Technical Edge

NYSE Breadth: 82% Upside Volume (!)

Advance/Decline: 74% Advance

VIX: ~$14.75

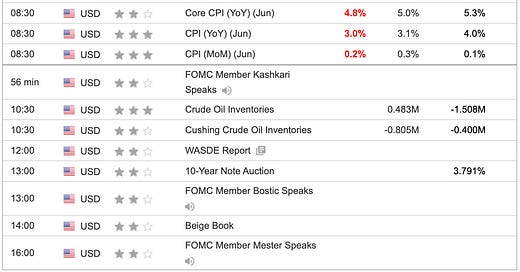

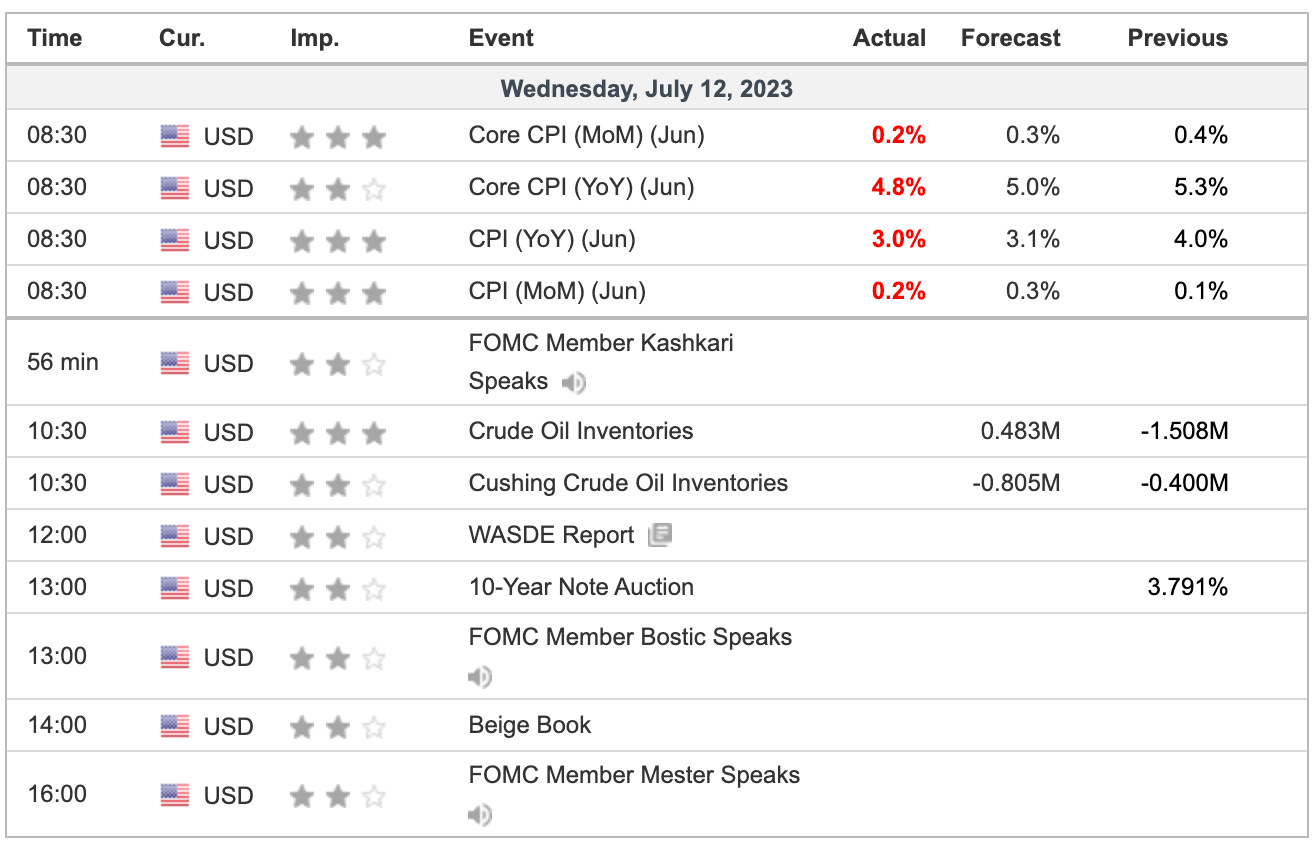

The CPI numbers all came in light vs. expectations. Will that give FundStrat’s Tom Lee his 100-handle S&P rally? I don’t know about that, but if it does, there’s still room to run with the S&P “only” up 70 basis points in pre-market trading.

Instead, I think we can keep milking some of our long positions, while riding fresh breakouts in ARKK and other areas of the market. The S&P 500 — whether we’re looking at SPY $444, ES 4500 or SPX 4450 — is set gap-up over resistance.

For the bulls to have legs into earnings season, it is critical that the index holds this breakout level.

SPY

SPY was as tactical as I can remember yesterday and did exactly as a trader would want it to. After gapping up, it faded off the open, filled the gap and held that area as support. Then it pushed higher and ran to Friday’s jobs-day high.

$444 remains key on the upside and must close above this zone to unlock the $450s. If the CPI reaction is bearish, last week’s ~$437 low needs to hold for the bulls.

Upside Levels: ~$442.65, ~$444 resistance

Downside Levels: $440 (pivot), $437, $435, $430

S&P 500 — ES Futures

4500 was key during the second quarter. Bulls need to clear this hurdle and hold above it, opening 4550+ on the upside.

Upside Levels: 4490-98, 4526-30, 4550, 4570

Downside levels: 4419, 4411, 4395-4400, 4370

SPX

Pivot: 4412.50

Upside Levels: 4430, 4440, 4450-60

Downside Levels: 4440-50, 4424-27, 4411, 4393, 4370

Nasdaq — NQ and QQQ

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.