The Fed Minutes are weighing on stocks as investors continue to fret about rates.

Market participants find themselves in an impossibly difficult situation: Don’t fight the Fed or don’t fight the trend?

While the Fed is closer to the end of its rate-hiking spree than the beginning, doesn’t mean the market is prepared. As Powell & Co. reiterate their calls for “higher for longer,” the market had been — until very recently — calling the Fed’s bluff and pricing in rate cuts by year-end.

Even though the stock market continues to barrel higher and the seasonality stats remain strong, the bond market has taken notice and started to price in higher rates. That leaves us with a trade setup in TLT and a note on the /ZB futures and 10-year yields, but we’ll drop those below in the technical section.

Technical Edge

NYSE Breadth: 38% Upside Volume

Advance/Decline: 29% Advance

VIX: ~$14.75

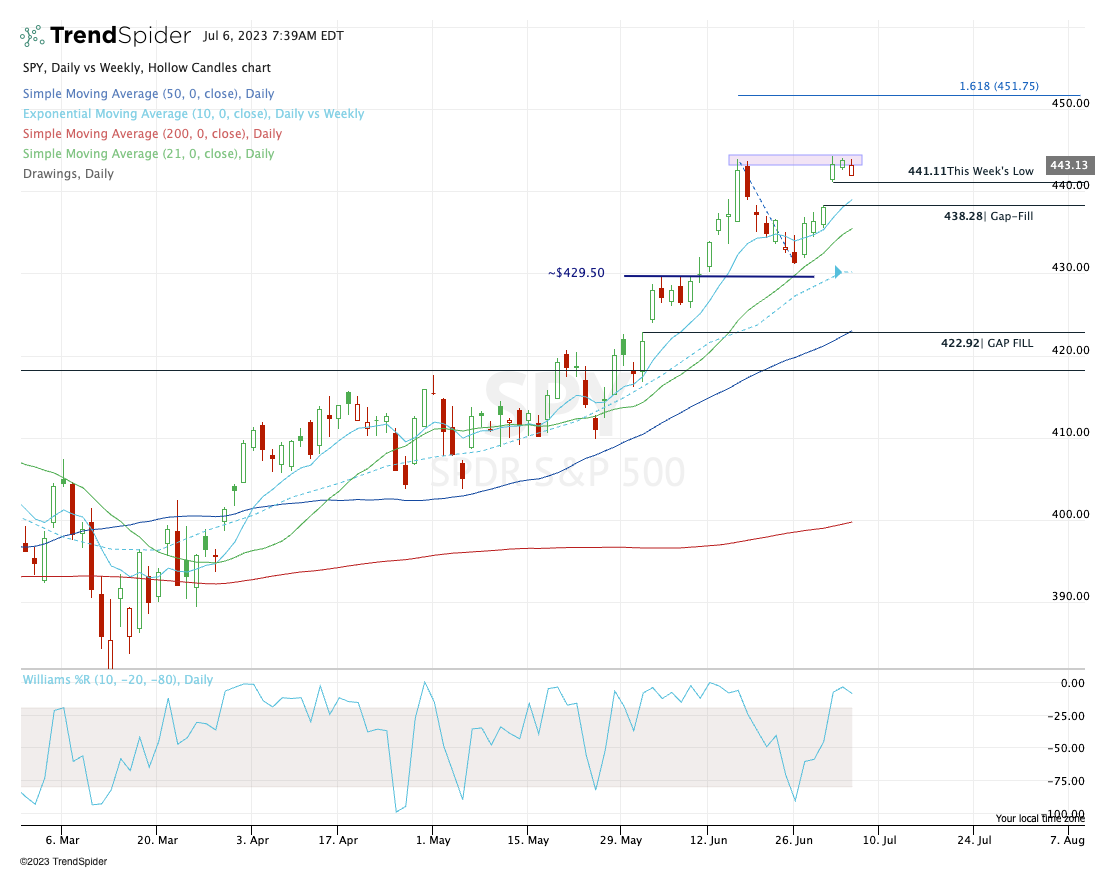

SPY — Gap-Up Caution

Bid right off the open yesterday, as SPY continues to hold this week’s $441 low. There’s more selling pressure this morning, so let’s keep an eye on that mark this morning.

Below $441 and the $438.28 gap may need to be filled.

Pivot: $441

Upside Levels: $442, ~$444

Downside Levels: ~$438, $436

S&P 500 — ES Futures

Bounced really nicely off our 4465 pivot and couldn’t regain the 4490s. Now under pressure again, we see if the bears can gain momentum with rates working in their favor.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.