Technical Edge —

NYSE Breadth: 89.8% Upside Volume (!)

NASDAQ Breadth: 83% Upside Volume (!)

VIX: ~$26.00

We were oh-so-close to a 90%+ upside on the NYSE yesterday, but lacked the end-of-day momentum to get us there, unfortunately. On the plus side, the rally was enough to let us take another round of profits on AAPL, GOOGL and DG.

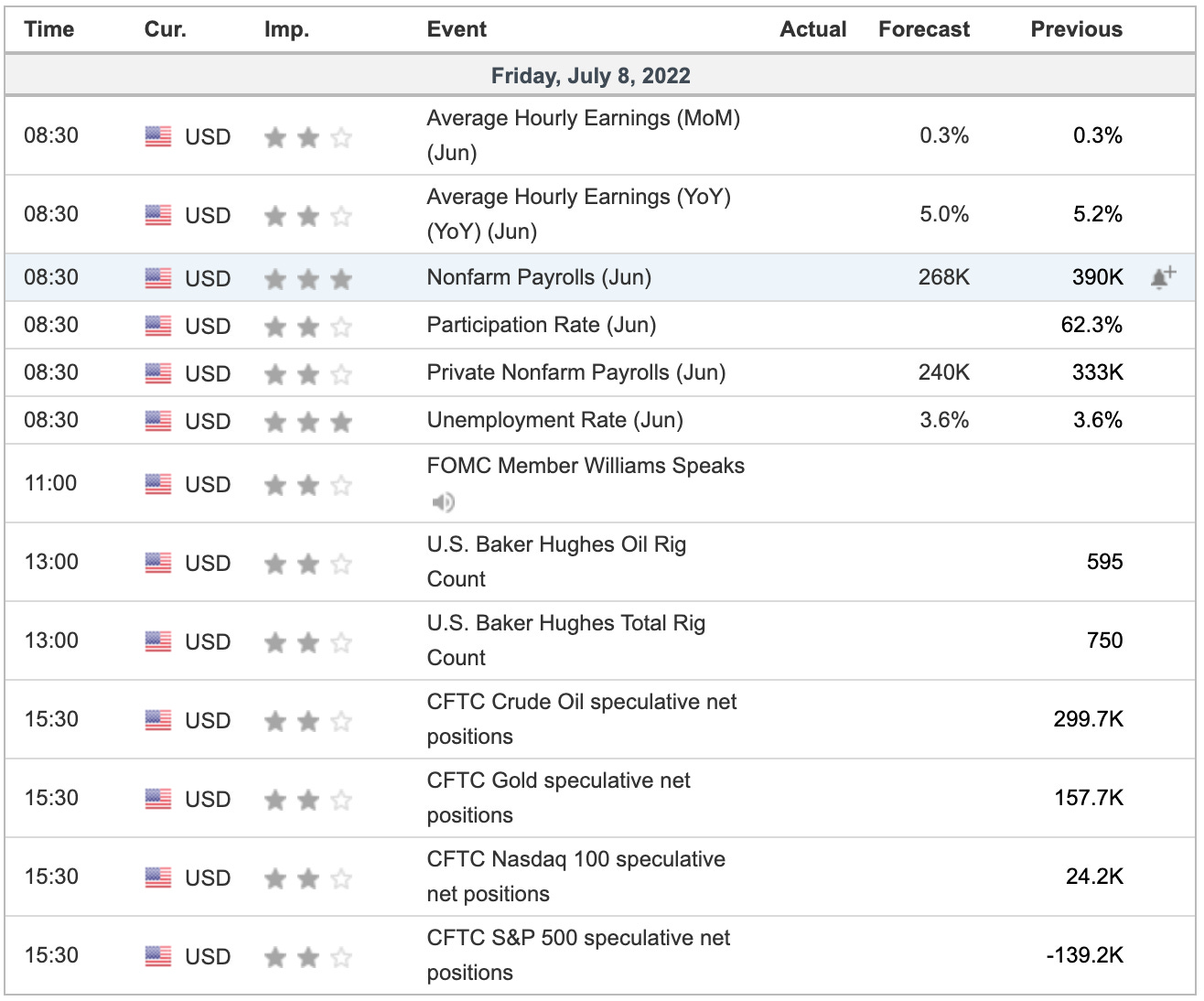

Today’s big focus will be how we react to the jobs report. The semiconductor stocks are acting well and if the S&P fetches a bid, there are some clear upside levels to focus on.

Game Plan: S&P 500 (ES & SPY), Nasdaq (NQ & QQQ), ARKK, META, AR

S&P 500 — ES

Given that the ES will trade on the jobs report for about an hour before the regular US open at 9:30 ET always makes jobs day tricky. In any regard, if the ES can go daily-up over ~3914, it opens up some very clear levels on the upside.

They include: 3920, last week’s high at 3950, the 50-day moving average near 3970 to 3975 and finally, the 61.8% at 3987.

On the downside, bulls would love to see the ES hold the 10-day and 21-day moving averages, and yesterday’s low at 3832.50 .

As for picking a direction, I wish I could. But on a jobs day we just have to react to the levels, and breadth. Predictions (like betting short and watching it rip or vice versa) are what gets traders into trouble.

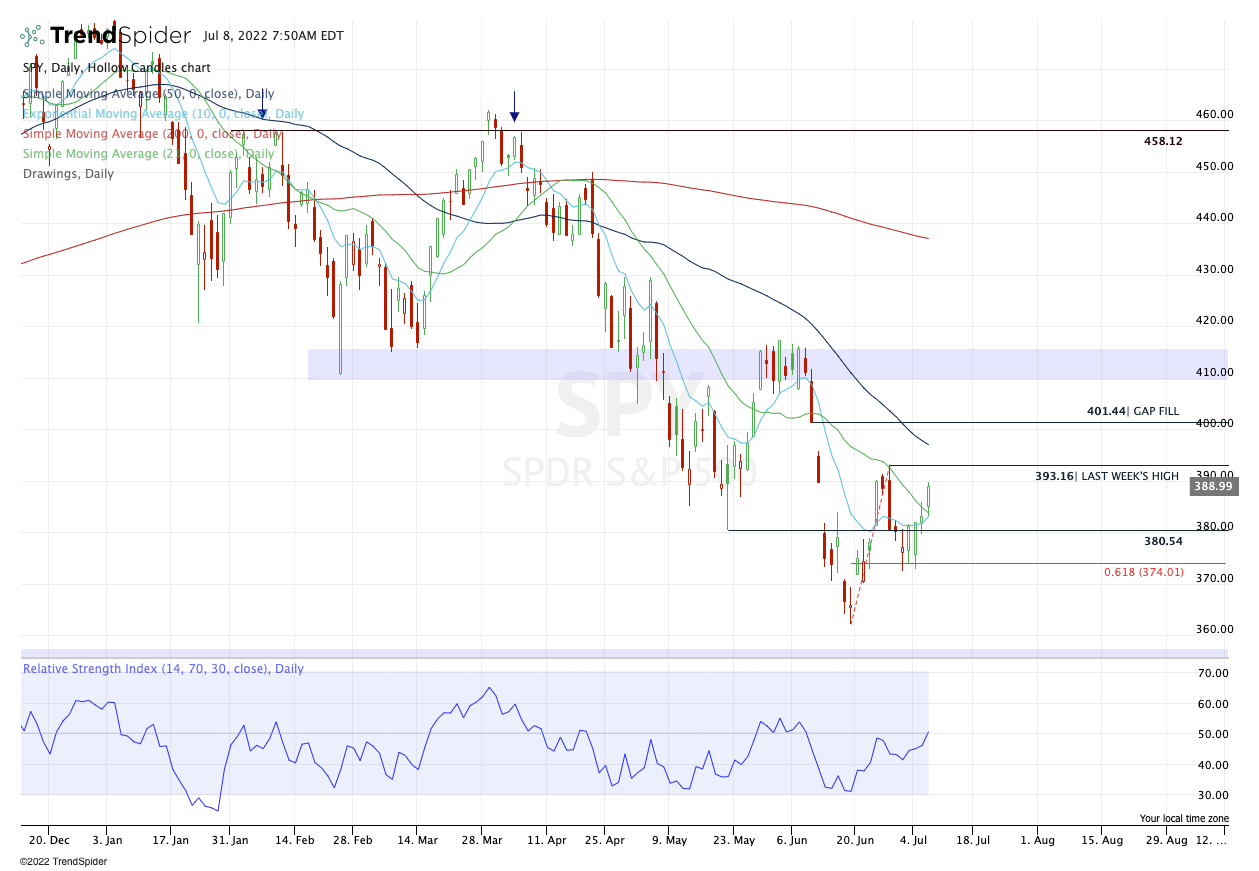

S&P 500 — SPY (Daily and Weekly)

As for the SPY, same thing. I want to see it hold yesterday’s low and the 10-day and 21-day moving averages.

It would not be uncharacteristic to see another lower high at this point, but for the bulls’ sake, it would be nice to see some more reprieve here before an eventual dip.

On the upside, keep an eye on yesterday’s high near $390. Above it could give us last week’s high near $393. Above that is the 50-day, then the gap-fill near $401.

Nasdaq — NQ

Keep an eye on the Nasdaq, which was a leader yesterday. Daily-up over 12,168 could give us a tag of the 12,200 to 12,260 area, which is where we find the 50-day moving average, 61.8% retracement and last week’s high.

That’s a key area to me.

Nasdaq — QQQ

“Let’s see if this can drift up to the $295 to $297 area.”

And drift we did. Now sitting at the 50-day and 10-week moving averages, as well as last week’s high, the reaction to the jobs report is what could either cement this area as resistance or ignite the QQQ higher.

If higher, $305 to $310 could be in play.

ARKK

Daily on the left, weekly on the right.

If ARKK closes above $46, we could have something here. For two months now, this level has been resistance, but a close above it could unlock more upside potential, perhaps up to the $50 to $52 area.

Keep in mind, ARKK could rally all the way to $65 and not even retrace one-quarter of its losses. Back below $46 and I’m not interested in this name.

Today will be a big tell on how it trades going forward. Keep in mind, ARKK did not make a new low last month, while the S&P and Nasdaq did.

AR

We have been paid quite well on the long side with AR, but if it opens above Thursday’s high and fails to hold it, we could be looking at a potential short setup — especially if it loses the 10-day.

If that’s the case, we could be looking at $30 on the downside, then $27.50.

Otherwise, above $32.75 with strength could send this to $36.

META

Given the potential binary nature of today’s jobs action, I almost hate even putting this here. But I think it’s worth pointing out the $172.50 area on META.

This has been resistance for almost a month. If it can clear this level, the gap-fill near $175 is in play, followed by a potential push into the low-$180s.

Below $165 and $155 could be back in play.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Trade Sheets:

MCK — We have hit two trim zones so far on MCK. Feel free to cash the last ⅓ of the position as you see fit. $335 to $340 is a potential upside target if it continues higher. Moving stop-loss up to $315

DG — We got our second price target at $256 → That leaves us with one tranche left and looking for $260 to $262 with it. Break-even stop.

MRK — Hit Targets 1 & 2 → Now out of ½

$90 to $91 Stop Loss (or B/E).

Looking for $95+ for ¼, then not sure. Maybe hold the last ¼ for a push to $100 if we don’t get stopped out.

GOOGL — Booyah! GOOGL gave us our target at $2,375 and is now into a resistance area. I am out ⅔ here and may fish for a push to the $2,450 to $2,500.

B/E Stop

AAPL — I am out of 80% of my AAPL position as it hit our second target in the $145 to $146 area. It was specified that this was a lotto setup. Now just a runner left. We don’t let that go against us now!

Relative strength leaders (List is cleaned up and shorter!) →

DLTR

MRK

ABBV

UNH

JNJ

XLE

CLR

VRTX

DG

IBM

MCK