Technical Edge

NYSE Breadth: 61% Upside Volume

Advance/Decline: 52% Advance

VIX: ~$15

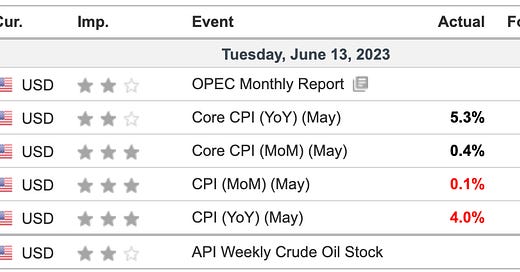

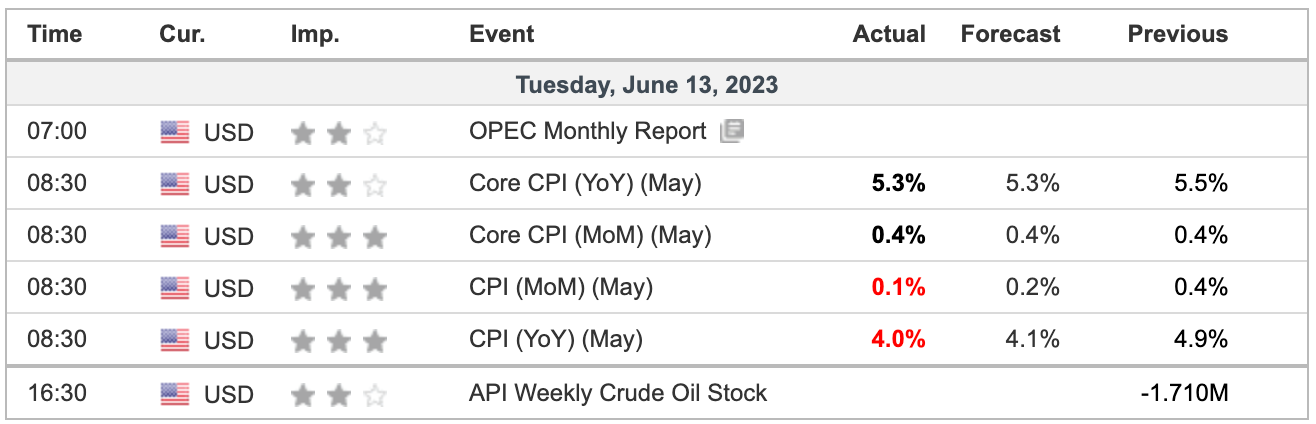

The CPI print was not necessarily great but had nothing too terrible in the headline numbers. The S&P is rallying slightly, with the ES up about 15 points overall and up 10 points off since 8:30 a.m. ET.

The market likes the number, but doesn’t necessarily love it. I could see today’s gap being filled after the open.

Earlier this month the S&P popped higher, rallying ~100 points in a two-day span on June 1st and 2nd. Then it consolidated sideways and is pushing higher once again. It’s through the first upside extension (near 4375). If it continues higher, that 4420-25 area is of major interest.

In other words, bulls continue to dominate the tape and until that trend ends, traders should keep buying the dips.

SPY

Upside Levels: $435-36

Downside Levels: $429.50, $426, $423

S&P 500 — ES (September Contracts)

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.