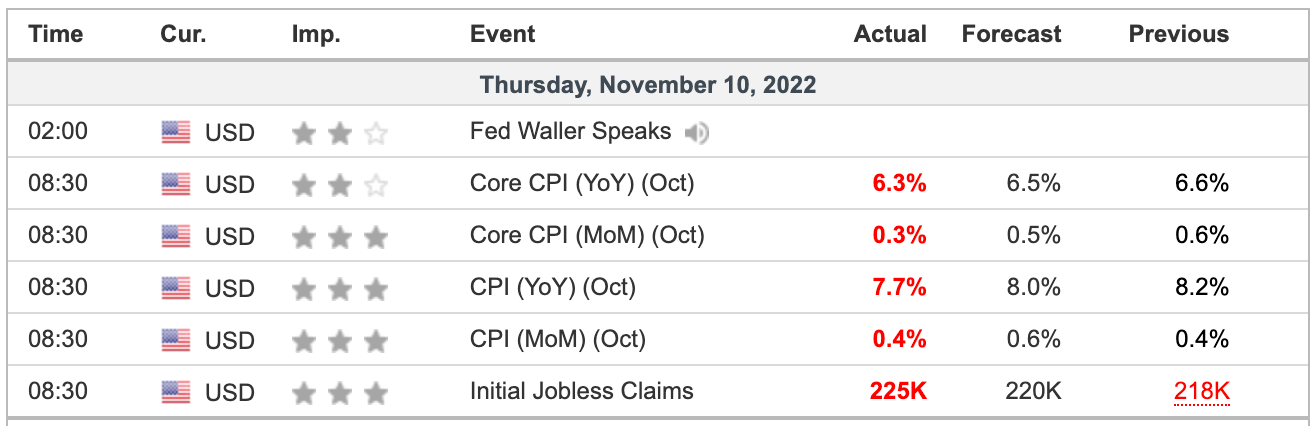

The four main CPI measurements all missed economists’ expectations — in a good way.

In other words, inflation came in lower than expected. Coming into today, odds stood at around 50/50 that the Fed would raise by 75 basis points vs. 50 bps. in December. My gut now tells me that the odds will start to favor the 50 bps hike.

The higher jobless claims number helps too.

Technical Edge —

NYSE Breadth: 9% Upside Volume (!!)

Advance/Decline: 19% Advance

VIX: ~$26.00

The lower-than-expected CPI results are going to have a bullish reaction in the S&P. The question, so to how big of an extent?

Yields are falling (bullish), the dollar is falling (bullish) and my guess is that investors will speculate on a less-hawkish tone from the Fed (bullish, if true).

I wonder if we can get a 90/90 day on breadth & advancers, signaling a big return of demand. Let’s try to do some charting.

S&P 500 — ES

Above is the ES and a 1-hour chart. You can see how it’s powering through this week’s high of 3867.

The 78.6% retrace is at 3880. Above that and we could see 3900, then 3920-25.

ES Daily — Bigger Picture

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.