Technical Edge —

NYSE Breadth: 91% Upside Volume (!!)

NASDAQ Breadth: 78% Upside Volume

VIX: ~$24.50

Game Plan: Bonds, Dollar S&P, Nasdaq

Coming into Monday of a busy week with CPI and PPI on tap on Tuesday and Wednesday and quad-witch expiration on Friday.

In that sense, we don’t want to be too active, yet at the same time, I like to move early in the week on quad-witch weeks and get out of the way for the messy action we typically see later in the week.

We had an 80%+ upside day on Wednesday, then a 91% upside day on Friday. That’s pretty damn impressive, although the S&P is wandering into an area of possible resistance, which we’ll outline below.

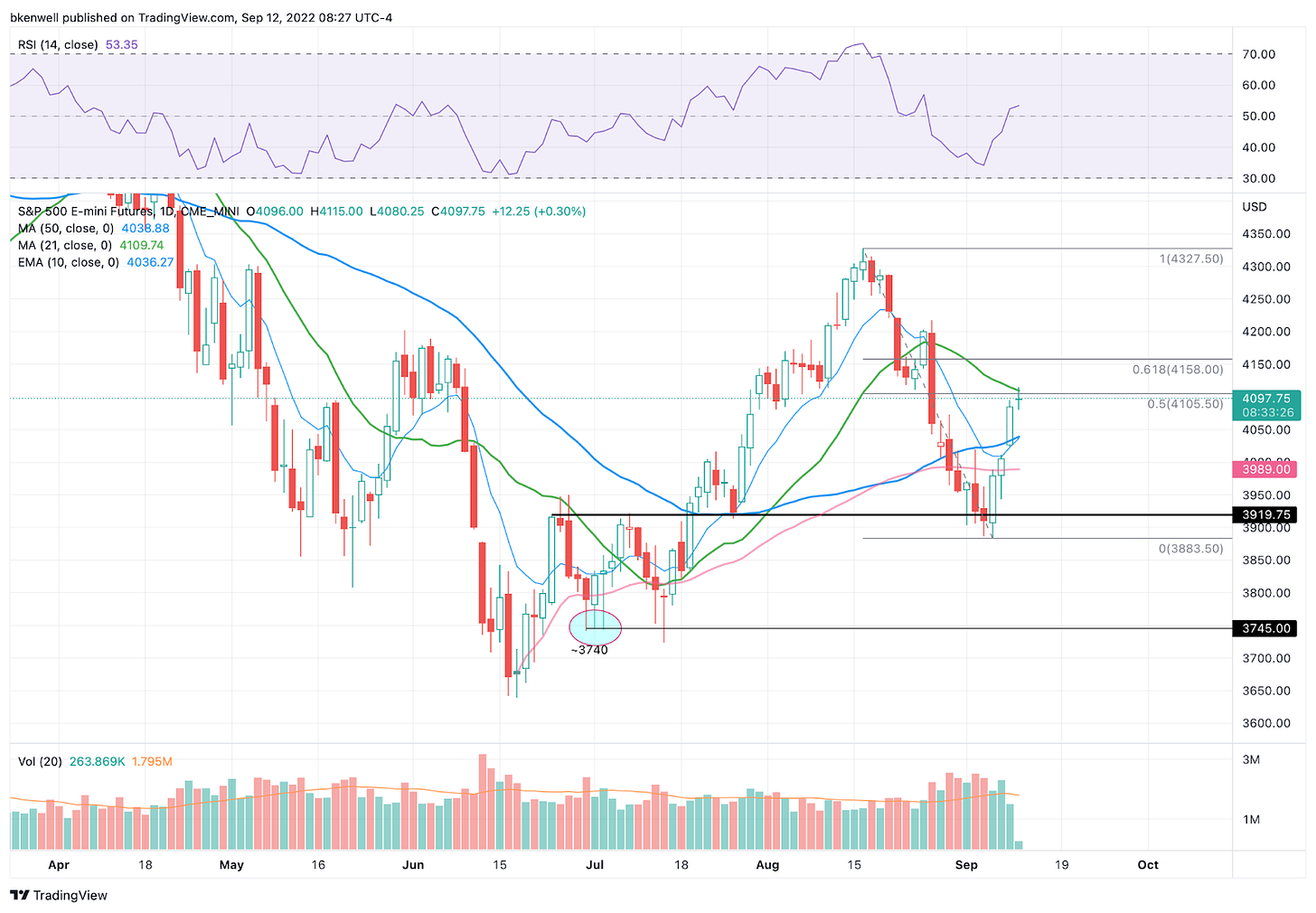

S&P 500 — ES

Amazing effort by the S&P and Nasdaq last week. After Friday’s 90%+ upside day and no horrific news over the weekend, it’s no surprise to see an opening push on Globex.

Now looking at the chart though, we have the ES pressing into the 50% retrace near 4105 and the declining 21-month moving average.

At the very least, that should give bulls some pause I would think.

The 50% retracement of this rally is 3999-and-change — so call it 4000. I don’t know if we see that, but 4040 to 4050 (the 10-day and 50-day moving averages) wouldn’t be an unreasonable resting point.

If we take out the Globex high of 4115 and power higher, don’t rule out a move to 4150 to 4160 (the 61.8% retracement).

Below Friday’s high of 4095 and I want to give this some time to see which direction gains momentum. Use that as your pivot.

SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.