Here Are My 2 Main Questions for the Market Right Now

Can we rotate higher after an inside day on Thursday?

Technical Edge

NYSE Breadth: 47% Upside Volume

NASDAQ Breadth: 35% Upside Volume

Mixed breadth after a mixed day. Thursday did not give us much excitement but for those of us who look at the market as a puzzle, it did give us a clue to work with.

On Tuesday and Wednesday, the markets pulled back but did not retest last month’s low. They bottomed just above the low and turned higher with Wednesday’s big rally. While the gains did not make as much progress as bulls’ had hoped, Thursday’s action left us with an inside day.

Now that inside day could resolve in the bears’ favor, but at the very least it gives traders a range to navigate against!

Game Plan

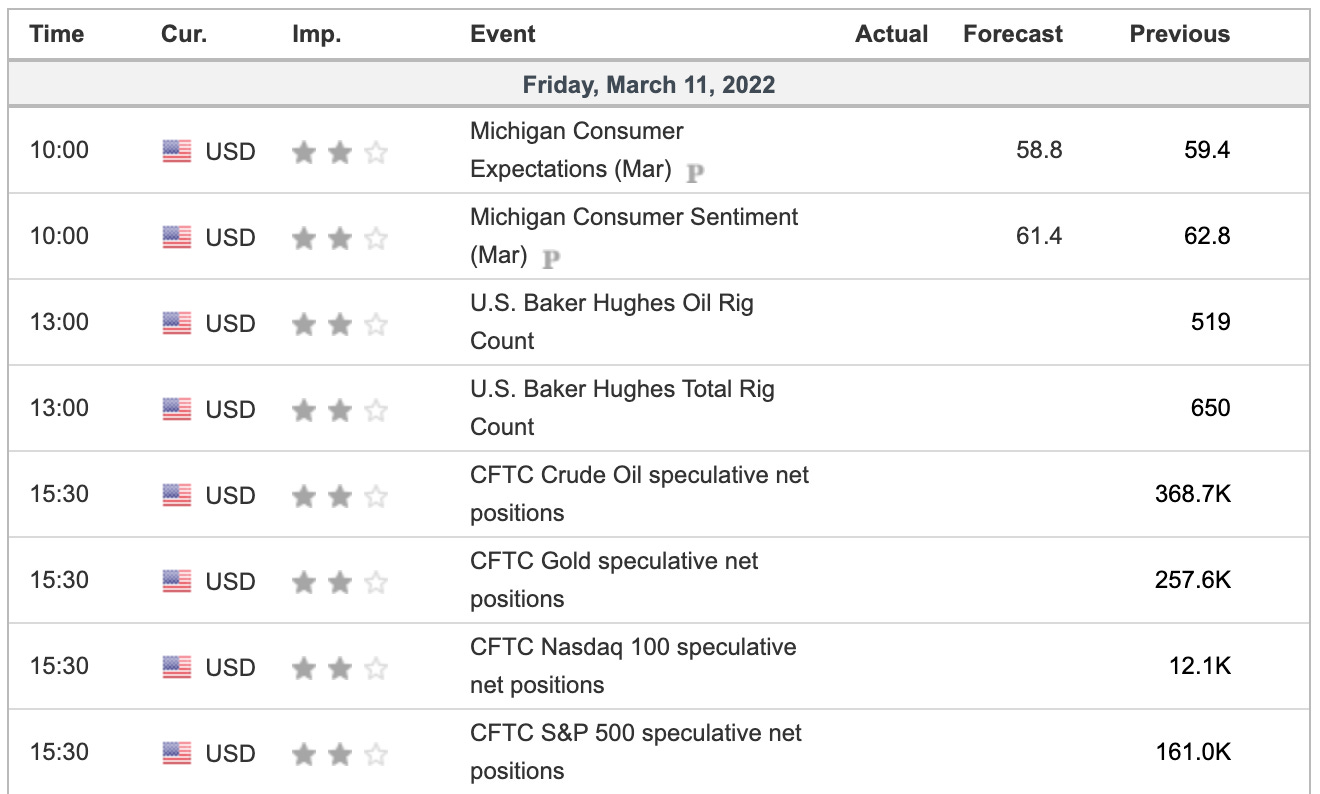

Even after the volatility of the last few days, the levels in yesterday’s video remain in play. That’s how I will navigate Friday for the ES, NQ, Gold and Oil.

The futures now sport a big pre-market pop due to positive comments out of Eastern Europe.

My question becomes multifold:

A pre-market fade seems more than possible in this environment, especially under the premise of: Who wants to go home long into the weekend?

Yes, there is risk to going home short too, but the fear has been on the downside.

The Fed is next week. Do we rally into that event or decline into it? I have been bracing for the latter, but we’ll see what today brings.

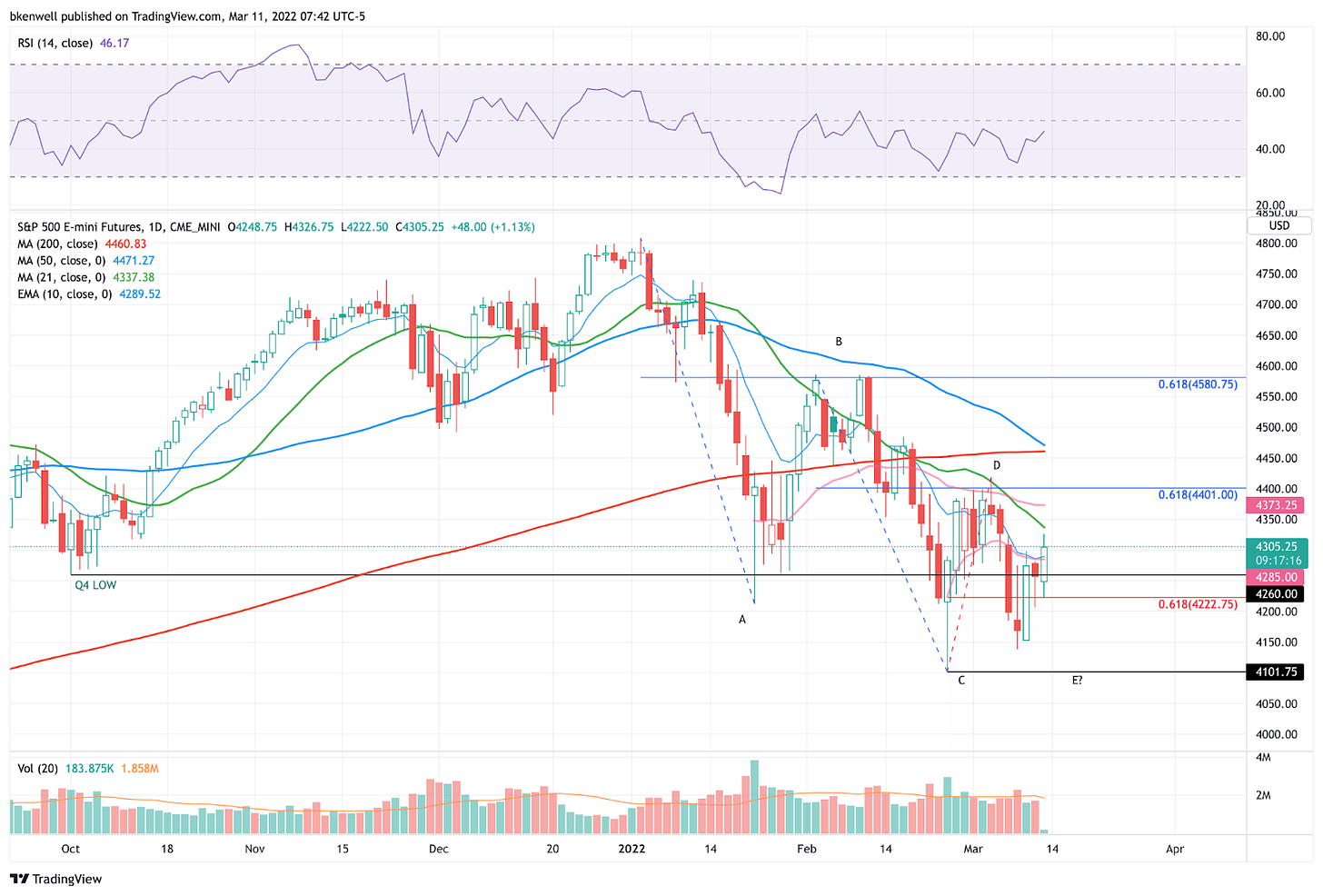

S&P 500 — ES

Feel free to extrapolate this layout to the SPY.

*Just go level-to-level. “If 4275 fails on the downside, it puts 4260 in play.” “If ES clears 4312, the 21-day is in play.”

The upside levels are:

4312

21-day sma

4375

4400

Downside levels of interest:

4282 — we don’t want to lose yesterday’s high and the 10-day ema.

4275

4257-60

4223 (remains a key pivot and the O/N low)

SPY

I know we talk about the ES a lot, but here’s a weekly view of SPY just for some perspective. Over $432 puts $437.50 in play, then $440. Below last week’s low of $427.11 keeps the bears in control, IMO.

Nasdaq — NQ

Feel free to extrapolate this layout to the QQQ.

Plain and simple: NQ has to clear yesterday’s high of 13,778 and the 10-day ema. Above it opens the door to 14,000 and the 21-day.

Below 13,550 puts 13,395 to 13,450 in play.

Crude & Gold — *Covered in Video*

*Volatility remains incredibly high in the commodities space. If trading the futures, keep that in mind. Consider smaller position sizes and honor your targets and stops.

Crude

Despite the volatility, I feel like we have navigated this one pretty well.

Crude was rejected by the $115 to $116 area and gave us an inside day yesterday. An inside-and-down rotation could put this week’s low in play near $103.50, followed by our big downside level at the 21-day sma and $100.

Gold

Another #KISS setup on a volatile name. Gold continues to hold active support for us, between $1961 and $1975, along with the 10-day ema.

So far, buying dips to this area have paid off well. However, if we get tactical, one could say that below $1975 keeps the door open to the 10-day and the overnight low.

Below $1961 and we could be looking at $1950 or lower.

VRTX

At one point last month, I had VRTX earmarked as a short. Now that it’s stabilized, I can’t help but notice how many times it’s bumping its head against the 2021 high at ~$243.

I don’t like buying breakouts/rotations in this tape, but as BTU proved yesterday, it can be quite profitable to do so (noted below on the watch list).

Over $243 is a multi-day and a weekly-up rotation. If it sticks, we could be looking at $250 next.

AMZN

I would love to see AMZN rotate higher and clear $3,000 going into the weekend. Just be leery of a fade.

It’s trading just above yesterday’s high in the premarket now. A break to the downside could trigger a bearish reversal. That could be a “cute” short if the market rolls over early, even if just for a quick cash-flow trade.

Go-To Watch List

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

TU — Tight chart and daily up over $26.20

TECK — beauty thus far. Trim ½ & look for $44.25 on the rest.

Energy —XLE, APA, CNQ, CVX, ENB | b/e stop on these.

Boring but Good: BRK.B, KHC, MKC

ABBV, BMY

Gold, GDX

FCX

ADM — looking to buy near $80

Defense — RTX, GD, LMT, NOC

CHKP — $140+ Daily-up rotation

UPST

COOP

AR

COST, DLTR, BBY

BTU — Huge winner off that Daily-up move. Definitely trim. I am down to ⅓ already.