Apologies on the morning delay. Some tech issues on my end. Here’s today’s game plan.

Technical Edge —

NYSE Breadth: 60% Upside Volume (Thursday)

Advance/Decline: 55% Advance (Thursday)

VIX: ~$19.50

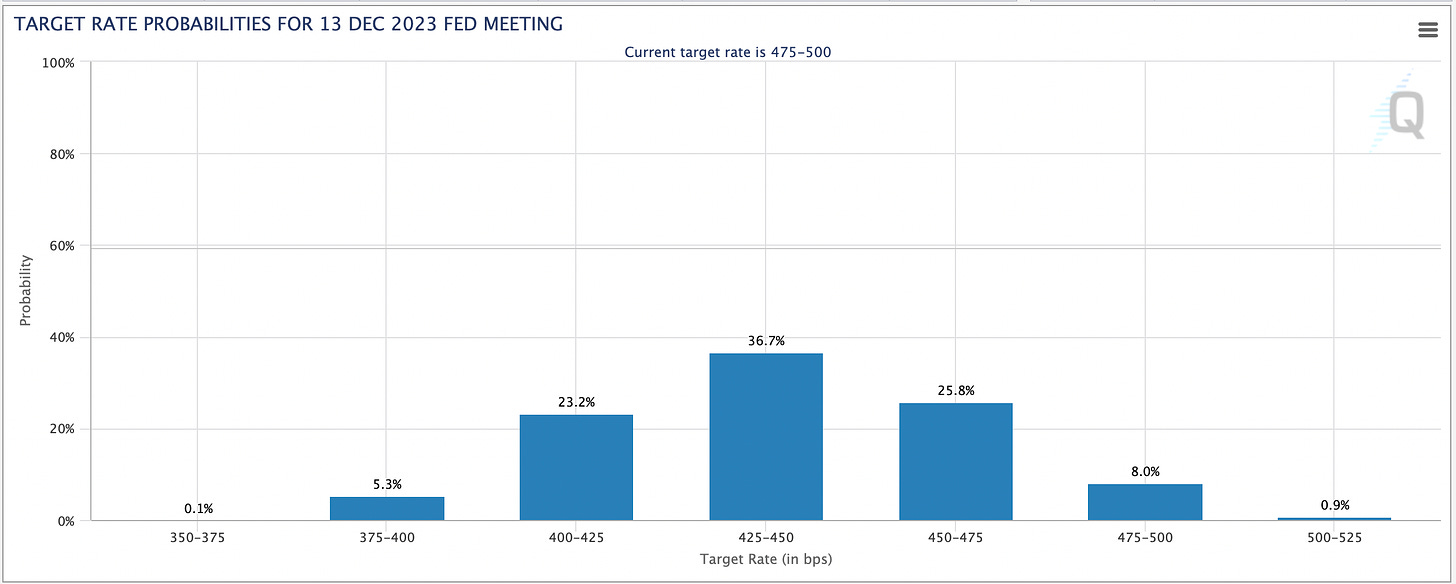

One explanation for the current rally? The expected drop in interest rates. While the market still expects a 25 basis point increase from the Fed in early May, estimates call for rates to fall 50 basis points from current levels at year-end (or down 75 basis points from May’s expected hike).

A month ago, the consensus estimates were for rates to be 50 basis points higher than current levels at year-end. So this has likely helped fuel a bit of the recent rally, even if the catalysts behind the rates hikes are not good.

S&P 500 — ES

4135 held as resistance on Friday and it’s now the two-day high. Above it keeps the March high in play. Below could put more pressure on the ES into a key zone.

Upside Levels: 4142.50 (March high), 4158-60, 4172-75

Downside levels: 4095-4100 (that’s the 10-day ema and two-day low), 4076, 4060-65

SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.