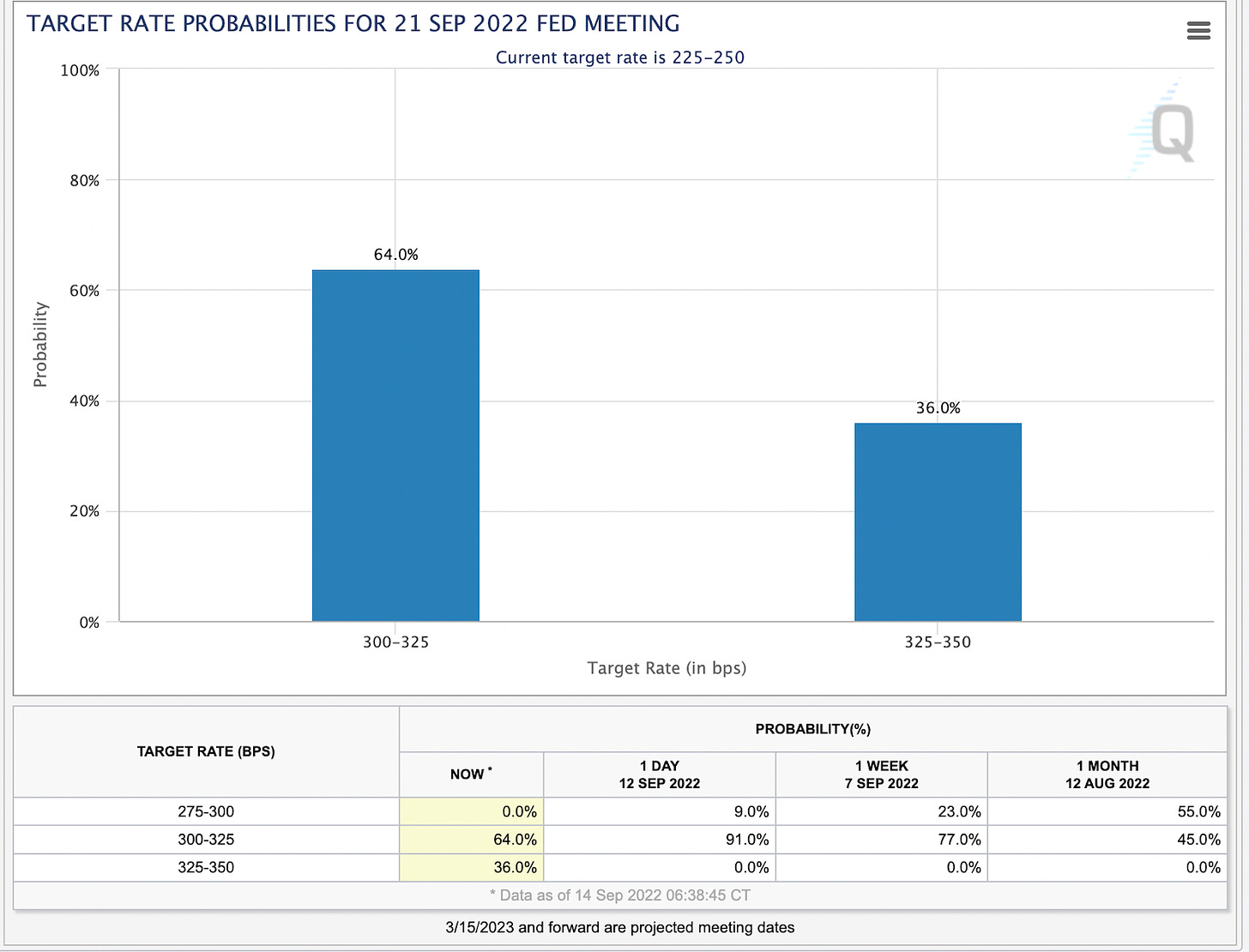

A week ago, the odds for a 50 basis point hike from the Fed on Sept. 21 was 23% and a 77% chance for a 75 bps hike. Now those odds call for a 64% chance of a 75 bps hike and a 36% chance of a 100 bps hike!

Technical Edge —

NYSE Breadth: 95% Downside Volume (!!)

NASDAQ Breadth: 80% Downside Volume

VIX: ~$27

Game Plan: Bonds, Dollar S&P, Nasdaq

I think the bonds did it again; they warned investors about what was to come. In early August, we asked “What Are the Bonds Trying to Tell Us?”

The bonds have been right all along and they were breaking to new YTD lows ahead of the CPI print.

I don’t know what yesterday’s reaction would have been had the CPI report showed a cooldown in inflation. I guess the markets would have rallied, even though they were up big in just a four-day stretch.

With yesterday’s fall, the S&P has nearly wiped out all of its gains from that big thrust, doing so on 95% downside volume. But the crazy part is, after yesterday’s action we are just back to where we were trading last Monday/Tuesday.

Let’s talk the S&P here, with a video to follow later today/tonight.

S&P 500 — ES

Watching yesterday’s low of 3938.50. A break of that opens the door down to the last two week’s of lows near 3883 to 3886. Weekly-down opens the door down to 3750 to 3780.

On the upside, the 50% retrace of yesterday’s move is ~4060, but I’m not confident we’ll get there.

S&P Close-Up

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.