Technical Edge —

NYSE Breadth: 55% Upside Volume

NASDAQ Breadth: 50% Upside Volume

VIX: ~$27

The way I see the current situation is this: On some of the smaller time frames, the stock market has made some great progress. On the larger time frames though, we clearly remain in a downtrend. Bulls need further development for that situation to change and if that occurs — which is still a big “if” right now — it will take some time (i.e. higher lows, reclaiming broken support, etc.)

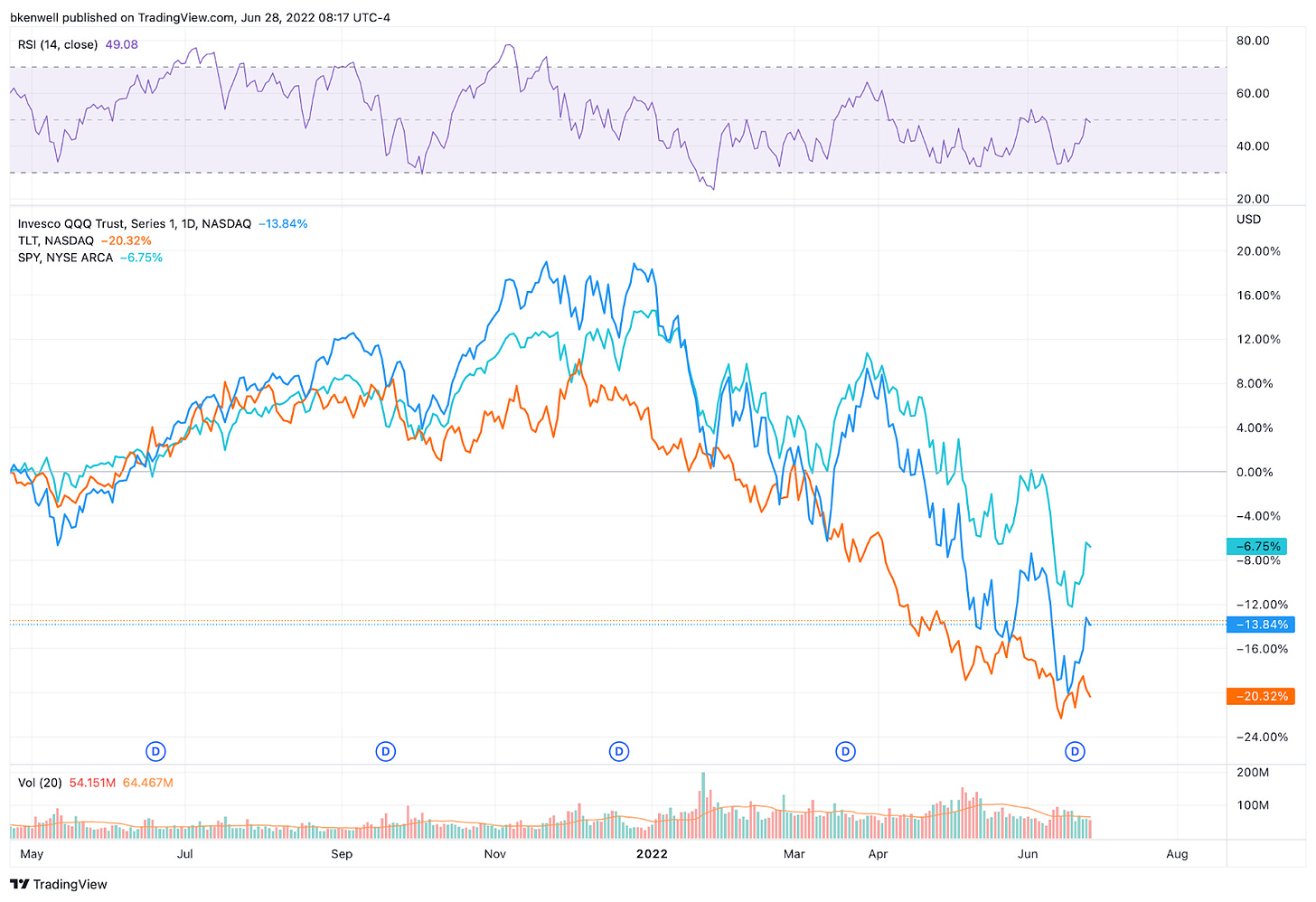

I don’t really like the way bonds are turning lower again — like /ZB and TLT — as it has traded alongside equities pretty well this year since the Q4 highs.

On the Go-To watch list, there are several new names added. Once they dip/base, they could be great trading candidates.

Game Plan — S&P 500 (ES & SPY), Nasdaq (NQ), ARKK, Energy

S&P 500 — ES

The ES was choppy yesterday, but did a good job not rolling over — especially after Friday’s monster rally. From here, the ES needs to build over Friday’s high of ~3920. That’s also the 50% retracement.

If it can do that, it increases the odds that the ES can clear 3948, which is this week’s high. Above that opens the door to 3987 (the 61.8% retracement) and naturally, 4000, which I expect to be resistance upon the first test.

On the downside, a move below 3885 puts the 3850s in play along with the now-rising 10-day ema. Below that puts 3807 back in play.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.