Technical Edge —

NYSE Breadth: 69% Downside Volume

NASDAQ Breadth: 67% Downside Volume

After a big-breadth rally on Wednesday, the bulls totally dropped the ball on Opex Thursday, as we took a bearish turn into the holiday weekend.

Earnings will really pick up the pace this week and in general, earnings season could play a big role in what happens next. Do they buy stocks on the news or sell them and cause the next leg down? Powell speaks this week too, for what it’s worth.

Game Plan

Those of you who have been reading the Game Plan for several months know that I like to tip-toe into Monday’s. Monday sets our trading tone for the week and I hate starting off on the wrong foot.

As nice as some of our individual trades have been, the indices remain a tough trade.

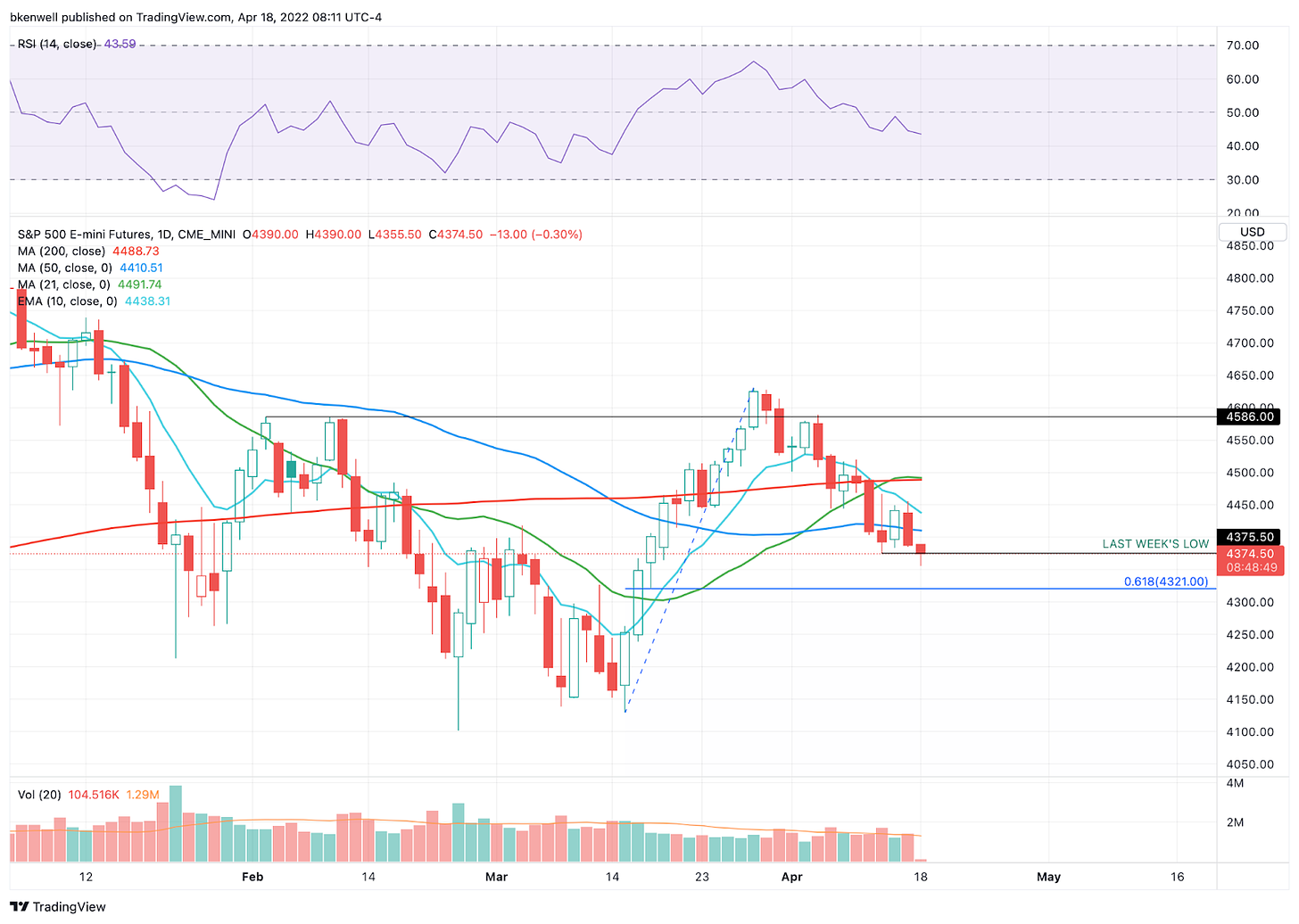

S&P 500 — ES

Feel free to extrapolate this chart to SPY

The ES moved lower in Globex but is popping off the lows. Last week, the prior week’s low (at 4444.50) was resistance all week.

Now flirting with last week’s low during Globex (at 4375.50), bulls need to recover this mark.

If they can do so and stay above it, it puts 4400 in play, then the 4412 to 4417.50 zone. Above that puts active resistance in play via the declining 10-day moving average.

On the downside, watch the Globex low at 4355.50. A break of that mark that’s not reversed could open up 4321 on the downside.

Nasdaq & Individual Stocks

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.