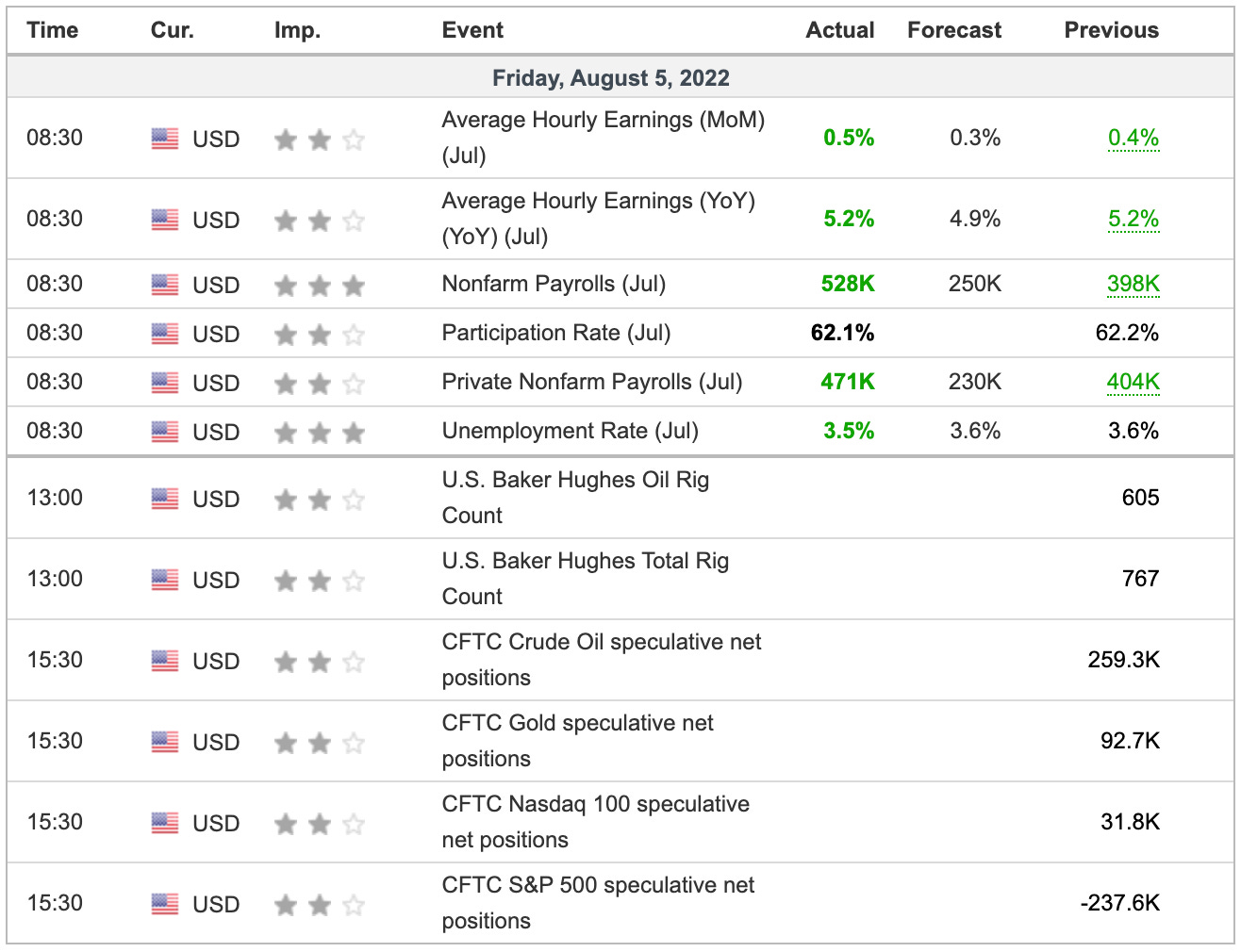

Jobs Report Comes in Hot. Here Are the Levels to Know

Now the Fed has more freedom to raise rates, in my opinion.

Technical Edge —

NYSE Breadth: 45% Upside Volume

NASDAQ Breadth: 68% Upside Volume

VIX: ~$21.75

Game Plan: ES Futures, SPY, QQQ, AMZN, GOOGL

I just want to reiterate yesterday’s sentiment, which is that we’ve had a nice rally off the lows (and off last week’s low) and while I believe that the upside bear market rally can continue…it’s still just that to me: A bear market rally.

We have not had a meaningful return of upside breadth and while the markets can’t go down forever, they can still go down this year. We’re trying to toe both sides of that line and it’s not easy (being overall bearish but bullish in the interim).

For now, we’re taking what the market gives us and we’ll move along and switch gears when it tells us to.

S&P 500 — ES

The ES has two very clear levels: The 4080s and 4170.

The former has been clear support this week and now gets the rising 10-day into this zone. The latter has been resistance the last two days and comes into play near the weekly VWAP measure.

If we can clear 4170 and not reverse back down, 4200 is in play, followed by the 4223 level (which is the 50% retracement for the 2022 range). Above that puts 4250-ish in play.

On the downside, the 4140 area is short-term support. Below that could open the door for an eventual test of more stout support at 4080.

S&P 500 — SPY

Watching $415 to $417. A push above that puts the weekly VWAP in play, followed by the $424 area.

On the downside, $407 is key, along with the 10-day moving average.

I don’t want to be in a rush to do anything as it’s been a quiet upside drift the last few days, but a strong short-term burst off the lows. I don’t want to fight that move until it’s exhausted and rotating lower.

Nasdaq — QQQ

Less of a trade and more of an observation in the Nasdaq, but tech continues to trade quite well. Yesterday was a low-volume rally and in fact, most of this upside move has been on low volume.

However, the QQQ continues to push through a number of key levels. Last Friday it pushed through the 21-week and even on Monday and Tuesday’s “down days,” the QQQ rallied off the opens.

Obviously jobs day can disrupt the trend here, but the bulls remain in control. Does that put $330 to $333 in play next? It very well may.

On a pullback, I need to see the $310 to $313 area hold as support. Below could put $296 to $300 in play.

GOOGL

GOOGL is into a key area here on the charts. Resistance and the 21-week moving average.

If it can push through, $125 is in play. If it can’t, we’ll need to see how the 50-day and 10-day moving averages act as support.

This isn’t a trade, just an observation on the market.

AMZN

If we see $145 on AMZN, it may be an opportunity for traders to lock in some or all short-term profit, as that may be an area where it loses steam.

On the downside, $130 to $135 is key support on a pullback.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Trade Sheets: Now have 2-3 live trades, all with breakeven or better stop-losses. Great stress-free position to be in as we try to squeeze a bit more of upside out of this move.

MCK — finally got out $348 to $350 target. I am out the last bit here, but with a profitable stop-loss at $325 (entry in the low $300s), anyone who wants to press for $355 to $365 with their last ¼ to ⅓ position can do so. Cheers

PEP — We got out Target No. 2 at $177. Either all out now or down to ⅓ of a position if playing for a breakout. Stop at $172 (above B/E).

UUP — $28.60 to $28.80 is ideal first trim zone, but bulls can trim ¼ at $28.50-ish if they’d like, as the UUP runs into the 10-day ema.

CHNG — volatile session on Monday, but held where it needed to. In fact, that spike down gave us a level to measure against. I’m using a stop-loss in the $23.20 to $23.35 area.

Looking for $24.50 to $24.70 for first small trim, (i.e. ¼ to ⅕ position trim). More aggressive traders can look for $25+ for first trim

O — I will go with an unusually tight stop-loss here at $71.75. If I get stopped on this, I want a small loss and will look to re-enter around $70.50 and $70.75 — the breakout zone.

On the upside, $74 is our first upside target.

Relative strength leaders (List is cleaned up and shorter!) →

O

CNC

HRB

ENPH — kickstarted the rally in Solar

TAN

FSLR

MSTR

LNG

PWR

CHNG

COST — trade is live

PEP — trade is live

BA

UNH

XLE

MCK — trade is live