Technical Edge —

NYSE Breadth: 48% Upside Volume

NASDAQ Breadth: 70% Upside Volume

VIX: ~$28.75

Let’s just get right to it.

Game Plan — S&P 500 (ES & SPY), Nasdaq (NQ), Russell 2000, Oil and Copper

S&P 500 — ES

The ES is clearing 3800 this morning, which is incredibly key. If it can hold above this level, then the gap-fill at 3896.50 is a possible upside target, preceded first by last week’s high at 3878.50.

On the downside, a break of 3800 puts the Globex low in play near 3781. Below that and 3750 or lower could be in play.

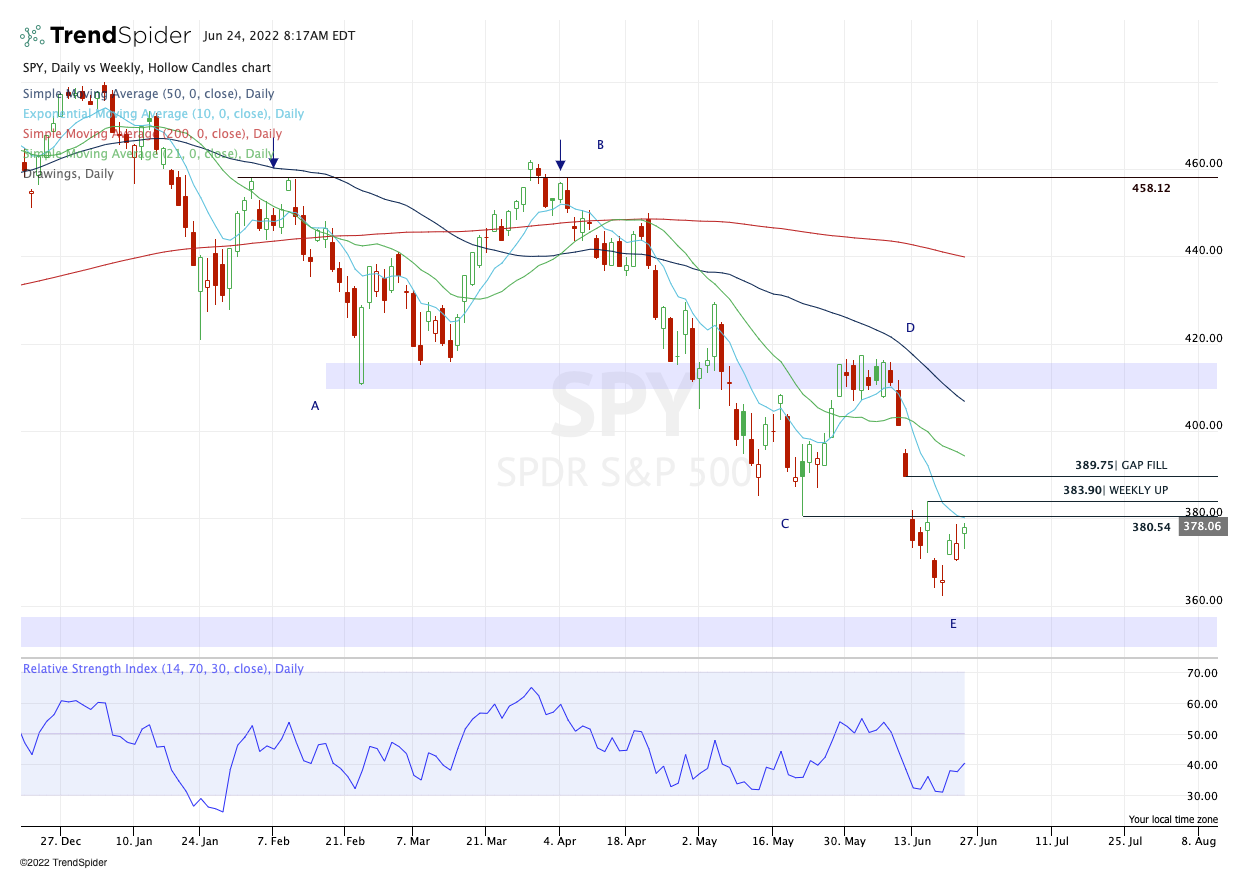

S&P 500 — SPY

SPY is trading $381 as of 8:30 ET. If we open here, it will get us back above the key $380.54 level.

Above that opens the door to $384 (last week’s high) and above that puts $389.75 in play. That would likely take a multi-day move to hit the latter — if we hit it at all.

The risk for the bulls? Fading from the $380.50 to $381 zone. If that happens, yesterday’s high will be the first test at $378.83.

Given the significance of $380.54 and the declining 10-day, a cash-flow (day trade) short may be a good risk/reward near the open, looking for a small fade early in the day. For others though, the small-change won’t be worth the effort/risk and that’s fine too.

Nasdaq — NQ

Yesterday’s plan read like this: “If we can clear 11,675 and hold this area as support, look for 11,750 on the upside. Perhaps if we have strong enough breadth, then the gap-fill is in play.”

We did not get the gap-fill yesterday, but we’re getting it right now during Globex.

If the NQ is rejected from this area, bulls need to see the NQ hold the 10-day moving average and the Globex low at 11,685 — 10 points about the recent key level of 11,675.

If it can’t, sub-11,600 could be in play.

If it can hold support or if it continues higher from here, look for 12,000 to 12,050. That’s the 50% retracement and the 21-day moving average.

Russell 2000 — RTY

Like the Nasdaq, the RTY has been one of the downside leaders amid this bear market. Now it’s rallying back into a prior support area and the 10-day moving average. The latter is active resistance, while the former could become resistance.

Let’s keep an eye on the 1730 to 1735 area. If RTY can clear this zone, then the 1750s are in play, then the 1770s. However, if this area is resistance, be wary of how the other indices will trade.

Oil

This has been a mixed and quite frankly, unfavorable week for oil. However, yesterday gave us a very clear inside day. Despite a near-$5 trading range, CL closed within 15 cents of where it opened.

That said, we’re below the trend line, as well as the 10-day, 21-day and 50-day moving averages while commodities get whacked.

If oil can go inside-and-up and clear Thursday’s high, then $110 could be back in play.

If oil goes inside-and-down, then $100 or lower is in play, with this week’s low sitting at $101.53.

Copper — HG

We don’t talk about Dr. Copper all that much and anyone trading it must remember that HG is a big contract capable of big moves. That said, let’s start to pay attention if we see a move into the $3.30 range.

That was a big breakout point and where we find the 200-week moving averages. Just above that, we have the 50% retracement near $3.50 too.

Like Bitcoin, it’s one to watch even if we’re not trading it.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

DXY / UUP — Still carrying ¼ of the original trade (cost basis: $27.20) but out of the second trade, after the remaining ½ triggered our break-even stop-loss.

On the upside, I’m still looking for $28.20+ to trim more.

$28.50 to $28.65 is the next meaningful upside target.

On the downside, my last ¼ will operate against a B/E stop-loss too.

MCK — Looking for $320 to $325 for another trim and raising stops to $305.

SLB — Triggered on Wednesday’s dip and we got a nice rally for some cash flow. Otherwise, a $36 stop-loss works just fine here.

Relative strength leaders (List is cleaned up and shorter!) →

BMY

XLE

MTDR

AR

CLR

VRTX

DLTR / DG

IBM

ARCH

NVA

MCK