"Constructive vs. Concerning" as We End Q3

Q4 is just around the corner as the S&P still searches for direction.

Technical Edge —

NYSE Breadth: 16% Upside Volume (!)

NASDAQ Breadth: 16% Upside Volume (!)

VIX: ~$31.75

Game Plan: S&P, Nasdaq

On Thursday the S&P 500 made new 52-week lows for the second time this week, but closed above the prior low from June — albeit, barely. The QQQ made new lows, but again, closed above the June low (while the Nasdaq Composite or NQ did not make new lows). Neither did the Russell (IWM, RUT, RTY).

That’s interesting, as these “risk-on” indices tipped their hand 9 months ago by not making new highs with the S&P and Dow, and now they’re trying to hold off on making new lows while the latter two are (SPX and DJI).

We keep seeing the market hammering the June low, but showing a lot of reluctance to break below it, let alone close below it. Obviously quarter-end has the potential to bring some wild price action as the funds allocate new money and rebalance their portfolios.

We’ll see if that’s enough to break support or hold it for another day.

Bulls have to like the way the SPX continues to hold the June lows, but they can’t be too confident with 3750 acting as a ceiling while active resistance (the trend) continues to squeeze lower.

SPY

The same situation continues to build in SPY, as $363 has been in a “bend don’t break” situation all week, while $370.50 has been resistance.

It’s constructive that we keep getting a “look below” the June lows and closing above them, but it’s concerning that the S&P can’t get enough traction to reclaim the $370 to $373 area and close above the 10-day moving average.

Really, that’s what we’re waiting for — a break of one of these levels.

S&P Futures — ES

The S&P futures show the same thing: A reluctance to close below the contract lows from June, but a hesitancy to make a notable push higher.

A break of 3639 that isn’t reclaimed puts this week’s low at 3613 in play. On the upside, 3750 is resistance until proven otherwise.

ES — The Trade

Above is a 30-minute chart of the ES. As you can see, we are currently bouncing off the 3640 zone, which is the June contract low and the Globex low.

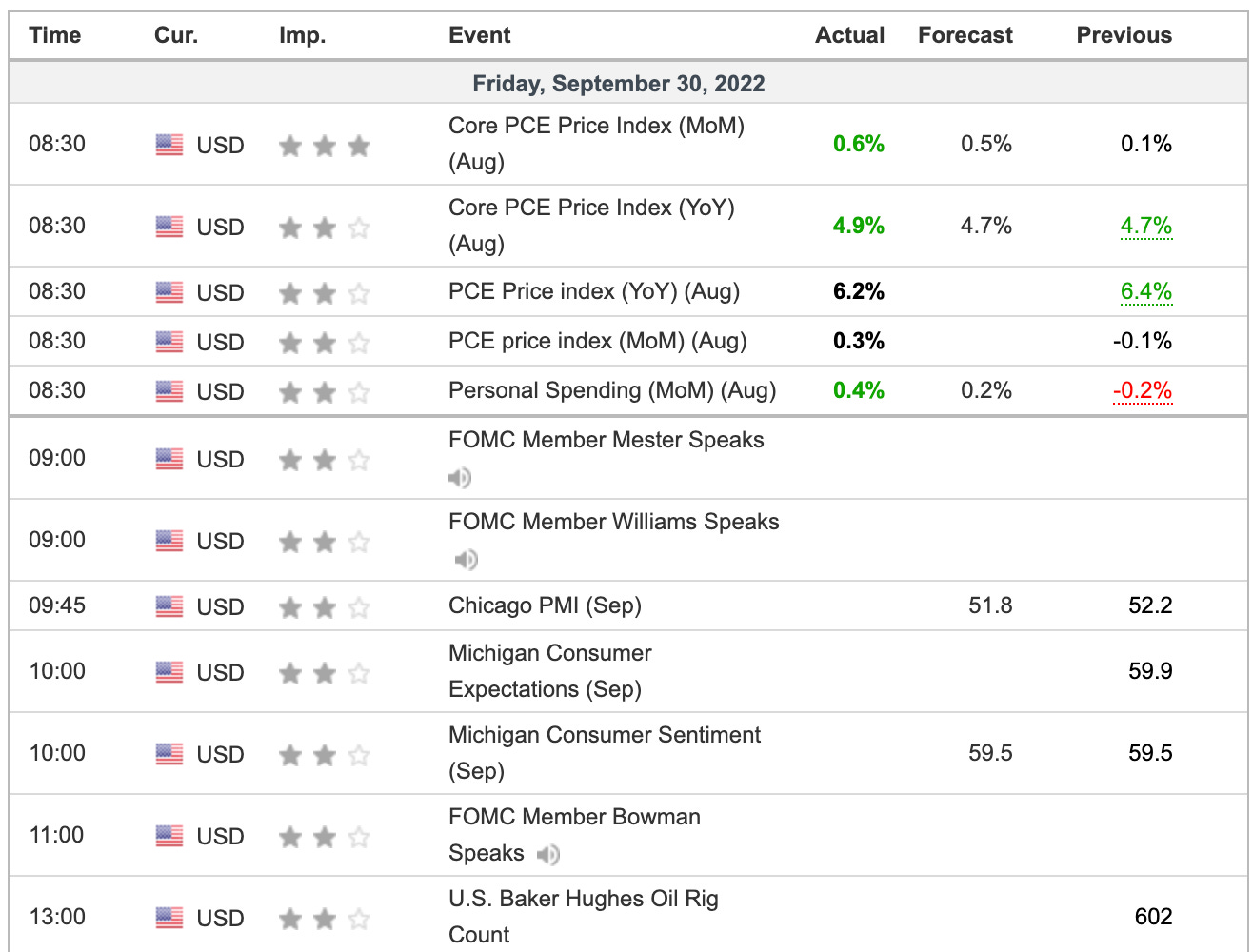

Initially falling on a disappointing PCE reading, we have some clear levels to watch.

Pivot: 3660 to 3670.

Above the pivot and the 3690s are a big level, followed by 3710 and finally, 3730 to 3735.

Below the pivot and 3640 remains vulnerable. If 3640 holds as the Globex low coming into the regular session, this level becomes vital for the bulls to defend and the bears to break.

A break and failure to reclaim 3640 puts 3622 in play, then 3613, then 3585.

Nasdaq — NQ

Let’s keep the NQ simple here.

Pivot: 11,230 to 11,250. Above this zone and it’s possible that the NQ pushes into the 11,350 to 11,380 area. Above that and the 11,500s are possible.

Below the pivot and 11,150 is vulnerable, followed by this week’s low at ~11,091 and the 2022 low at 11,068.50.

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Notes:

Relative strength leaders →

Top:

ENPH — holding the breakout near $269

LNG — nearing the breakout near $150 — Monster Reaction

MCK — holding the breakout near $340

CAH — holding the breakout near $64 — Monster Reaction

Here’s a quick look at the stocks above.

FSLR

ALB

VRTX

CYTK

PWR

CHNG — robust

CELH