Can Buyers Force Upside Rotations in AMD, AAPL, TSLA and QCOM?

Bulls can take control, but will they?

Technical Edge

NYSE Breadth: 62% Upside Volume

NASDAQ Breadth: 70.7% Downside Volume

Friday was filled with good news and bad news.

After Amazon shares surged more than $400 a share at one point, the stock market came roaring back to life after a bad Thursday and a poor open on Friday.

On the plus side, the SPX and Nasdaq rallied 0.5% and 1.6%, respectively. On the downside, the final hour of trading was not very strong, with the ES falling 48 handles and the NQ falling almost 200 points at one point into the close.

Both index futures closed more than 1% below the post-3:00 pm high. That’s a tough pill to swallow going into the weekend, but it’s not surprising traders wanted to take a “risk-off” approach to the weekend.

Game Plan

Now we need to see if that approach was just that — a de-risking move ahead of a weekend that has various risks attached to it — or part of a larger scheme to “sell into strength.”

We’ve already seen GOOGL pull back from its EPS rally. Will AMZN be next? Just something to be aware of, given the impact these trillion-dollar companies have on the indices.

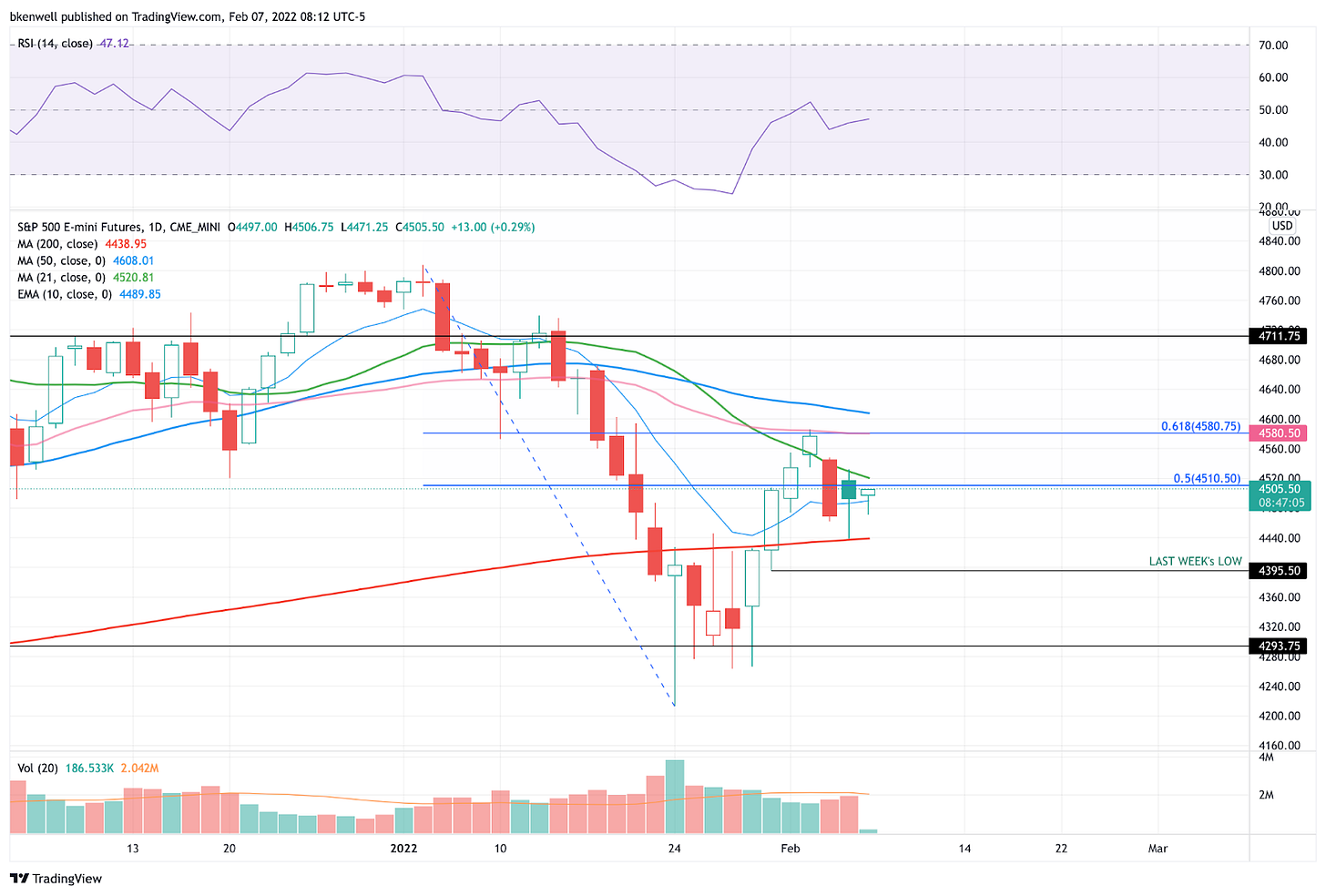

S&P 500 — ES Futures

On Friday the ES undercut the prior day’s low, then reversed higher as AMZN remained strong and as they bought the dip after the NFP report. The ES double-bottomed around 4443, then followed our sequence pretty well from there.

That was: “Above 4510 opens the door 4528, then 4545 to 4550.”

However, the ES never saw the latter range, as it topped out ~4.5 points above 4528 and reversed to close below 4500.

I’m never in a rush to do anything on Monday morning. We have the whole week to trade and the last thing I want to do is get into a hole early in the session.

The Trade: On the upside, let’s see if the ES can take out Friday’s high at 4532.50, as well as the declining 21-day moving average. That would put 4550 in play, followed by 4575 to 4580.

On the downside, bulls don’t want to lose Friday’s low at 4438.50 and the 200-day. If we do, the ES could see last week’s low.

Nasdaq + TSLA, AAPL, AMD, QCOM

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.