Technical Edge —

NYSE Breadth: 46% Upside Volume

NASDAQ Breadth: 57% Upside Volume

VIX: ~$24

Game Plan: ES Futures, S&P 500, NQ Futures

Monday was a choppy, cautious session as tensions rise surrounding the Nancy Pelosi/Taiwan situation.

Tuesday looks to be starting off in a risk-off nature as well, with the situation above acting as the “excuse” needed for a short-term breather. For now anyway, that action seems healthy.

I will have a follow-up email with some individual stock setups. For now, enjoy the look at the indices. Cheers

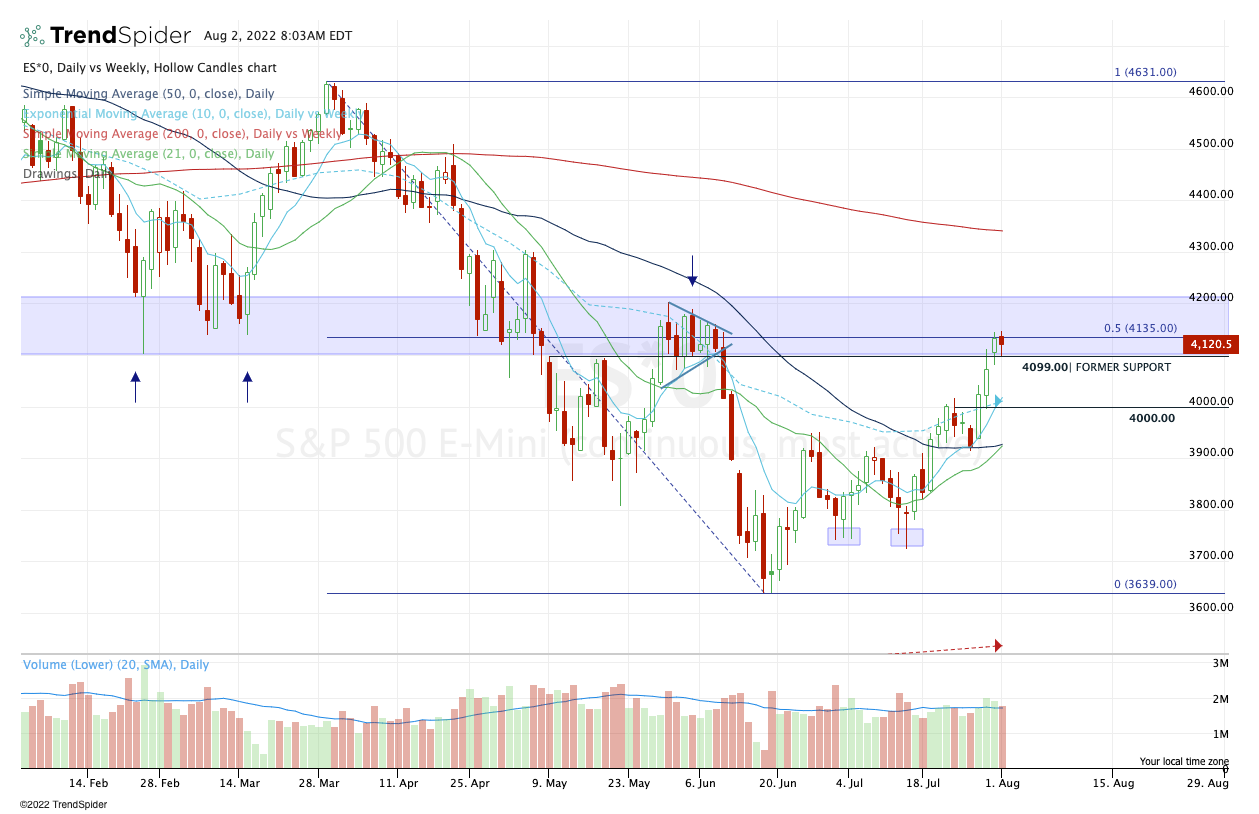

S&P 500 — ES

I’m keeping an eye on yesterday’s low at 4097, as well as the 4100 level. If we go daily-down below this zone and fail to reclaim it, we could be looking at a bit more downside.

Will this be the rug-pull?

That’s not what I’m speculating; I just want to go from level to level. If we do push lower, I think that is somewhat healthy.

It will have me watching 4000 to 4020, where we find the 10-day, 10-week and key breakout area of this recent move. Below 4000 puts 3930 to 3940 in play.

On the upside, 4140 to 4150 is resistance for now.

S&P 500 — SPX

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.