Technical Edge —

NYSE Breadth: 39% Upside Volume

NASDAQ Breadth: 70% Upside Volume

VIX: ~$27.50

Tuesday was a damn impressive showing from the bulls. The S&P traded down into support and — to many traders’ surprise — it held!

Now we have some pretty powerful wicks off the 3740 (ES & SPX) area in three straight sessions, showing that bulls may want to run this one higher. At the very least, there’s a line in the sand.

Game Plan: S&P 500 (ES & SPY), Nasdaq (NQ), Bonds, Dollar, GOOGL, AAPL

S&P 500 — ES

Yesterday, I wrote: “On the downside, a break of 3740 puts 3700 in play.”

That 3740 area held just fine on Tuesday and now look at those three beautiful wicks off the 3740 area.

The key focus for Wednesday is 3857.75. That’s yesterday’s high and about where the 21-day moving average comes into play. That moving average was resistance last week, too.

If the ES can clear this level and go daily-up, it could open the door to the 3900 area. Above that is the 3920 to 3950 zone.

On the downside, a move back below 3807 could put the 3740 to 3750 area back in play.

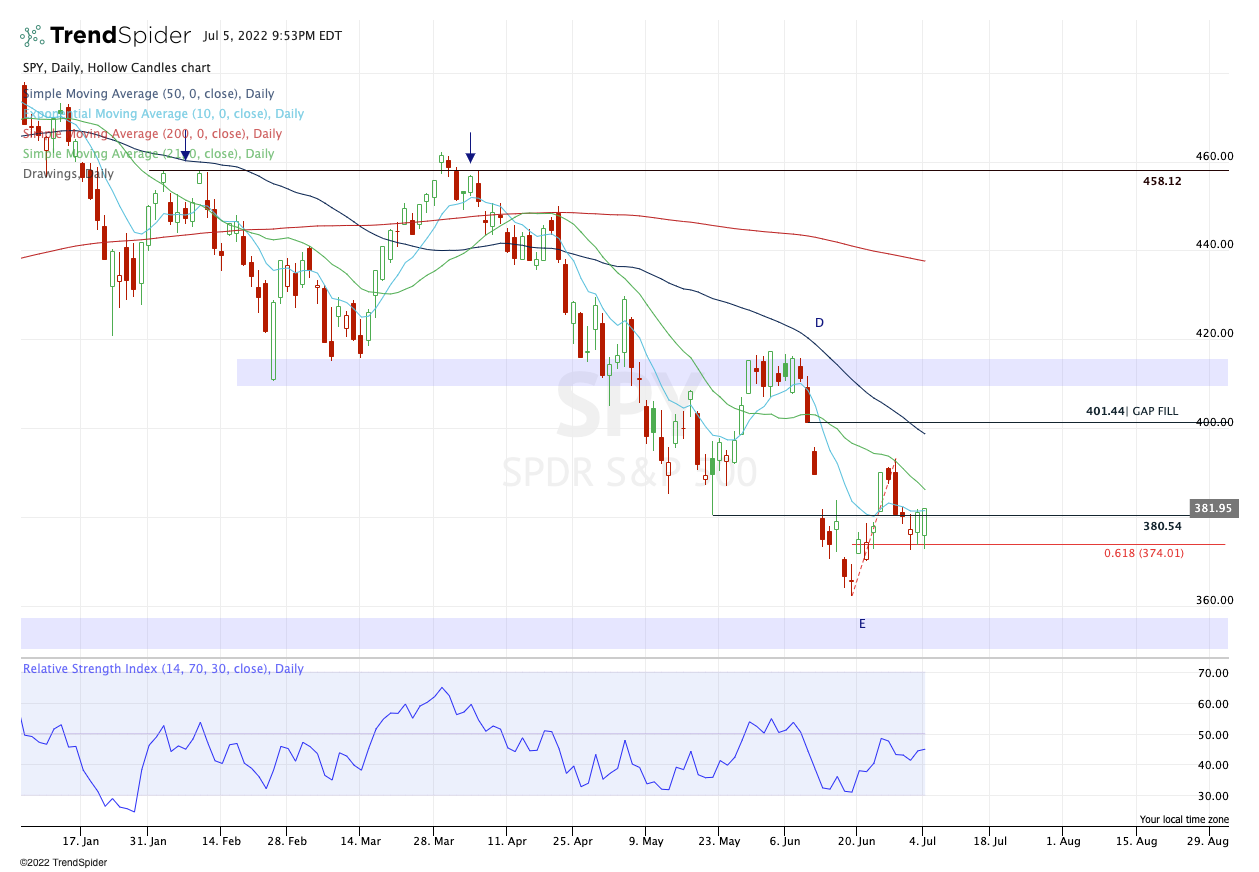

S&P 500 — SPY (Daily and Weekly)

Daily-up over $382 puts the 21-day in play, then potentially $390. Looking a little longer term, over $390 could put weekly-up in play at $393.16.

On the downside, back below $380 and I would have a little caution in my approach, but really, the SPY looks okay as long as it continues to hold $373 to $374.

Nasdaq — NQ

Man oh man, that 11,350 to 11,380 level was impressive! Now the NQ is flirting with a daily-up rotation over 11,815. If it can clear that and the 21-day moving average, we could have a quick move into the 12,000+ level and the 50-day.

On the downside, I would love to see the NQ hold the 10-day and the Globex low of 11,731.

If it doesn’t, 11,631 is the 50% retrace of yesterday’s range.

Bonds — ZB

If Bonds go weekly-up over 141’11, then we could see a push up to the 144 area.

UUP

All we had to do was be long the dollar — DXY or UUP — over the last 4 to 6 weeks and all would have been fine.

I punched out the last ¼ position I was carrying in the UUP after Tuesday’s move. Bulls who prefer to stay long can continue looking for $28.68+ but as mentioned below on the trade sheets, $28.50 to $28.65 was the next meaningful upside target and that level was achieved.

Cheers.

GOOGL

With an elevated VIX, I have been more drawn to the intermediate-term trades (DG, MCK, UUP, MRK, etc.) but GOOGL caught my eye.

It has its 20-for-1 split later this month, which tends to act as a before-the-event catalyst. Yesterday it had a strong day, rallying to the 50-day.

If there is going to be a bid in the market and in tech, look for a potential daily-up over $2,267.50. If GOOGL can do that — and sustain above this level, not just a “look above” it — then we could see a potential move into the $2,360s.

AAPL

I’m looking at AAPL as more of a short-term lotto situation if there is a bid in tech today/tomorrow.

Daily-up over $141.61 that sticks (again, not just a “look above”) opens the door to ~$143.50, last week’s high. Above that could put $145 to $146 in play.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Trade Sheets:

DXY / UUP — “$28.50 to $28.65 is the next meaningful upside target.” and it was finally achieved on Tuesday.

MCK — We have hit two trim zones so far on MCK. Feel free to cash the last ⅓ of the position as you see fit. $335 to $340 is a potential upside target if it continues higher. Moving stop-loss up to $315

DG — Trim and raise stops → “If this stock sees $250 to $252 today, I will be out of ½ and looking for $256 for the second tranche and $260 to $262 for the last portion.”

That is still the plan → ¼ at $255 to $256 & ¼ at $260 to $262

MRK — Looking for $93 to $93.50 as the first upside target. Using $90 as my stop. → came within 5 cents of the first upside target on Tuesday (close enough for me, but we’ll see how it trades today).

$94 to $95 as second target

$90 Stop Loss. Conservative bulls can go to a B/E stop.

Relative strength leaders (List is cleaned up and shorter!) →

DLTR — just went monthly up.

BMY

MRK

ABBV

UNH

JNJ

XLE — 200-day is getting close.

CLR

VRTX

DG

IBM

MCK