Technical Edge —

NYSE Breadth: 87.1% Upside Volume (!)

NASDAQ Breadth: 80% Upside Volume (!)

VIX: ~$27.50

The VIX remains elevated in the high-$20s despite three robust days where the NYSE gave bulls 83%, 87% and 87% upside volume days.

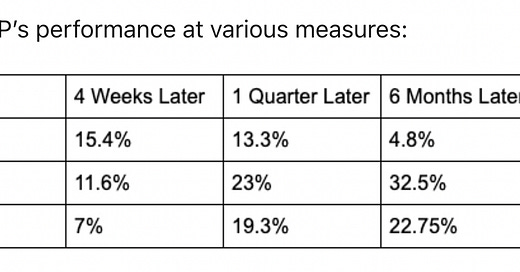

In the past, we have had multiple stretches of back-to-back 80%+ upside days. But the last time we had three 80%+ upside days was in March 2020, on the 24th, 25th and 26th. You may recall that the S&P 500 bottomed on March 23rd.

When we combine it with the stats of 7 or more consecutive down weeks (shown above), I think it’s a fair question to wonder whether the market has bottomed. I would feel comfortable thinking that the low is in for intermediate term, but of course, that doesn’t guarantee that it is!

Game Plan — S&P (ES and SPY), Nasdaq (NQ and QQQ), ARKK, Oil, Wheat

S&P 500 — ES

Man, I don’t know what else to say about the ES. It gave us the power move up to the the 4150 level. On Friday, we said if it goes weekly-up that this level was possible and the holiday trade likely made it work.

I want to take today slowly after such a strong finish to last week.

If the ES can clear Friday’s high at 4168, then 4200 is back in play. Above that opens the door to 4220, then the 50-day.

On the downside, holding 4100 is ideal, but 4050 and the 10-day and 21-day moving average is almost a necessity if bulls want to stay in control. All bets are off below 4,000.

SPY

One would expect the SPY to cool a bit after such a robust three-day run. If it does, that’s fine. But I want to see it hold $405, along with the 10-day and 21-day moving averages.

Below $400 and the bulls lose plenty of control.

On the upside, a push to the $420 area could be in play if the SPY clears Friday’s high. $421 is the 50% retrace of the 7-week down leg.

Nasdaq — NQ

We weren’t looking beyond 12,595 — the prior week’s high — on Friday, but +325 was enough points on the NQ to go into the weekend happy. That’s even as the NQ cleared 12,700 in Friday’s session and pushed even higher during Globex.

Now back into a significant area of interest, the NQ is feeling some pressure. That makes sense — it’s rallied 1000+ points in three days.

From here, I just want to see it hold the 10-day and 21-day moving averages.

Above 12,720 and the Globex high at ~12,880 is within reach. Above that puts 13K in play.

Nasdaq — QQQ

Tech has been more compressed than the rest of the market, so the QQQ could have more pep in its step if the rally continues.

On the downside, I’d love to see it hold $300 and its key short-term moving averages.

On the upside, $318 to $320 is the next big level. Above that puts $325 to $327 in play — which is the 50% retrace and the declining 50-day.

ARKK

ARKK ended last week by clearing the $44.50 resistance level and going weekly-up. If it holds the 10-day and 21-day moving averages, the stage is set for a push up to the $50 to $52 area.

If it loses the 10-day and 21-day, $40 could be back in play.

CTVA

Lower in the pre-market now with a low of $61.22 on Friday.

Can we undercut the low and tag the 10-day? If so, could give bulls a great entry.

CL — Oil

Clearing a key resistance area now, CL has the door opened up to $122.50. Rising oil prices could cap the stock market, as investors know the pressure that puts on the consumer.

Above $122.50 and $127 is in play.

We cleaned up on energy last week with XLE and XOM. These will be go-to candidates on the dip.

Wheat — ZW

I am keeping an eye on the 1114’4 area — last week’s low. If we break that mark and tag the 10-week ema, and the bounce back through 1114’4 (a classic reversal), then bulls can get long against this week’s low assuming it’s reasonable and look for a larger bounce.

If it doesn’t trigger, that’s okay. But it’s something to watch.

More aggressive bulls can just buy the dip to the 10-week.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely. Bold are the trades with recent updates. Italics show means the trade is closed.

We have been spanking the very select individual trades we have taken. For that, I’m super grateful! It shows that discipline wins out in a tough tape.

DXY / UUP — 103.50 to 104 would be the ideal first trim area. For UUP, that's $27.50 to $28. For UUP, conservative bulls may be waiting for a gap-fill at $27.09 and a tag of the 50-day before getting long.

ZB (bonds) — Weekly-up in play → Came oh-so-close to our trim spot and reversed. Longs can either exit now for a small loss or hold as long as ZB can reclaim last week’s low of 140’01 and hold above it. I’m opting to exit at a small loss.

MRK — Got us our first target above $93. → Can go with a break-even stop-loss or use Friday’s low at $91.75. $94 to $94.50 is next ideal trim zone.

Relative strength leaders (List is cleaned up and shorter!) →

XLE / XOM

AR — just robust. Into the 161.8% nowz

DLTR

CTVA

VRTX

AMGN

MRK

MCK

JNJ

BMY