I’m borrowing the following entry from a good friend of mine, Danny Riley. I think it does a good job talking about the Fed.

Our View

Coming into Friday, investors were looking for a Fed pivot from Chairman Powell. He did anything but, doubling down on the Fed’s fight against inflation. Fed President Neel Kashkari’s comments yesterday only added to it, saying:

“I was actually happy to see how Chair Powell's Jackson Hole speech was received…People now understand the seriousness of our commitment to getting inflation back down to 2%.”

You know the old rule: Don’t fight the Fed — and right now the Fed seems to prefer tightening over loosening, hawkish over dovish, higher rates over lower rates and being more restrictive rather than accommodative.

As we enter September, the Fed’s plan now calls for unwinding some of its balance sheet. Here are some of the highlights:

The Fed will boost its monthly caps for the amount of Treasuries and holdings of mortgage-backed securities that it will let mature to $60 billion and $35 billion, respectively, while using its $326 billion stash of T-bills as filler when coupons run below the monthly level. September will be the first month that bills will be redeemed since coupons will fall below the monetary authority’s new cap.

The Fed’s portfolio has $43.6 billion of Treasury coupons maturing in September, which means that officials will need to let go of $16.4 billion of bills as well. It will also need to let another $13.6 billion run off in October. These will be the largest declines for the bill portfolio until September 2023.

There are longer-term concerns because as the Fed has less securities to lend to dealers in its daily operations, it will impede their ability to cover short positions and make it more expensive to borrow in the repo market.

Now onto our regular-scheduled programming:

Game Plan: S&P, Nasdaq, Oil, Bonds, Individual Stocks

Monday’s action saw the stock market trying to rally, but failing to gain sufficient upside momentum. In a holiday week — Labor Day — that’s not too surprising, although volume has been pretty steady so far.

The biggest focus right now? Have we shifted gears?

Put another way, have we gone from buying the dips to selling the rips?

We may be due for a bounce as the ES/S&P flushed down into a key support area on the charts and they gave us a doji-like close yesterday. There are plenty of charts to get through. Let’s get started!

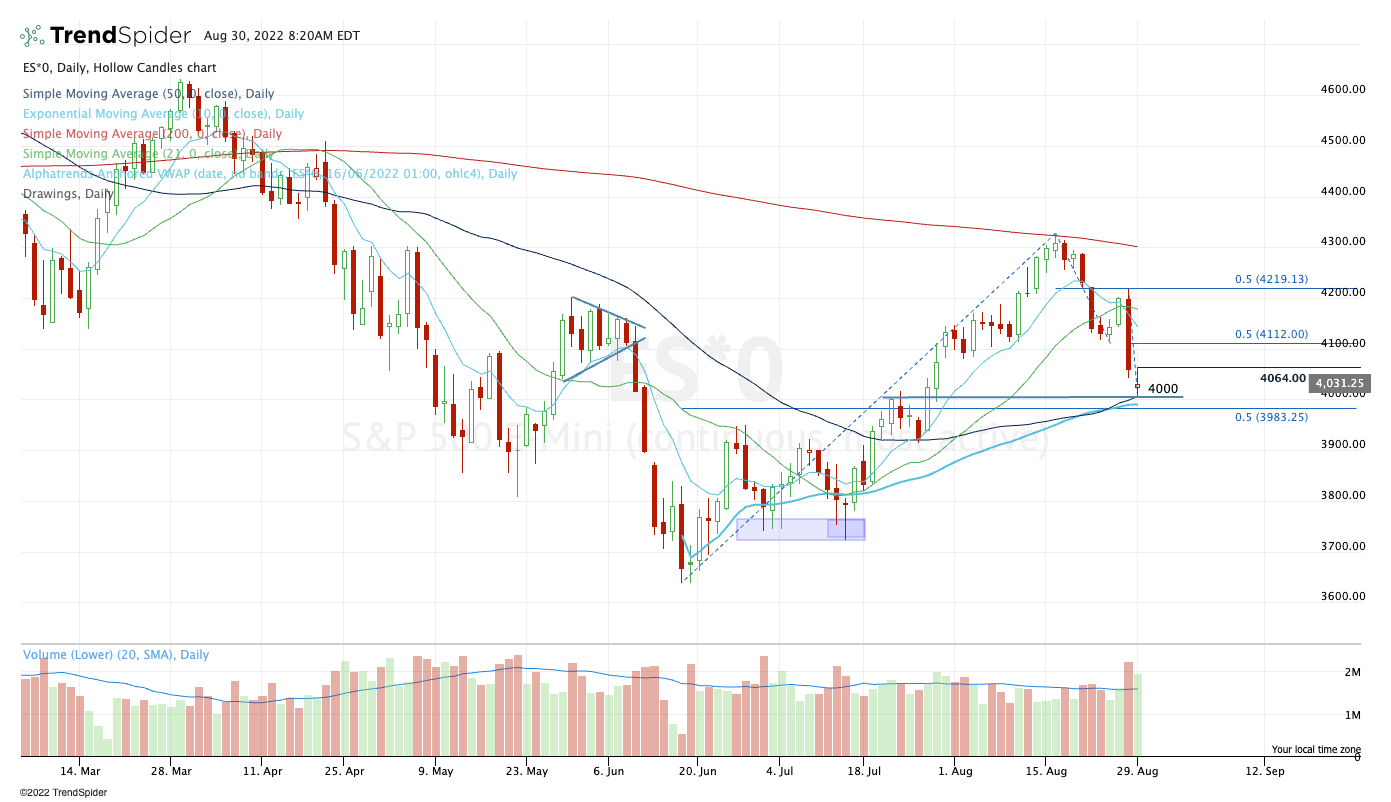

S&P 500 — ES

Friday’s lows around 4042 have been an interesting pivot. It was resistance yesterday until the afternoon, then support, and then finally lost shortly before the close. Again, it was resistance in the early part of Globex but has been support in the overnight session once reclaimed.

On the upside, keep 4064 in mind — yesterday’s high.

A move above that level that doesn’t reverse keeps a daily-up rotation in play, opening the door to the 4080s, then 4112. The latter is the 50% retracement of the recent range and was also a support level last week (until Friday’s action).

On the downside, a move back below 4040 is not good and puts the Globex low in play around 4027, followed by yesterday's low at ~4007.

SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.