Technical Edge —

NYSE Breadth: 60% Downside Volume

NASDAQ Breadth: 50% Downside Volume

VIX: ~$32.50

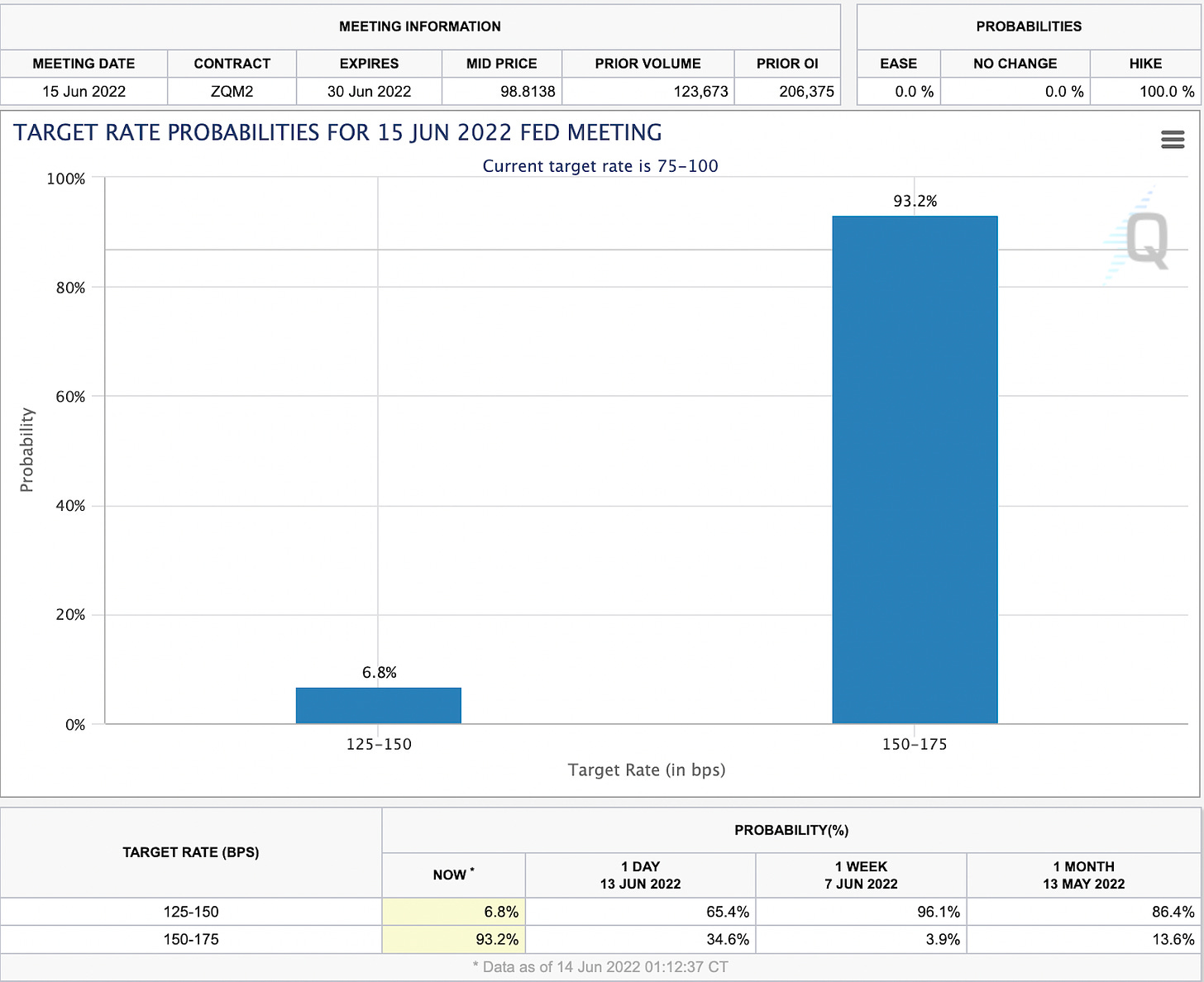

Today we have the Fed. A couple days ago, it was assumed the Fed would raise rates by 50 bps. That quickly changed, as the market is now pricing in a very strong likelihood that the Fed raises by 75 basis points, with a small, small (lotto-like) chance they raise by a full point.

Game Plan — S&P 500 (ES and SPY), Nasdaq, Bitcoin, AR

The S&P made new 2022 lows on Tuesday, but tried continuously to find its footing, suffering just a small loss on the day.

We were right not to trust the market’s gap-up, as it went on to retest the closing prints, then break the lows. It’s so hard to trust a gap-up in a downtrend.

Remember how FOMC days go. They like to run the stops on both sides.

S&P 500 — ES

I can’t emphasize this enough: When things speed up, we must slow down. When it gets noisy, we must quiet down. Traders need to be like a keel on a sailboat, looking for stability amid increasingly choppy waters.

Sorry to get all philosophical on you, but it’s the truth! When things get complex…we need simple!!

Coming into Monday’s gnarly gap-down, that was what we preached: Simplicity. Either 3807 (the prior low) was going to hold or it wasn’t. It didn’t and now yesterday it was resistance.

So let’s keep a darn close eye on this level today. If we reclaim it —

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.