Technical Edge

NYSE Breadth: 32% Upside Volume

Advance/Decline: 28% Advance

VIX: ~$19

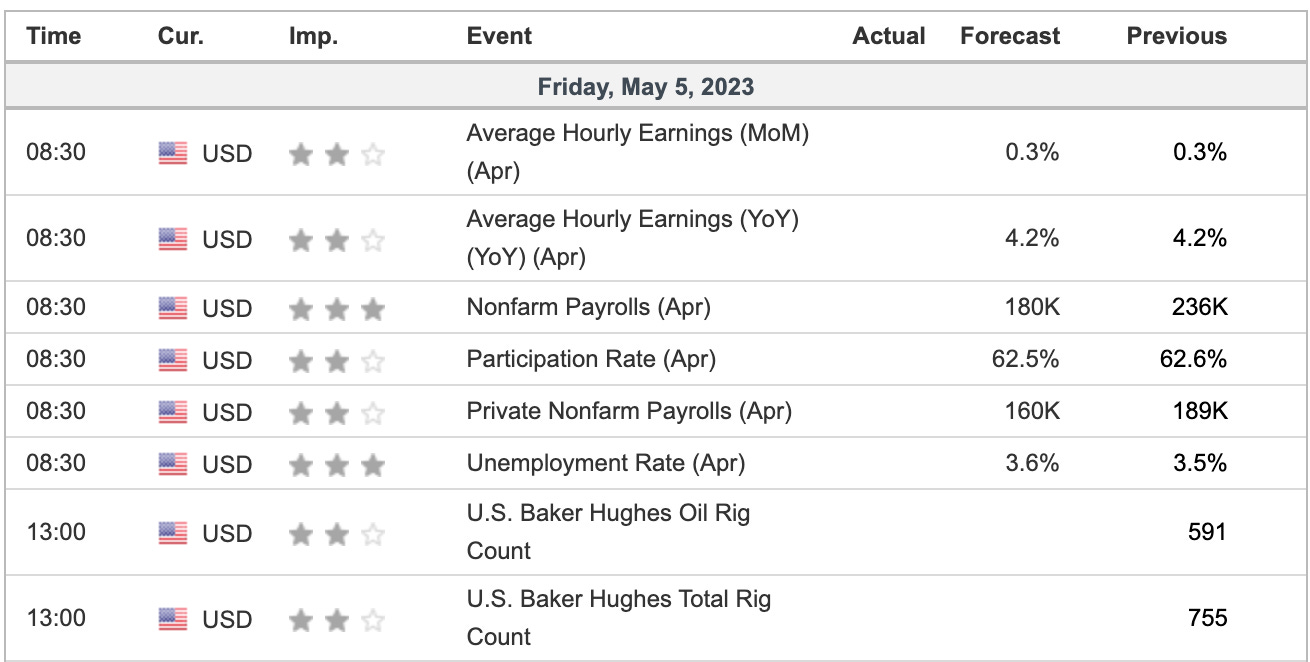

The labor report was pretty strong, with every main metric topping expectations. I’m not an economist, so I will only theorize so much.

However, it does put the Fed in a tough spot. Jobs and wages are up and the unemployment rate is down. That’s going to make inflation harder to kill, while higher rates are contributing to a more stressed financial system.

On the other hand, the economy/jobs market is stronger than expected, which is a positive (broadly speaking).

As much as we all want to see inflation come down — for our own sake and in regards to the Fed’s agenda — no one (or no one should) want to see catastrophic economic turmoil.

Enough.

I’ll get off my soapbox so we can look at some levels.

Remember: Exercise patience. We can afford to wait for the prime setups, even if it means scaling back and getting through a couple of these tougher sessions (Fed, AAPL earnings, Jobs report, etc.)

S&P 500 — ES

Down four days in a row but trying to hold last week’s low

Upside Levels: 4120-25, 4135, 4150, 4175-80

Downside levels: 4060-65, 4025-30

SPY

Gapped below $408 and couldn’t fill it yesterday. Now we have to see if the SPY can hold last week’s low, which it did quite well on Thursday.

Upside Levels: $408, $410.50 to $411, $412.50

Downside Levels: $403 to $403.50, $399 to $400

SPX

Key Pivot: 4050

Upside Levels: 4090, 4113, 4130, 4150

Downside Levels: 4035, 4000, ~4075-80

QQQ

Upside Levels: $320, $322.50, $323.65, $325

Downside Levels: $315, $312.50, $309.90

NQ

Notice that, despite all the noise, we are basically just stuck between 12,950 and 13,300.

Upside Levels: 13,175, 13,230, 13,300-10

Downside Levels: 13,000, 12,925 to 12,950

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B

** WYNN — watching for the breakout over ~$117, but not expecting it today.

** CMG — Closely watching that buy-the-dip setup.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

MCD, PEP & KO, WMT, PG — XLP

LLY

NVDA, CRM

MSFT, AAPL, META

PANW, FTNT (10-week/50-day combo & prior breakout level)

ULTA, LULU, CMG

GE

HCA

DKS

WYNN

MELI