Technical Edge —

NYSE Breadth: 84% Upside Volume

Advance/Decline: 74% Advance

VIX: ~$30.50

I am looking for some individual trades, but the rapidness of this rally combined with a lack of exceptional upside breadth AND an elevated VIX make this a tough environment to trust individual stocks. I am sorry that that is the case, but we can only trade what’s in front of us!

Until then it’s paramount to focus on the indices, sectors, bonds and the dollar.

Game Plan: S&P 500, Nasdaq, Bonds & The Dollar

General strength in the dollar and weakness in bonds remains a concern for stocks.

We pointed out this oddity in yesterday’s newsletter and, alongside the “tough to handle” 80-point gap-up, the S&P sold off right out of the gate before an afternoon bid shored up prices.

Admittedly, I wasn’t coming into the session shorting on tilt, but the setup was there to push the index lower. Looking at it now, it does continue to shake off a lot of bad news, like the CPI report and the recent news from Apple.

The banks reacted well to earnings and now NFLX is +14% in after-hours trading. So there are a few things for the bulls to hang their hats on.

Further, I’d rather come into the day under a bit of pressure than gapping up.

S&P 500 — ES

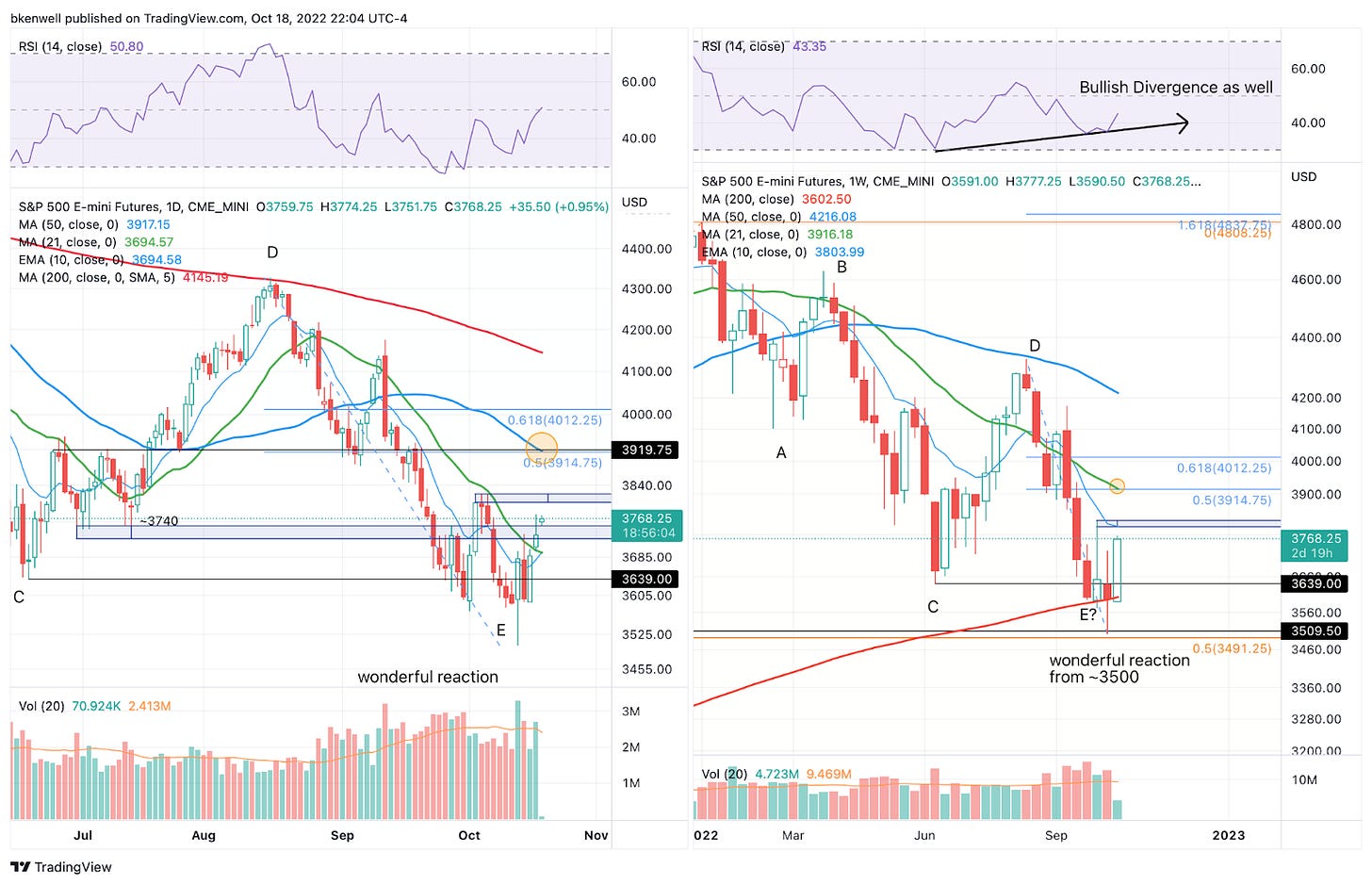

Above shows the daily on the left and the weekly on the right. For those looking at a “bigger picture” setup, keep these levels in mind.

If the bulls maintain upside momentum, 3800 to 3820 is the first zone to know. It’s resistance from early October and the declining 10-week moving average.

Above that opens the door to 3900 to 3925. That’s the 21-week and 50-day moving averages, 50% retracement and a key pivot level.

On the downside, bulls need 3680 to 3700 to hold as support. Below puts 3640 or lower on tap.

Possible Trade:

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.