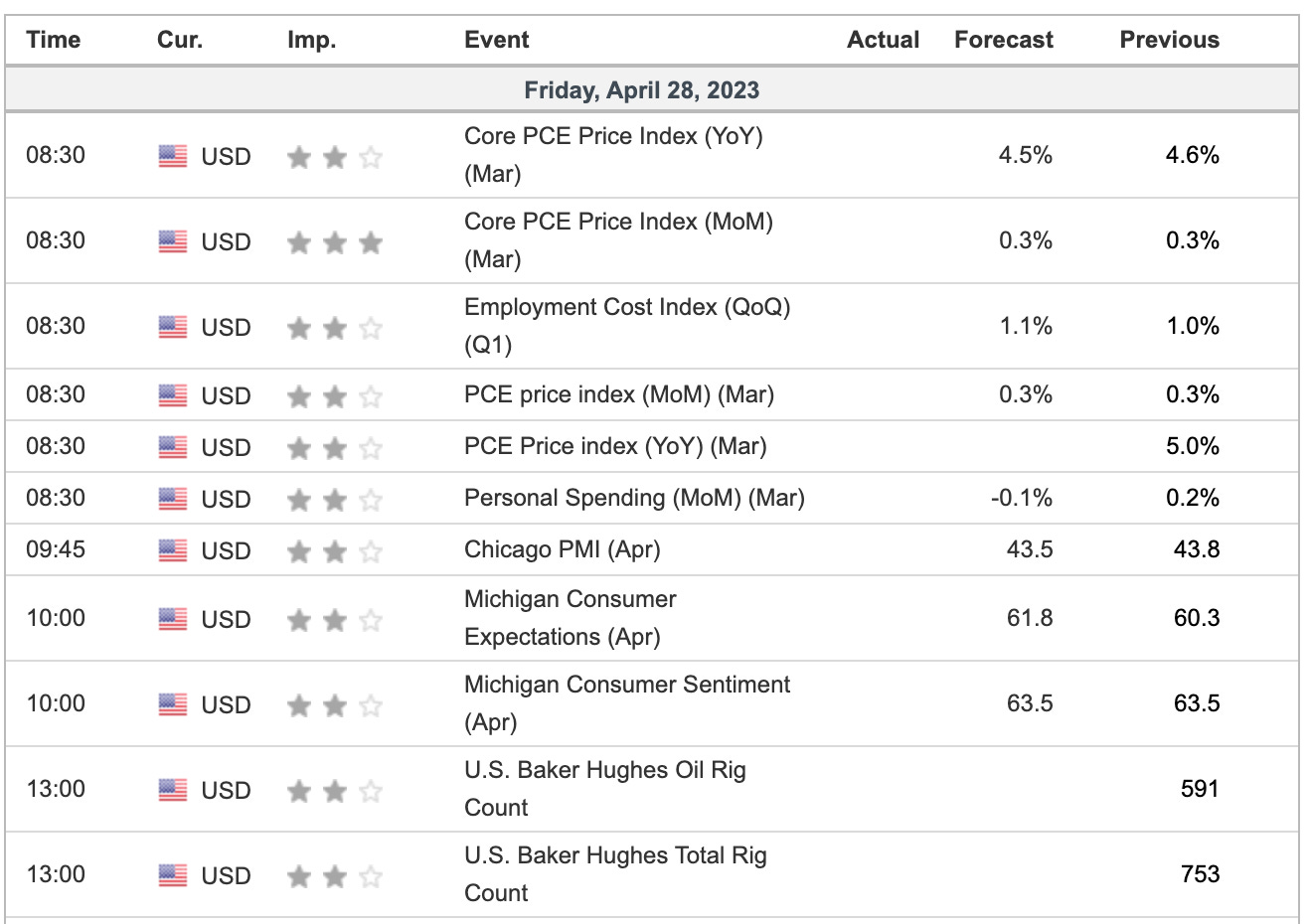

Economic Calendar