Technical Breakdown

NYSE Breadth: 59.5% upside volume

NASDAQ Breadth: 69% upside volume

Simply put, traders were out of position going into the Fed meeting. After a robust move last week, stocks opened strong and on Monday, stocks were punched in the nose. The S&P fell 91 basis points on Monday and closed at its low, then gapped lower and at one point fell 1.3% on Tuesday.

From Monday’s high to Tuesday’s low, the S&P 500 was down 2.2% and it was down again on Wednesday ahead of the Fed’s announcement.

Traders kept taking off long exposure and/or getting short ahead of the news, which allowed stocks to roar higher once the news was out — even though the news wasn’t necessarily good!

The Game Plan

The plan all week has been not to do anything stupid. Essentially, bide our time as the pre-Fed action soaks up most of the nonsense, while trading the viable setups. We had some good fortune with Apple early in the week, then Nvidia and a few growth stocks on Wednesday.

With bulls grabbing the wheel yesterday, it’s now up to the longs to maintain control. Breadth was very poor early in the session, but finished higher on both the NYSE and NASDAQ, which is a step in the right direction.

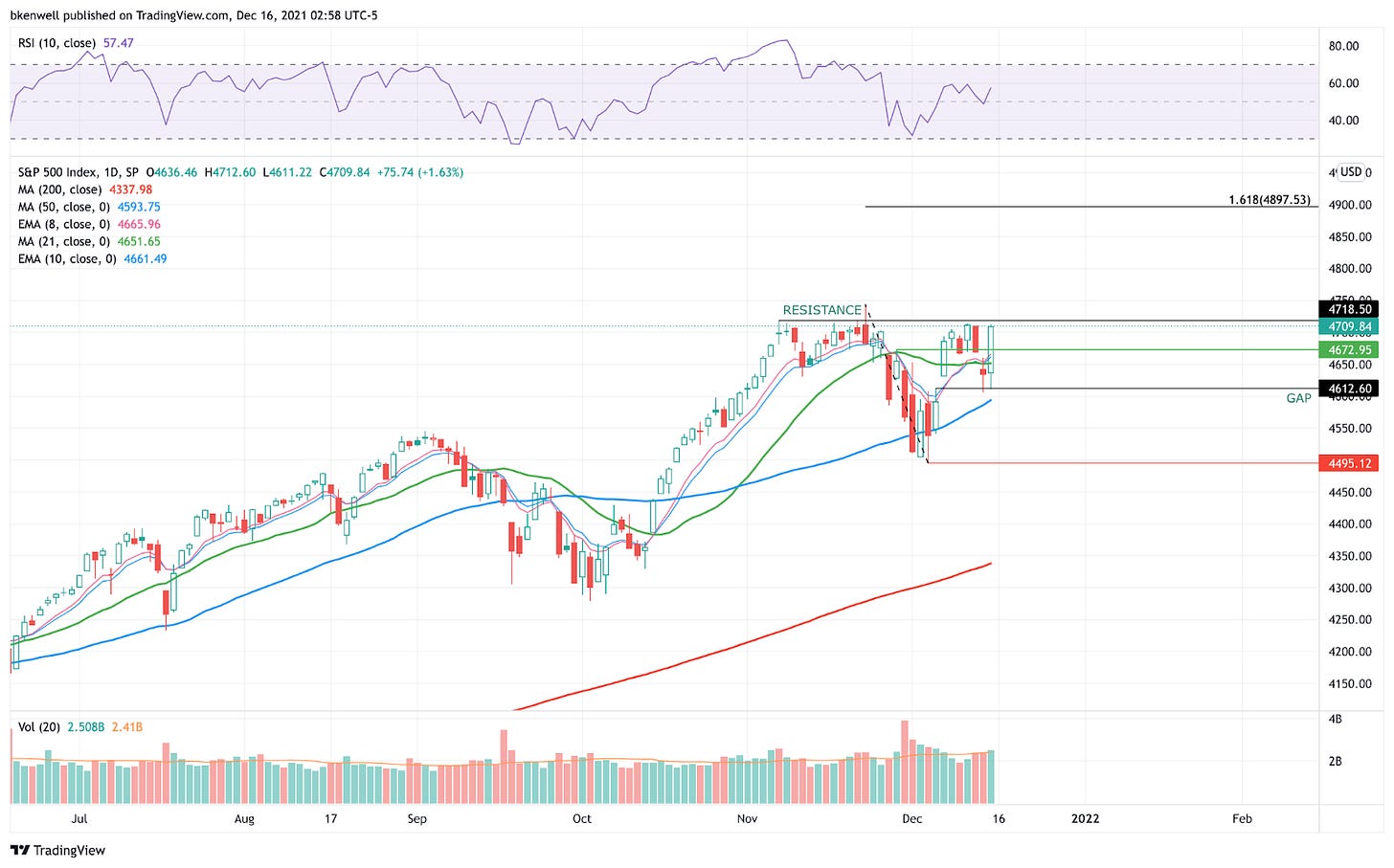

S&P 500

The S&P 500 found support at last week’s gap, then ripped higher back above its 10-day and 21-day moving averages, as well as the prior week’s high near 4673.

Now approaching resistance near 4720 again, bulls are looking for the breakout.

As we look at the ES futures, which are up another 25 handles overnight, the ES is trying to go weekly-up over 4723.25. That now leaves the all-time high in play at 4740.50.

If it can clear that, bulls can start looking at upside extensions. The reality is that we don’t know how the market will handle a gap-up scenario. Does quad-witch have one last trick up its sleeve?

If the S&P 500 can hold 4718 and if the ES can hold 4723 on the gap-up, then the tides may shift in the bulls’ favor.

Nasdaq

For the Nasdaq, we’ll look at the futures, as the NQ has not been able to clear the 16,436 level. Let’s see if it can do so today or at the very least, by the end of the week.

If it can, it opens up the all-time high at 16,767. Above that and 17,000+ is on the table.

Growth stocks have clearly weighed on the Nasdaq.

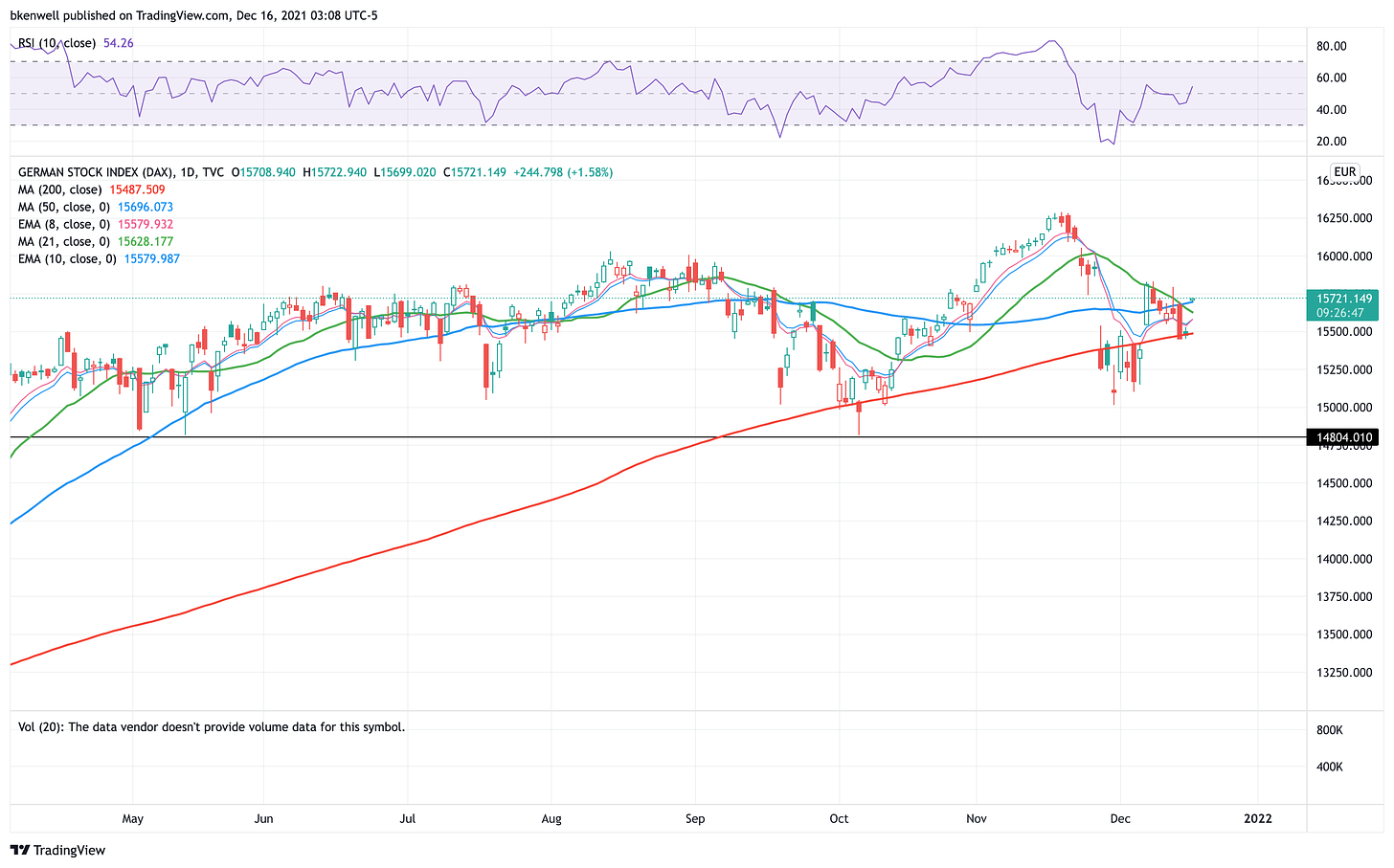

Dax

In the beginning of the month, we had a pretty tasty trade in the Dax that spit out almost 700 points on the upside (of course, that’s to the peak, but it’s just for context).

However, the 21-day moving average was stiff resistance. Gapping above that mark now, let’s see if the Dax can gain some momentum back to this month’s high, at 15,834. Above that and 16,000 is possible.

Individual Stocks

I have been going on and on about PG, but now that some money is rotating back into growth and tech stocks, will we see some of that money rotate out of P&G? If so, keep this one on your radar, specifically on a test of the 8/10-day moving averages.

Speaking of growth, Wednesday’s Game Plan went incredibly well. We said:

NVDA is at the 50-day.

NET is at the 10-month moving average and the 161.8% downside extension.

UPST gap fill and some divergence.

AAPL resetting nicely to the 8/10-day moving averages.

Yesterday ended up with NVDA +7.5%, NET +5.4%, UPST +6.4% and AAPL,

If you caught just one of those, it should have paid quite well. Now I want to see which ones can continue to power higher. NET and UPST have the most ground to make up, while ROKU gave us a slick little reversal yesterday.

Let’s see if growth stocks can gain ground. I’d love to see a low in the group now using ARKK as the proxy for the growth stocks. Speaking of ARKK

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.