Friday or "Fry-Day?" | Can Bulls Harness Control From the Bears?

Right now sellers are in control, not buyers.

Technical Edge

NYSE Breadth: 76.3% Downside Volume

NASDAQ Breadth: 81.6% Downside Volume (!)

There are so many bad moves taking place below the surface. I continue to see the high-growth stock names — essentially the ARKK holdings — getting buried. I can’t help but think it’s the irrational exuberance being punished.

To some extent, I do believe it’s overdone. The PYPL, TWLO and ROKU’s of the world are actually good companies. However, I also know it’s a bear market and there’s no telling where the bottom is. My biggest fear (for this group anyhow) is, how will they react if and when the larger indices eventually roll over?

Before I go further, just a note to all the readers here: Enjoy yourself this long weekend. If you’ve making a killing, enjoy that feeling and remember to be humble. If you’ve struggled and lost, take it easy on yourself, regroup and focus on the positives. This is not an easy business.

Game Plan

For now, the sellers remain in control.

Earlier this month, we talked about the possibility that S&P was setting up an “ABC” correction and we were simply chopping around in the “B leg” portion of that dip.

In that case, it could put last month’s low back on the table.

We could make a case for the long side too, but the way I see it, the default trade sits with the bears — selling the rallies — and the bulls need to take back control before we shift into a different outlook (ie buying the dips).

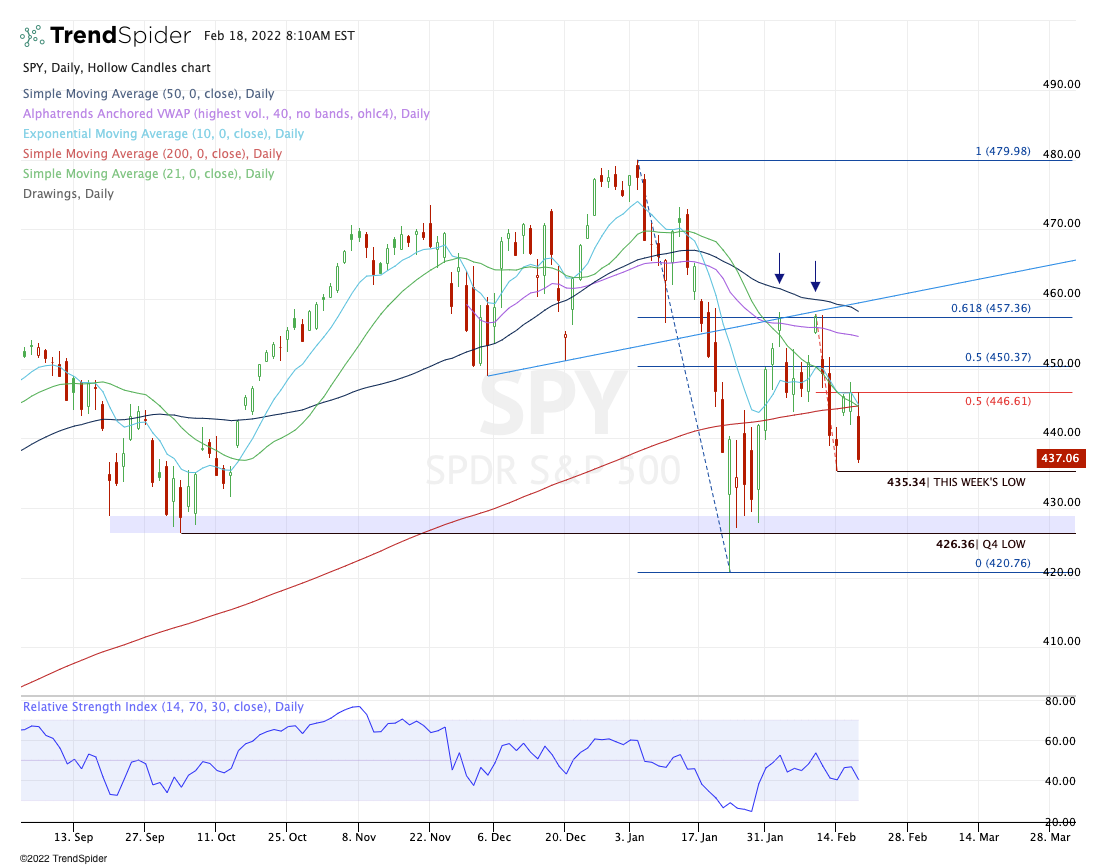

Let’s show it via the S&P chart below.

S&P 500 — SPY

Feel free to extrapolate this layout to the ES.

Notice how the SPY came down super hard, found its footing in the high $420s and bounced. However, the S&P couldn’t push through the 61.8% retracement, topping out here in back-to-back weeks. That goes for the ES too.

Last week, the $446 area was support. This week, it was resistance (and it’s also the 50% retracement of the recent range).

On their own, these nuances — especially for a group conditioned to “screw it and buy the dip” — are nothing to think twice about. But taken together, they are telling a story.

A hard fall that bounces to the 61.8% retracement and fails…bearish.

A dip to $446 support, which turns to resistance…bearish.

Failure to get back above the 21-day moving average for more than two sessions…bearish.

Breaking below last week’s low…bearish.

Currently, the SPY is up about 50 basis points in the premarket. Could it gap-and-go to the upside? Yes. But it could also be a bounce to sell into.

The Trade: My gut says that if we gap up like this, it’s an opportunity to sell some and at least erase some or all of the morning gains. If the breadth is strong, maybe it holds up, but the ball sits in the bears’ court right now.

The upside levels are:

$440.90 — the prior H4 high

~$443

$444.50 — 200-day sma

Downside levels of interest:

$436.32 — Thursday’s low (daily down trigger)

$435.34 — this week’s low

$432 — the start of last month’s support zone ($428 to $432)

Nasdaq — QQQ

Feel free to extrapolate this layout to the NQ.

What I meant in the Game Plan by “shorts have control, longs can make a case is this,” is:

While the sellers have been in control (ie the observations in the SPY), you could argue that the QQQ is making a higher low and is now giving us a falling wedge/flag consolidation at the moment.

I try to be as objective as possible and am a bull at heart (the long-term statistics favor the long side). But the long case is much more of a “prove it” situation, whereas the short case has been playing out.

Upside Levels:

$349.28 — Prior H4 High

$350.32 — Q4 High

$352.75 to $353.50

Downside Levels:

$343.89 — this week’s low

$341 — prior support

Individual Stocks & Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

I don’t want to disappoint, but let’s take a pass on individual stocks today. We’re going into a three-day weekend with a VIX at $28 and quite frankly, did quite well with our trades this week (ABBV paid, ZTS paid, TD paid).

It’s not worth screwing up a decent week ahead of a long weekend.

For the most part, we didn’t have a lot of individual setups this week and even when we did, not many actually triggered. That’s just the type of market we’re in now, unfortunately.

Once 9:30 comes around, I may look to build trades off the Go-To watch list, which is its intention of being included here.

Go-To Watch List:

TD — Inside & Up day over $84.83. B/E stop from here.

ABBV — Down to ⅓ of position. Stop raised to $142.

TU — Looking for a test of the rising 10-day and $24.75 area.

MAR — watch for undercut of $177.70 area and a possible bounce. 10-ema on the H4 & a relative strength monster. Otherwise, 10-day could be in play like Hyatt.

COST — Daily-up could put the 50-day in play.

_____

BROS

TSN

DE

WFC, MET — MS 2x daily up over $104.50

Energy — HAL, OXY, SLB, etc.

BRK.B

H and MAR — Airlines looking better too

PM

COOP

TU

MAT

V & MA — Resetting now. See if a bid comes in soon

MKC

TECK

UPST — one of the few growth stocks actually working