Intraday Update: S&P, AAPL, Bonds, Individual Stocks

The last few days, I’ve only looked at the S&P, Nasdaq and now the Russell. That’s mostly after a big rally in the indices and following the CPI results yesterday.

I want to dial in a bit more right now.

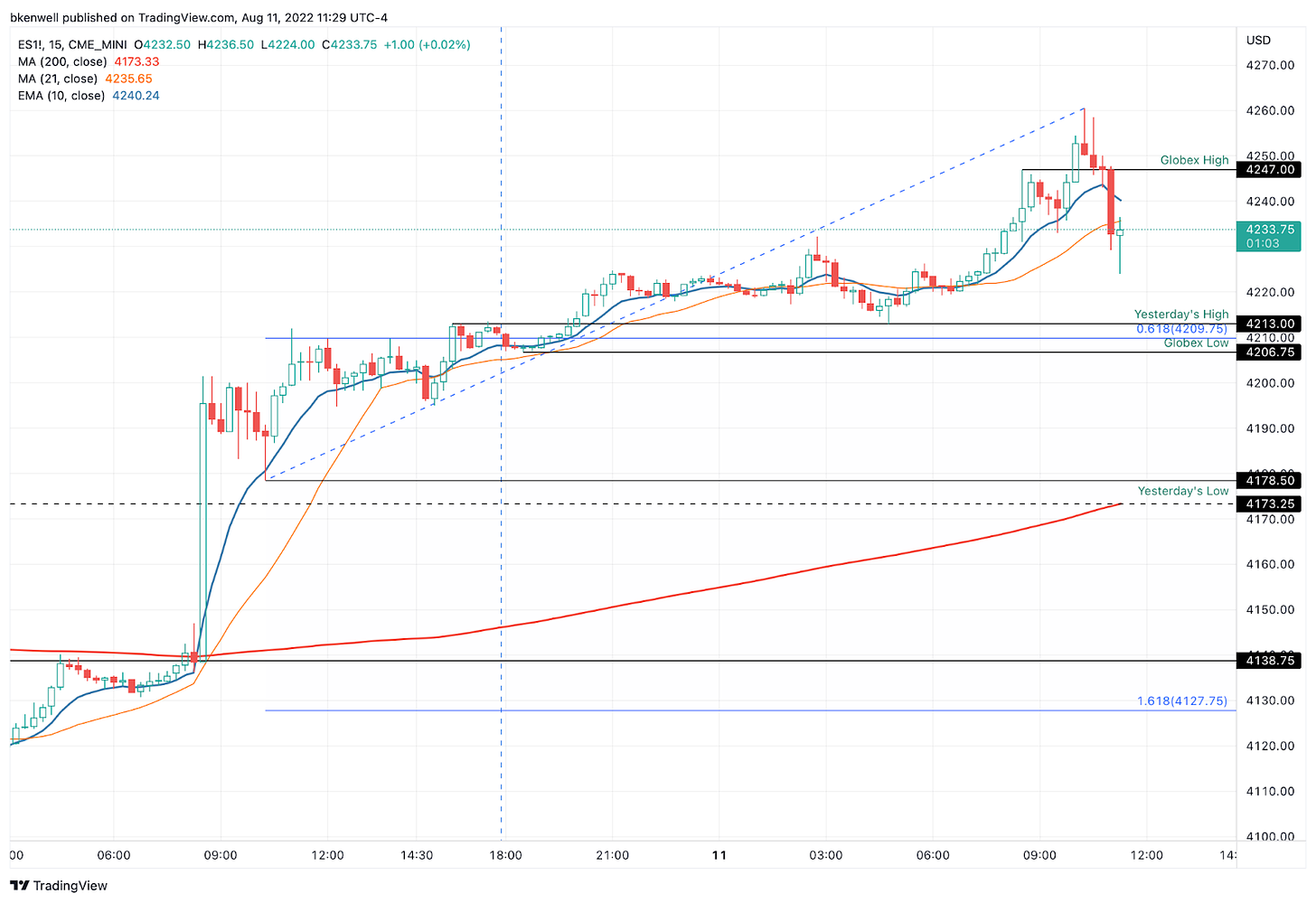

ES — S&P 500 Futures

Here’s a 15-minute look at the ES. It’s come in well off its highs while breadth has come down back below 80% so far. It’s 12:30 a.m ET.

If we see a further dip, keep a close eye on the 4210 area.

That zone has yesterday’s low, the Globex low and the 61.8% retrace from today’s high to yesterday’s low. The 10-ema on the 4-hour chart is also in this area.

All of this is to say that a dip to this area could be support.

Bonds

A few days ago, bonds showed a warning sign as they were rolling over and there has been a correlation between bonds and tech/equities.

Yesterday’s gains faded and TLT closed lower. Today it rolled over as it goes weekly down below $115.89. I don’t know if bonds will completely tip lower, but uptrend support is broken and bonds are rotating lower.

That’s something to keep in the back of your mind going forward.

Russell 2000 — IWM

The IWM traded up to our first target around $200 and immediately backed off. Let’s see how it handles from here.

AAPL

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.