Technical Edge —

NYSE Breadth: 93% Downside Volume (!!)

NASDAQ Breadth: 65% Downside Volume

VIX: ~$26.50

It has taken seemingly forever, but we finally got it: A break of the range. Last week’s low and recent support at 4070 broke ahead of the CPI report and we got a downside flush on 90%+ downside volume.

As a repeat from yesterday, “the next 6 sessions are not set to get any easier and should create a bit of chaos. Chaos usually does not favor the bull case, but we will see how it shakes up.”

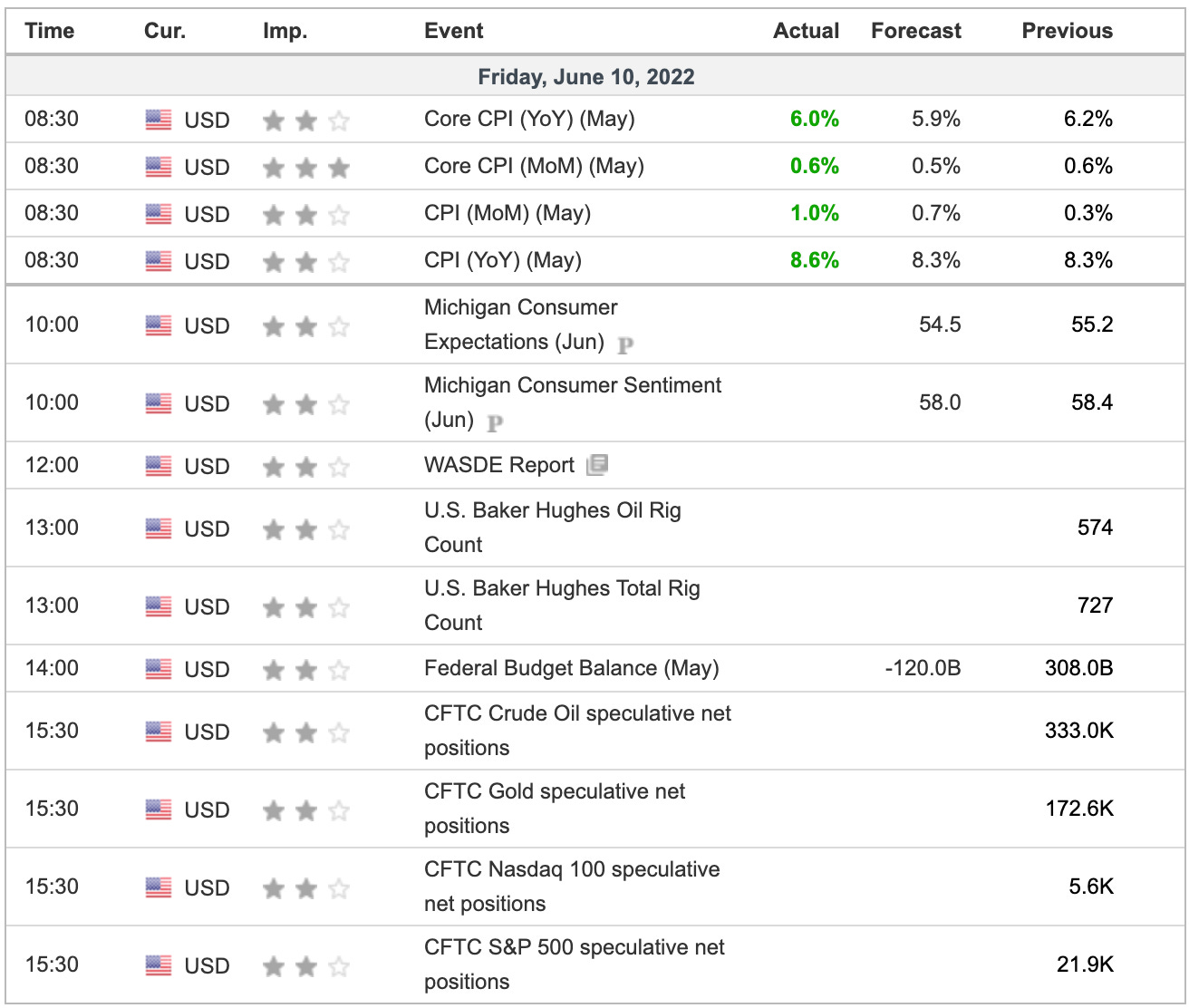

The schedule includes:

June 9th is “roll day” for the futures, as we move to Sept. contracts from June.

June 10th is the CPI report, which has become the most important economic data point for traders.

June 14th is the PPI report.

June 15th we have retail sales, but more importantly the FOMC release and likely a 50 bps rate hike (there is currently a 10% chance of a 75 bps hike).

June 17th is quad-witch expiration.

Game Plan — S&P 500 (ES and SPY), Nasdaq (NQ and QQQ), Oil, XLE, XOM

S&P 500 — ES

The ES had the robust move off the lows, then consolidated for 8 sessions, before breaking lower on the 9th session.

This chart has been burned into your mind by now, I’m sure! But look at how it broke 4070, triggering a landslide of stop-losses on its way to the downside.

Now trying to find its footing near 4000 and the 50% retrace, the levels are still clear. A rally back to the 4070 area — the breakdown spot and the 10-day — is suspect, unless it can reclaim this zone ahead of the weekend.

If 4000 breaks lower, the 61.8% retrace is in play near 3060.

S&P 500 — SPY

Same situation with the SPY as it broke down too.

On the downside, watch $399 to $400 — the 50% retrace. Below that puts $394 to $395 in play.

On the upside, a rally to the $407 to $408 area is suspect, unless it’s reclaimed.

Nasdaq — NQ

NQ broke last week’s low, which now puts 12,200 to 12,225 in play. Below that opens the door down to 12,000 to 12,050.

On the upside, bulls need a move above 12,450 to 12,500 to undo Thursday’s damage.

Nasdaq — QQQ

Above $303 to $304 is needed to undo the damage on the QQQ.

On the downside, watch $297 to $297.50, then $293 to $293.50.

Oil — CL

While great for the commodity bulls, the rally in oil is crippling the consumer.

As it bumps up against our $122.50 target — the 78.6% retrace — bulls are looking for a breakout. Above it opens the door to the $127.50 to $130 area.

On the downside, watch the 10-day moving average, followed by the $115 to $116 zone.

XLE

Energy will eventually correct. It always does in these cycles. Either supply will catch up or demand will wither away as the consumer gets pulverized.

Until that happens though, bulls can buy the dips near active support. For the XLE, that comes into play near the 10-ema. A bounce and hold could open the door to $100.

If that dip fails, I may be looking for a larger pullback down to the 21-day moving average and the $85 level.

XOM

Looking to buy a dip here near a nice trifecta: $100, prior resistance and the rising 10-day ema.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

AMD — First target achieved at $109.50. → Stopped at B/E or $100, whichever traders were using.

DXY / UUP — Trimmed into $27.50 as the first target. Now looking for $27.70 to $27.75. This tends to be a slow mover and it one we can hold for a while as long as our risk level holds.

DLTR — Price Target 1 & 2 hit on the same day it triggered → Now look for $165 to $166 on remaining balance. B/E Stop.

NEX — Trimmed at $12.50, stopped at B/E or $11.50 (for aggressive bulls)

Relative strength leaders (List is cleaned up and shorter!) →

These are on watch for dip-buys:

XLE

AR

XOM

TECK

DLTR

AMD — watch $104.55 (monthly-up)

IBM (of all names)

DOW

ARCH

NVA

XLU

TMST

VRTX — trying for weekly-up this a.m.

AMGN

MRK

MCK

BMY

Economic Calendar

A lot of stuff on the list, but seemingly the only thing that matters is the CPI report. Sentiment also seems relevant, given worries of a recession.