Technical Edge —

NYSE Breadth: 49% Upside Volume

Advance/Decline: 55% Advance

VIX: ~$20.25

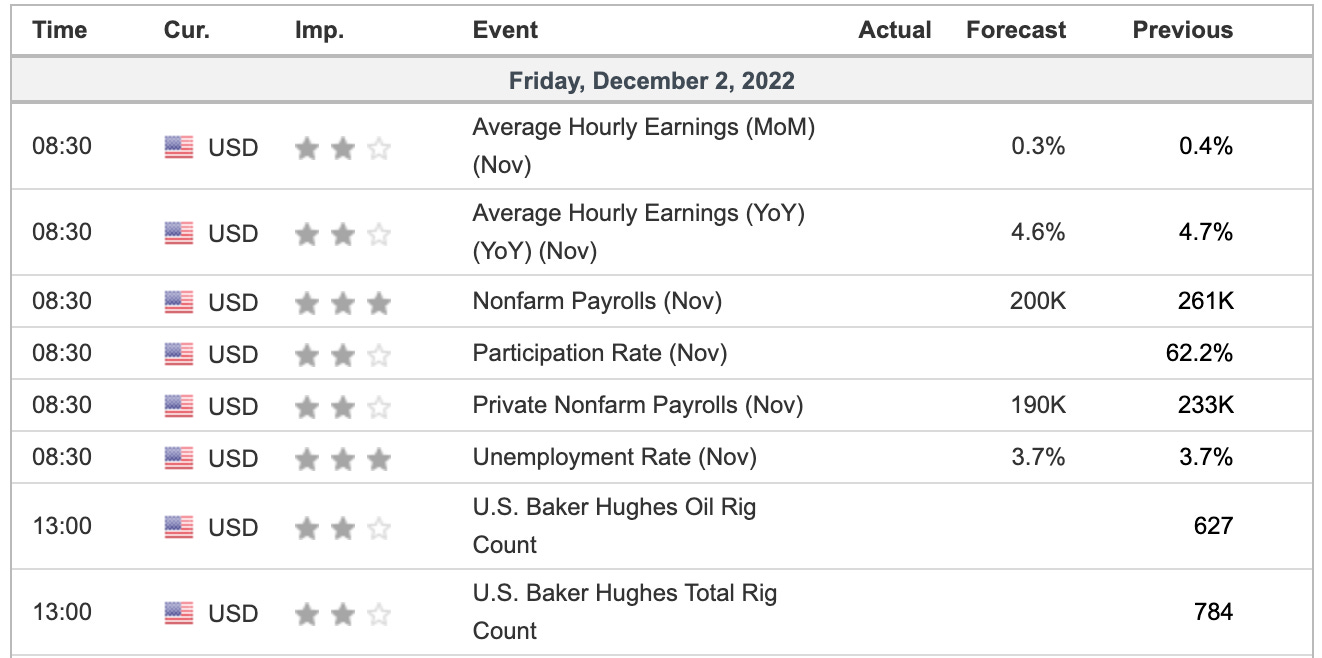

I’m going to keep it short ahead of the NFP report at 8:30 a.m. ET and may be back for an update later if something notable developments. But for the most part, we have played a damn good round this week and don’t want to force anything on Friday if it’s not a good R/R.

For now though, we continue to take trades, lock in trims and raise our stops. You can see our “Open Positions” tab is littered with the most trades we’ve had on since August. That speaks to the healthier trading environment we’re seeing right now.

I don’t want to put on too many new positions and instead prefer to keep trimming and getting those stops up to breakeven or better. Pat yourself on the back. It’s been a good run.

S&P 500 — ES

On the daily chart above, you can see where the two significant levels of support reside.

The first is around 4050, which is a multi-week high, yesterday’s low and the 200-day moving average.

If we get a dip down to this level — say down to 4050 and a quick bounce back up through 4054 (yesterday’s low) — it could give us a bullish reversal to work with.

If 4050 fails as support, it puts 4020 to 4025 in play, where we find the 10-day moving average and the 50% retracement of the recent rally. Below it all puts 4000 on the table.

On the upside, we need a sustained move above yesterday’s high (4110) to continue the rally.

SPY — Daily

I just want to keep this simple for those holding SPY.

Above $402.30 and the 200-day is healthy action for the bulls. Below the 10-day raises a few questions for the active sequence.

The SPY filled the $408.50 gap and is stalling at the weekly VWAP. It’s looking for direction now.

If it clears yesterday’s high at $410, it puts the 50-week moving average and $414 area in play.

TLT

The TLT has treated us marvelously over the past weeks. If you want to cut down to ½ position ahead of NFP, I can’t blame you. I certainly want to be down to ½ or ⅓ if we see $106 to $108.50, where TLT starts to run into some weekly measures, as well as the 50% retracement.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Numbered are the trades that are open.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Open Positions —

TLT — Long from ~$97, reloaded at $101.50. Now trimmed ⅓ over $104 yesterday. I want to be down to ½ or even ⅓ after yesterday’s move.

CCRN — down to ⅓ or less. Exit at $36+ or consider holding for $37.50 to $38. Stop raised to $34.

DIA — Reloaded on the daily-up over $339.37. Trim ½ over $346 if you did not trim yesterday. Let’s fish for $349 to $350 before the next trim.

B/E stop

Gold — Exit the rest if still holding. A monster trade I wish that we did not cut down prematurely.

TJX — Long from ~$79. Trim at $81. Stop at $78.50 (No need to let it unravel too far against us). Great reaction from the 10-ema.

IBM — Daily-up over $147.17 was the entry. $145.50 is our stop. Trimming ⅓ at $149.50+ (pre-market is fine). Ideally down to ½ if we see new highs over $150.50.

Stop at $145.50 or B/E for less aggressive traders

WMT — “For those “still fishing” let’s see if we get a true tag of the 10-day.” Long from $151.

Trimmed ⅓ at $153.25. I am going to say B/E stop and trim down to ½ if we see $154+

Relative strength leaders →

LNG

CAH

Retail — TJX, WMT, ULTA

SBUX

DE

CCRN

AMGN

MET

GIS

REGN

CI

MCD

ENPH, FSLR — solar has strength

VRTX

UNH

MRK

XLE — XOM, CVX, COP, BP, EOG, PXD (Weekly Charts)