CPI Pause: Stocks Waiting for Tomorrow's Inflation Report

Here's must-hold support in the Nasdaq and S&P.

Technical Edge —

NYSE Breadth: 69% Upside Volume

NASDAQ Breadth: 65% Upside Volume

VIX: ~$22

Will the market eventually care about Macro?

I’m a price-action guy all the way. While I find the macro stuff fun for weekend bullshitting, I am a “price first” type of analyzer. That said, you do start to wonder if and when there will be consequences to real-world developments.

Remember a few weeks ago when the Fed raised rates by 75 bps and most of FAANG missed on earnings or revenue (or both)? Yet the markets pushed higher. Despite more misses, guidance cuts and a jobs report that implied the Fed would be more hawkish, markets continue to tip-toe higher.

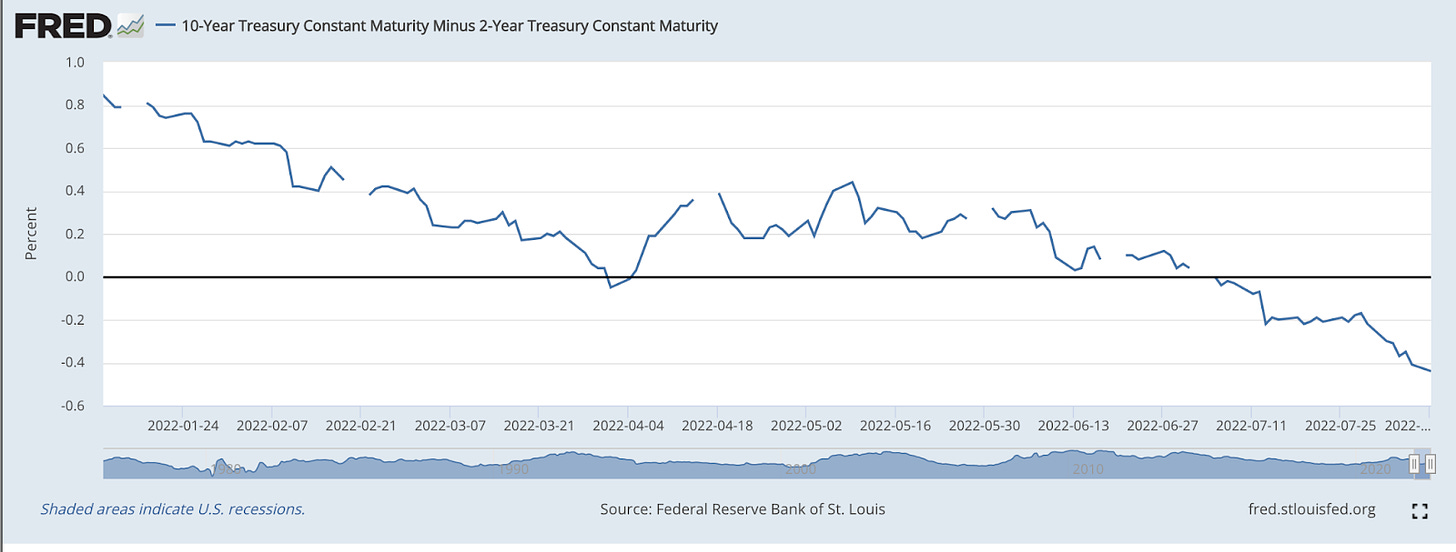

Nvidia came out mid-quarter and slashed its outlook. Micron followed up a day later. These are not good signs and yet, the market is shrugging it off. The 2/10 year spread — which isn’t a slam-dunk recession indicator, by the way — just hit a new low, but equities don’t seem to care.

As I noted in a separate piece yesterday, bonds could be flashing a possible warning sign. But until all of these issues manifests itself in price action, there’s not much for traders to go on.

Game Plan: ES Futures, SPY, QQQ, NQ Futures

S&P 500 — ES

No need for a different plan every day. Until the ES can break 4170, bulls have a ceiling. On the downside, 4080 is support.

Yesterday’s “look above” and reverse back down did suggest some caution from the buyers, but I suspect it is more related to a pause ahead of the CPI report than anything else.

In June, we had similar action as the 4150 to 4200 area was resistance. The ES was consolidating ahead of the CPI print, then broke lower following the release. I don’t know if the same pattern is setting up, but it’s something to watch.

S&P 500 — SPY

Earlier I mentioned macro vs. price action and this is why. If you back out all the noise — earnings, the Fed, what people are saying on Twitter, CNBC, etc. — and just look at the chart, the situation is pretty clear.

$416.50-ish was support in the first quarter, resistance in the second quarter and is acting as resistance now.

If we get above and stay above this level, it’s bullish. If we get rejected by this level and break below short-term support (like the $407 and the 10-day), then it’s bearish!

It took me a long time to realize that most often, “simple” pays off the most.

Nasdaq — QQQ

It’s not an analog and it’s not identical. But the action yesterday reminded me of the action in mid-November. That’s when the QQQ pushed to all-time highs, then reversed and ended below the prior day’s low — a bearish engulfing candle.

Yesterday’s action was quite that bad. But for the first time, it reminded me of that day, which a good friend of mine called “a day to take notice.” And he was right.

I don’t know that we’re in that same scenario now, but the hope and FOMO that came into Monday morning was pretty palpable, especially considering meme short-squeezes and initial rally in growth stocks.

First and foremost, the QQQ has to hold the 10-day moving average and $313 to $314 as support. If it can’t, $300 and the 21-day are in play, followed by $296.50.

If it can hold above initial support and ultimately clear the $325 hurdle, then we could be looking at higher prices to come. Especially if we don’t collapse on the CPI report.

Nasdaq — NQ

The NQ is not unsimilar to the QQQ. On a pullback, it has to hold the 12,900s and the 10-day for the active sequence to remain intact.

In fact, I am a buyer on a test of this area, as there’s no reason to bet against support in a bull trend until it fails (even if that trend is only a counter-rally amid a bear market). Once support fails, then we can change gears.

On the upside, 13,350 to 13,360 is resistance. If the NQ can get above and stay above this zone, 13,650 to 14,000 could be in play.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Trade Sheets: Now have 2-3 live trades, all with breakeven or better stop-losses. Great stress-free position to be in as we try to squeeze a bit more of upside out of this move.

MCK — finally got out $348 to $350 target. I am out the last bit here, but with a profitable stop-loss at $325 (entry in the low $300s), anyone who wants to press for $355 to $365 with their last ¼ to ⅓ position can do so. Cheers

PEP — We got out Target cNo. 2 at $177. Either all out now or down to ⅓ of a position if playing for a breakout. Stop at $172 (above B/E).

UUP — $28.60 to $28.80 is ideal first trim zone, but bulls can trim ¼ at $28.50-ish if they’d like, as the UUP runs into the 10-day ema.

CHNG — volatile session on Monday, but held where it needed to. In fact, that spike down gave us a level to measure against. I’m using a stop-loss in the $23.20 to $23.35 area.

Looking for $24.50 to $24.70 for first small trim, (i.e. ¼ to ⅕ position trim). More aggressive traders can look for $25+ for first trim

Relative strength leaders (List is cleaned up and shorter!) →

O

CNC

HRB

ENPH — kickstarted the rally in Solar

TAN

FSLR

MSTR

LNG

PWR

CHNG

COST — trade is live

PEP — trade is live

BA

UNH

XLE

MCK — trade is live