Technical Edge —

NYSE Breadth: 77% Upside Volume

Advance/Decline: 74% Advance

VIX: ~$19

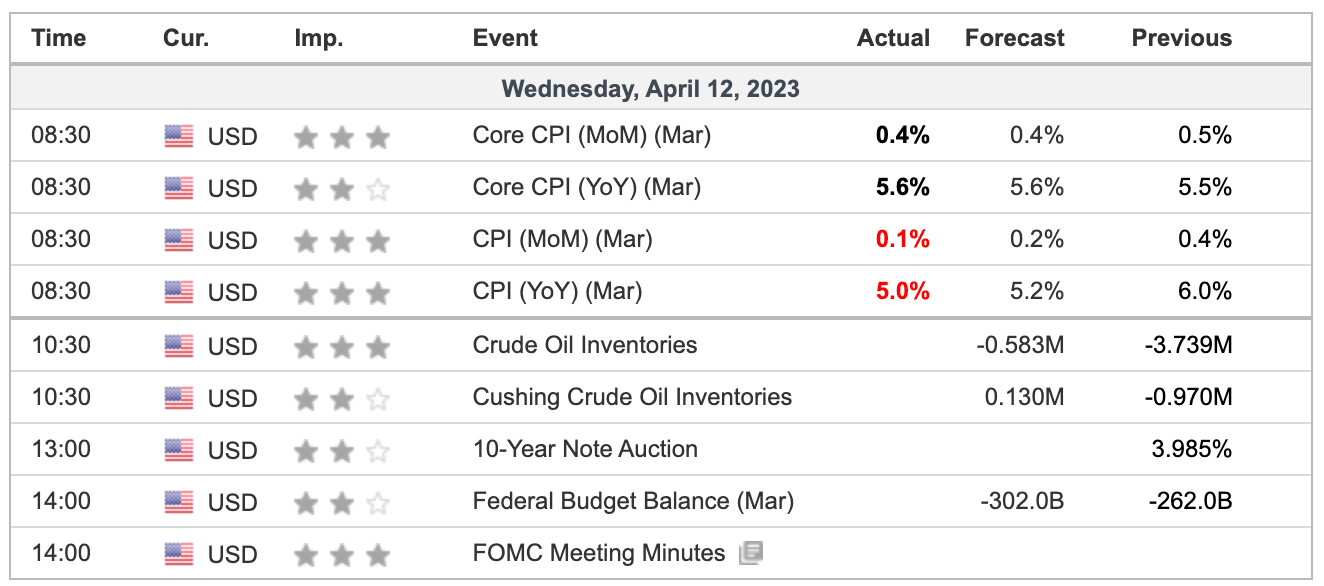

Keeping it nice and light today as the CPI will be the driver. Tech weakness lately could be the deciding factor going forward, as big tech is what’s been fueling the gains lately.

S&P 500 — ES

All that rallying and the ES still couldn’t hold above the March high of 4142.50. Now the CPI will be the driver for today.

Upside Levels: 4142.50 (March high), 4158-60, 4172-75, 4200.

Downside levels: 4095-4100 (that’s the 10-day ema and a multi-day low), 4076, 4054

SPY

Upside Levels: $409.70-ish (you can see the significance on the chart). $412, $415 to $416

Downside Levels: $405.50 to $406 & 10-day ema, $402 to $403

SPX

Upside Levels: 4110-12, 4133, 4150, 4172-75, 4195-4200

Downside Levels: 4070-75, 4050, 4020-4030

QQQ

Two inside days in a row. Look for a break of the range over $318 or below $315.30. A break needs to hold and we’re barely above yesterday’s high in the pre-market, FWIW.

DIA

Keep that tight weekly range in mind. Over $336.25 or below $332.63 could accelerate the move in the respective direction.

LMT

The action (and setup) will be dependent on the CPI results, but keep an eye on LMT and see how it handles the 10-day ema in the $485 to $486 area. It could set up as a long if it holds this level as support.

Stop loss would be $480. First upside target would be $490-92, then $495+ for another ⅓ trim.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

FSLR, NVDA, QQQ, AAPL, down to runners. Congrats, all. Great sequence!

AAPL — for those that were swinging AAPL for the longer timeframe, we got our $165 area to trim into and as we continue to tip-toe higher, I’d say down to ½ size here or even less.

Going for $168.50 to $170 on the next tranche. Raise stops up to $160.

CRM — I am long calls instead of common, as it’s easier to manage the risk in this case. For those long common, you don’t want to see CRM break $192 to $192.50.

GE — long from ~$94.50. Stop-loss at 30 or 60 minute close below $93 (or $93.50 if you are playing this tight vs. last week’s low).

Upside target is $96+ for ⅓ trim. Then $97+

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders → Tech remains absolutely the strongest group lately.

NVDA, AMD

TSCO

MSFT, AAPL, META

PANW, FTNT

FSLR

GE

PEP & KO → great reset trades to the 10-ema

AQUA

DKS, ULTA

LMT, RTX

GOOGL, AVGO

ULTA & LULU

MELI