Technical Edge

NYSE Breadth: 72% Upside Volume

Advance/Decline: 66% Advance

VIX: ~$14

Not much has changed from yesterday. The action was mostly choppy as the S&P had a big move higher on Friday but no meaningful bearish news to bring it down. I would still love to see a retest of the 10-day moving average and prior resistance, but just because we “want” that, doesn’t mean we’ll get it!

On another note, I’ve posted about ARKK a few times in the last few weeks, as it kept stumbling yet trying to push higher. Last week it gave us its first weekly close over the 50-week moving average since September 2021!

It’s been much better since, up 7 days in a row. Can growth stocks join the party?

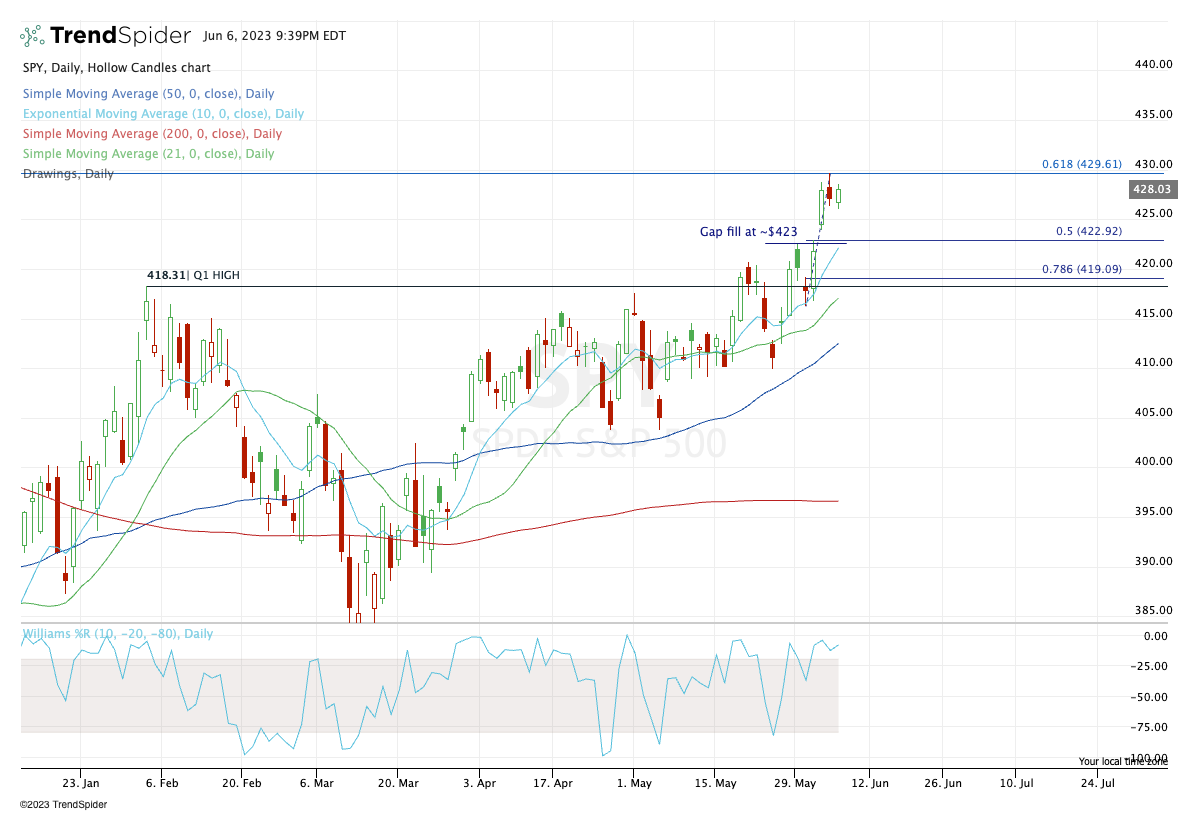

SPY

Rejected right off the 61.8% retrace of the bear-market range at $429.61. Now we must wonder if — or really when — the SPY will fill the open gap down near $423.

Upside Levels: $429.50 to $430

Downside Levels: $426.25, $425, $422.50 to $423

Yesterday we watched and waited for that 78.6% retrace + 10-ema combo on the 4-hour chart as a potential support area. Maybe we get it today?

The setup:

**For the SPX, the 78.6% retrace is at ~4253.50.

S&P 500 — ES

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.