Technical Edge —

NYSE Breadth: 67% Upside Volume

Nasdaq Breadth: 33% — the clear laggard

Advance/Decline: 59% Advance

VIX: ~$19.25

The VIX has now faded almost 40% from the recent highs, as investors seem less panicked about the banking situation.

Yesterday’s open saw a lot of selling pressure in tech, where we had several setups outlined (specifically, the QQQ, AAPL, AMD, NVDA & GOOGL). All stocks will be updated below in the individual stock section.

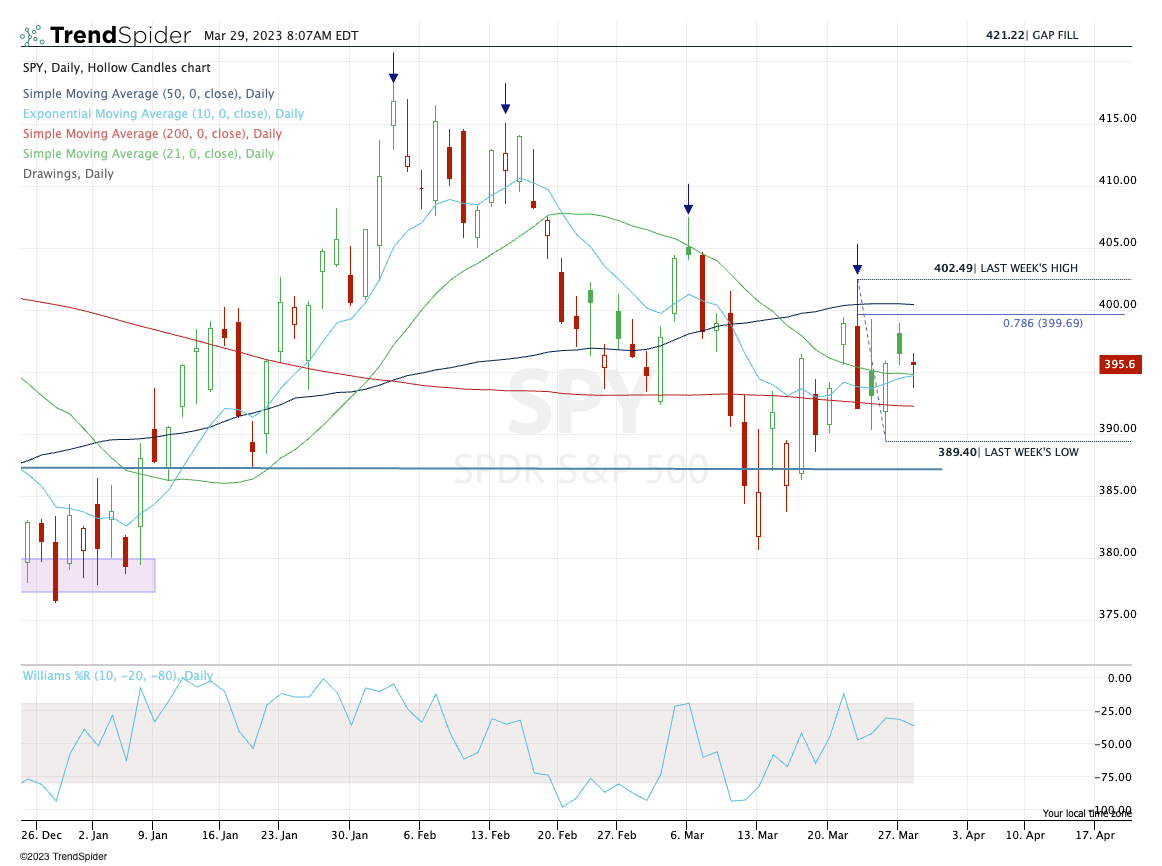

Let’s look at the S&P, which has been trapped in an ever-tightening range over the last month.

SPY

Set to open right near this week’s high, the SPY could push up into the $400 region. Will be key to see how it handles this area. I would expect some initial sells.

Key Pivot: $396.50

Upside Levels (SPY): $399, $399.75 to $400.50, $402.50, $404-05.

Downside Levels (SPY): $396-96.50, $393.75, $392

SPX

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.