Technical Edge —

NYSE Breadth: 16% Upside Volume (!)

Advance/Decline: 19% Advance

VIX: ~$17.75

I’m glad this was our approach yesterday: “Keep it light and stay sized right. We’re at an interesting juncture here as May starts off on tricky footing.”

On Monday, we closed the remaining open positions we had and we were lucky with the timing given Tuesday's action. From here, let’s see what the market gives us ahead of the Fed.

Some stocks still trade really well, but we can afford to wait a day or two to see how things shake out from here. There are some potential market-turning catalysts on deck (mainly the Fed and AAPL), so let’s be ready to pounce when appropriate.

The expectation remains that the Fed will increase rates by 25 basis points. However, it will be what the Fed has to say about ongoing hikes/momentary policy that will investors will be listening for.

It feels like the market is waiting for the Fed to pause, given the chaos we’re seeing with regional banks. Will that matter enough to Powell & Co?

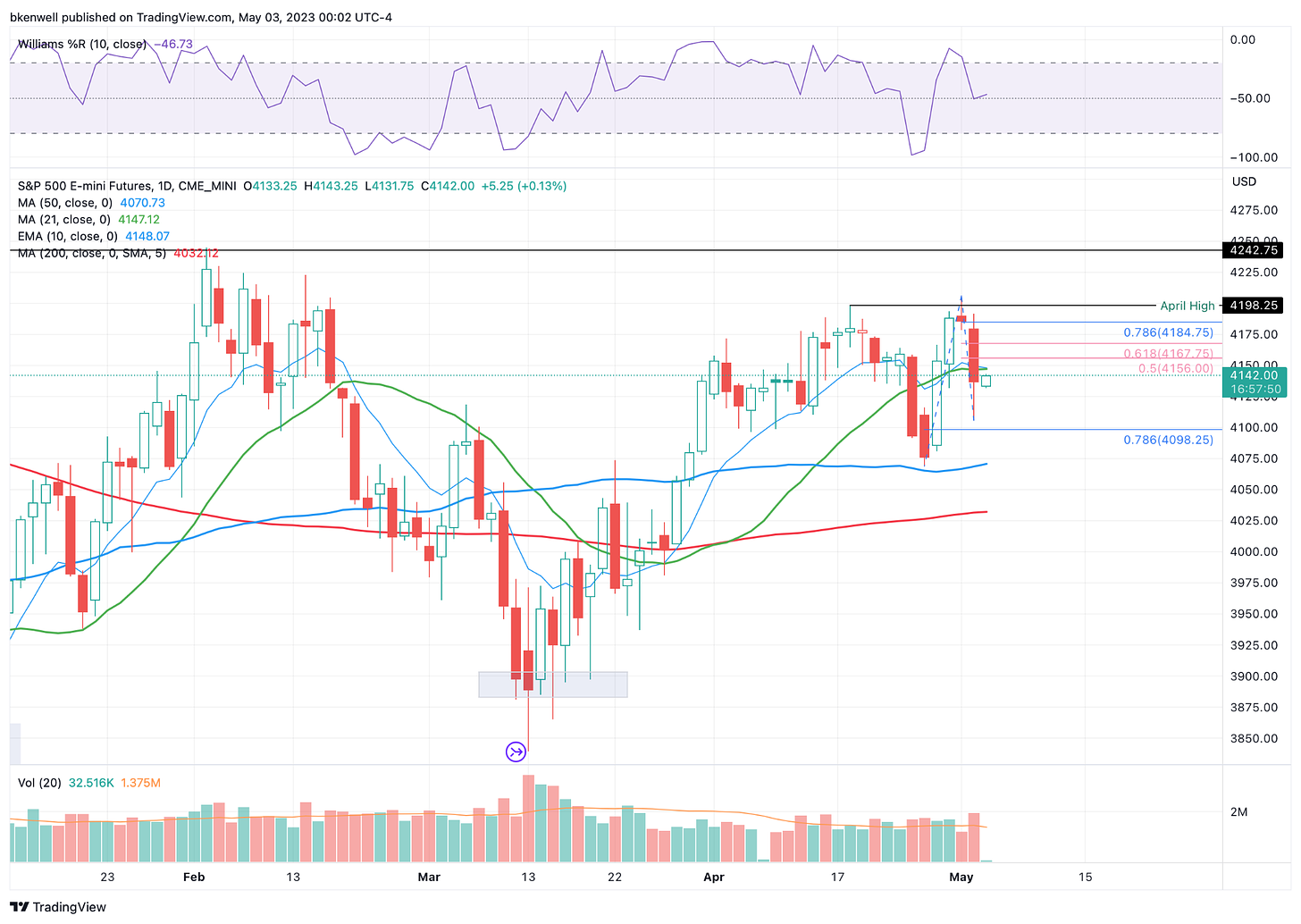

S&P 500 — ES

Upside Levels: 4150-56, 4180-84, 4200-06, 4242

Downside levels: 4130, 4095-4105, 4070-75

SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.