Technical Edge —

NYSE Breadth: 92% Upside Volume (!!)

NASDAQ Breadth: 85% Upside Volume (!)

VIX: ~$19.75 (first time sub-$20 since April)

Yesterday we wrote:

***In-line or below expectations on today’s report gives the market the opportunity to continue its upside move. Above-consensus results increase the odds we pull back from here.***

Remember, it is the reaction to the report we are looking for, not for the report itself. We are traders, not economists.

We’re seeing how that panned out now, as the indices rocketed higher on Wednesday. The “reaction” to the “bad news” has been different lately than it was in the first half. FAANG was missing earnings and/or revenue estimates, yet rallying on the results. The Fed hikes by 75 basis points and we rallied again.

Those are the “change-in-tune” developments bulls have needed to see and the reaction yesterday was the latest example. Now though, they need to maintain momentum.

Game Plan: ES Futures, SPY, QQQ, NQ Futures, IWM

Individual stock setups to come later today.

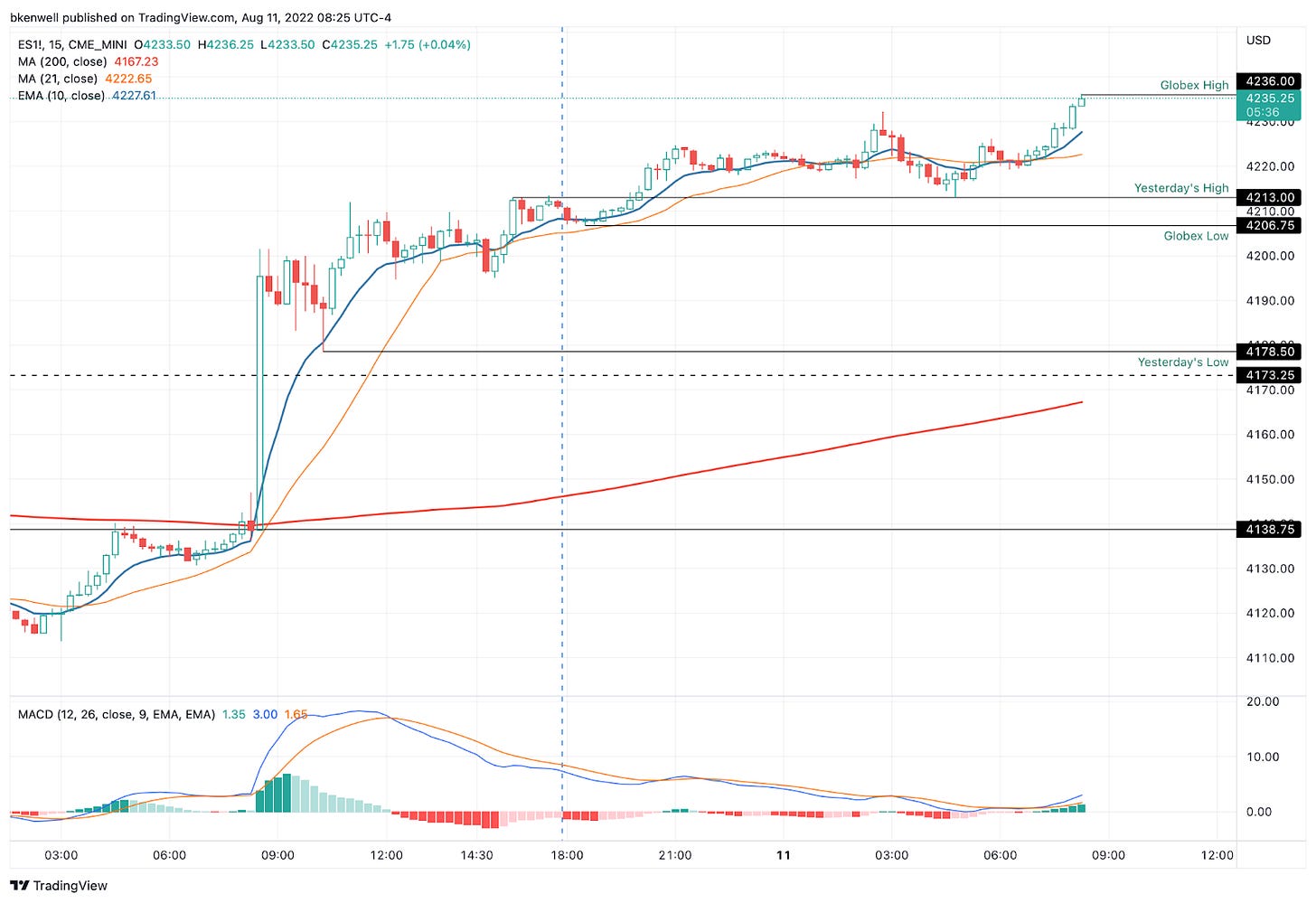

S&P 500 — ES

“Bulls need a sustained move above 4170 to 4175.” Well, they got it!

Traders can boil it down as simply as they want: Above the 4170 to 4175 zone and they can be bullish.

It “feels” like we’ve had a huge rally and from the lows, we have. But look at the daily chart above. The ES has quietly declined in 6 of the prior 7 sessions before Wednesday’s rip.

That said, keep the ~4223 level on your radar. In tandem with the 10-month moving average, this area is one to note. However, if we can push through it, the 200-day moving average and 61.8% retrace could be in play another 100+ handles above current levels.

On the intraday, 4210 to 4215 is of interest to me — yesterday’s high and overnight support.

S&P 500 — SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.