Fed Will Hike Rates, but What Will "Guidance" Be?

It's more about what the Fed will do going forward, rather than what it will do today.

Technical Edge —

NYSE Breadth: 13% Upside Volume (!)

NASDAQ Breadth: 75% Upside Volume

VIX: ~$27

Game Plan: S&P, Nasdaq (SPY, QQQ, etc.)

The downside breadth days have been piling up, with three 80%+ downside breadth days in the last six sessions (and one of those was a 95% downside day).

The market is trying to carve out some sort of bottom here, but ultimately its fate will rest with the Fed.

At 2:00 p.m. ET, the Fed will announce its rate hike. Forecasts call for a 75 bps hike, although there’s about a 15% chance the Fed goes with a full point hike.

Currently, the Fed news is like an earnings report. The market doesn’t care about the results as much as it cares about “guidance.” In other words, what is the Fed’s outlook on its rate hikes.

More aggressive or less aggressive? That’s what market participants want to know.

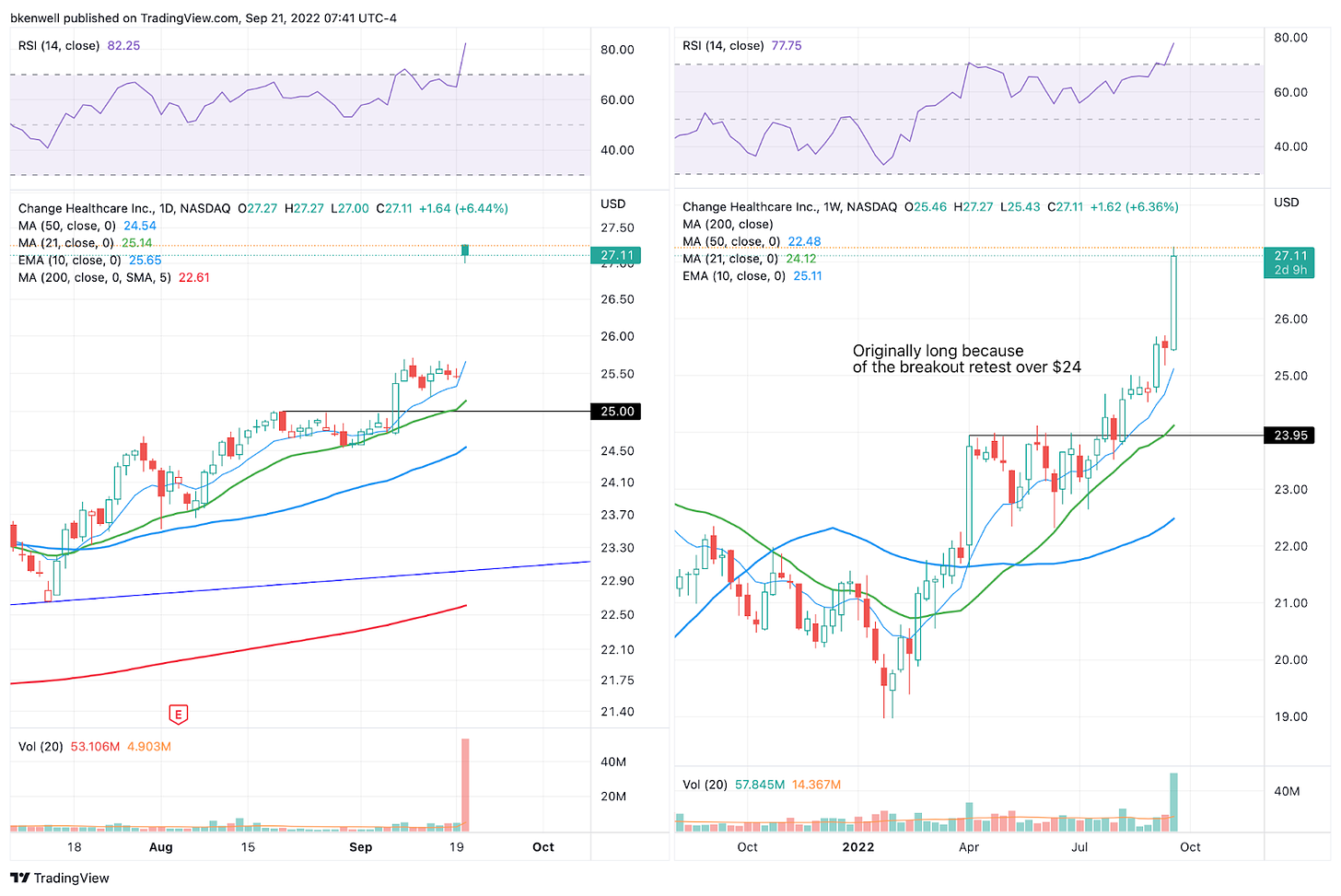

CHNG

Looking for $26 on the last chunk of our trade in CHNG, I closed out the rest of my position yesterday on the gap-up to $27.

While this is certainly a stroke of luck, I want to highlight something more important.

Notice how well this stock held up during the corrective phase in the market. It remains in a breakout state and above active support, (the 10-day ema). The trend and technicals remained healthy when the state of the market was not healthy.

That kept us in it and that led to yesterday’s big pop.

Keep that in mind going forward with other holdings.

S&P 500 — ES

Yesterday I made the remark that the market just doesn’t feel like it wants to go down, but it hasn’t been able to sustain any upside moves.

I can’t help but notice the strong wicking action out of the 3840 to 3850 area, somewhat similar (but less pronounced) than the action we saw out of the 3740 to 3750 area in July. (hence the “just doesn’t feel like it wants to go down” comment.”

Does that mean we rip? Well…

One thing is for certain: Bulls need to clear 3920 and the 10-day moving average on the upside. Above that could set up a test of the 4000 area.

Bears need to break 3843 to 3855. Below this zone could open the door to 3790 to 3800.

ES — Zoomed In

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.