Technical Edge —

NYSE Breadth: 68% Upside Volume

Advance/Decline: 67% Advance

VIX: ~$19.20

Quarter-end and Fridays are notoriously tough to trade. We’ve had a stellar week, first with the indices in the front-half of the week, then with follow-through strength in tech on Wednesday and Thursday.

So let’s take it easy into Friday. Trade smaller and less, IMO and be aware of the “larger forces” at play. Derivatives and institutions are going to control the game. They usually do, but that’s especially true today.

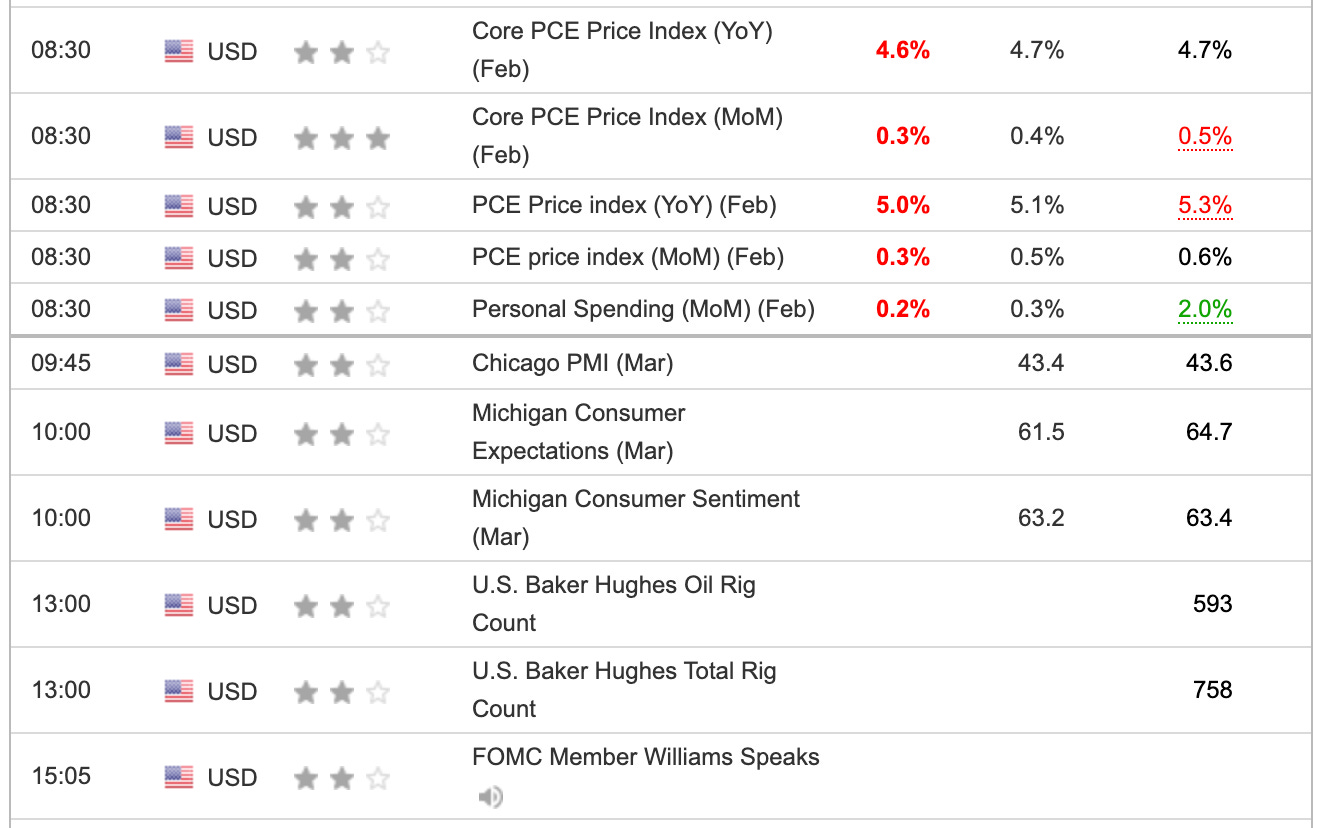

Plus, the Fed’s main inflation measure — the PCE — is going to be a driving force today.

Use today as an opportunity to zoom out and scan the monthly and quarterly charts, if multi-timeframe analysis is in your process. Cheers.

S&P 500 — ES

Toying with that 4090 level. A sustained move above it opens the door to 4100+ as the PCE number gives it a lift on Globex.

Key Pivot: ~4090, 4074

Upside Levels: 4090, 4118-4122, 4158

Downside levels: 4074 (last week’s high), 4058, 4037-4040, 4025

SPY

Upside Levels (SPY): $404.35, $407.50, $410

Downside Levels (SPY): $402.50 (weekly-up), $401.50 to $401.75, $400

SPX

Upside Levels (SPY): 4078-4080, 4110-12

Downside Levels (SPY): 4055-58, 4035-38, 4015, 4000.

NQ

NQ held 12,700 and gave us 13,080+. Plenty of meat on the bone to feast on.

Now keep an eye on 13,080 as the pivot to watch. Below it and we could see some of the recent strength unwind as it takes a needed rest.

Over 13,100 and the NQ can continue to run.

QQQ

Two goals for the QQQ.

Stay above the monthly-up mark at $313.68.

Clear Y’day high ($316.32) and that VWAP from the ATH (pink line).

WYNN

Wynn has traded quite well on a weekly basis and held “where it needed to.” Over $110.73 — can use a 30-min or 1-hour close above — gives us a weekly-up rotation.

Could put $113-113.50 in play, then $116-$117.

Stop could be $107-ish.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

FSLR, NVDA, QQQ down to runners.

AAPL — Long from $157. Trimmed down to half at $162. B/E Stop

Any chance we can trim into $164 to $165?

GOOGL — Trimmed ⅓ on opening push as GOOGL tried and failed to go daily-up.

Likely stopped at B/E for most. If not, needs to regain $101.25, then $102.50.

NVDA — Down to ¼ or ⅓ as we traded $274.99 Thursday. Down to runners here for most. Cheers

QQQ — Down to runners, as we cleared $314.50 and traded through $316. If still in the trade, consider raising stops to

AMD — Trimmed $97.50 and it got all the way to $99.50 for more trims. B/E stop and I would likely trim down to runners if we see $99-$100 today, (if you haven’t already).

TRIP — short from 18.90 — out roughly ½ on Friday’s dip.

Stopped near B/E

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders → Tech remains absolutely the strongest group lately.

NVDA, AMD

CRM, GOOGL, AVGO

MSFT, AAPL

PANW, FTNT

FSLR → so strong. We’ll look to get another long in this at some point.

GE → love this name if we can get a test of the 10-week ema

DKS

AQUA

ULTA & LULU

MELI