Is Santa Skipping Town on the Bulls?

It's been a tough week for the longs, which is why we follow the trend!

Technical Edge —

NYSE Breadth: 18% Upside Volume — (!)

Advance/Decline: 21% Advance

VIX: ~$22

S&P 500 — ES

I was briefly talking with a colleague/friend the other day when he told me he is finally turning the corner on a nasty cold and cough he’s had for a few weeks. Hopefully I can join him in saying the same as I have been under the weather as of late.

And hopefully yesterday’s levels helped keep readers out of trouble.

That’s as the 3870 to 3876 area continued to act as resistance, with yesterday’s regular-hours high coming in at 3875 shortly after the open.

15-min chart above.

I’m keeping an eye on the 3840 to 3850 area. Admittedly, it’s a big 10-point zone. The ES continues to rally on Globex and fade in the regular-hours session.

Maybe they change gears and rally them for a change here. I wouldn’t be surprised if they lulled the shorts to sleep like that, then ran them off the road.

In any regard, I’m watching this area as the 50% to 61.8% retrace zone, with the 200-sma in the middle.

If the ES can clear this area, then 3867 to 3870 is up next.

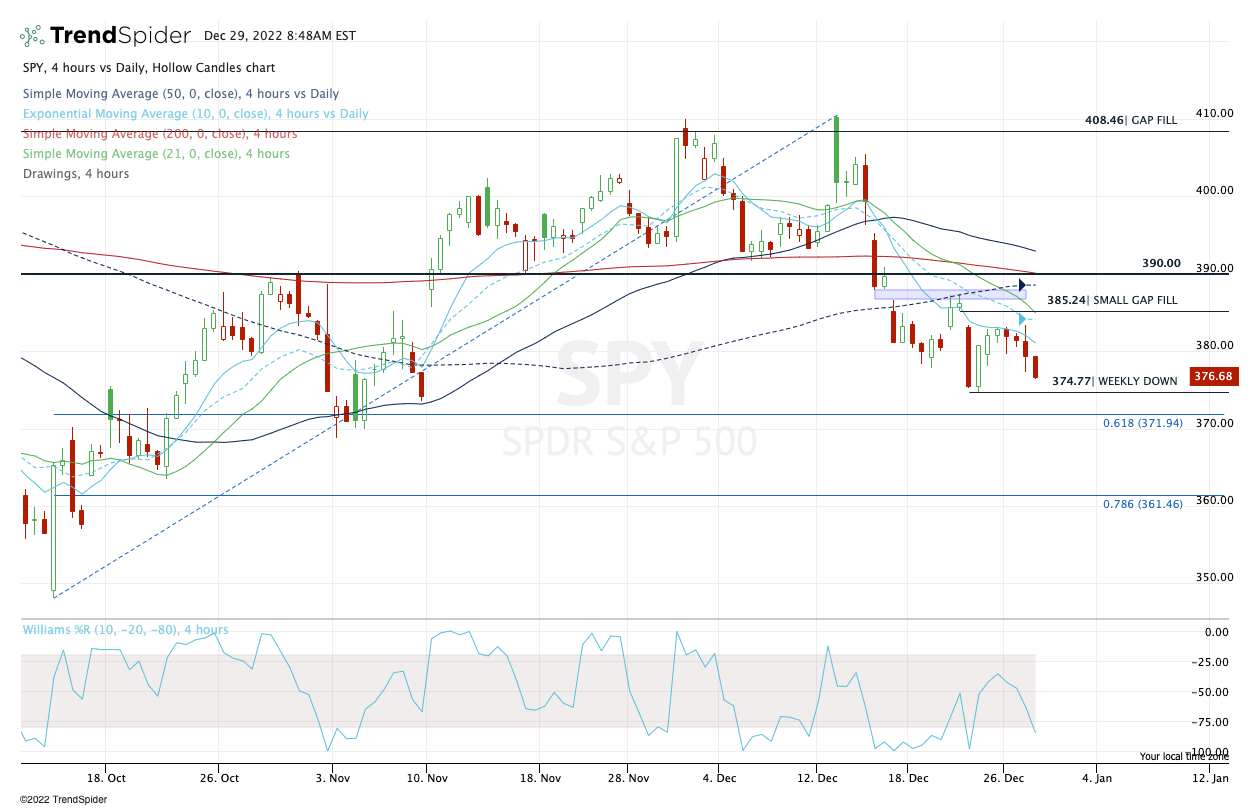

SPY

4-Hour chart above for SPY, where I’m watching the declining 10-ema and the high of the prior bar at $379.39.

If it can clear this area and hold above it, it opens the door back up to yesterday’s high and the declining 10-day moving average.

On the downside, a break of $376.42 could put last week’s low in play. Below that and the 61.8% retrace of the recent range is in play near $372.

QQQ

Fairly decisive fall yesterday. Below $259 and the odds that the QQQ goes on to retest the low goes up considerably.

Open Positions —

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.