Technical Edge —

NYSE Breadth: 28% Upside Volume

Advance/Decline: 34% Advance

VIX: ~$18.75

Yesterday highlighted the market clash between big-cap tech and worries over regional banks. With FRC on the brink, fears were renewed that the regional banking crisis is not over yet. It helped drive KRE to new 52-week lows in the process.

At the same time, mega-cap tech stocks have been driving the gains in the S&P 500. Almost 90% of this year’s gains were driven by just 7 stocks (AAPL, MSFT, AMZN, GOOGL, NVDA, TSLA and META).

Yesterday MSFT hit 52-week highs after its report, yet the S&P’s late-day selling pressure was correlated with a late-day fade in the KRE ETF. Meta jumped 12% in AH trading Wednesday, so the market will likely try to build off those numbers again tomorrow.

However, if MSFT couldn’t carry the load (with a $2.2 trillion market cap), how can Meta with a ~$540 billion market cap?

Trade update on Berkshire below, under “Open Positions.” Plus I have an interesting chart to show that combines two ETFs. It’s not a trade setup, but I use it for broader scope on the market.

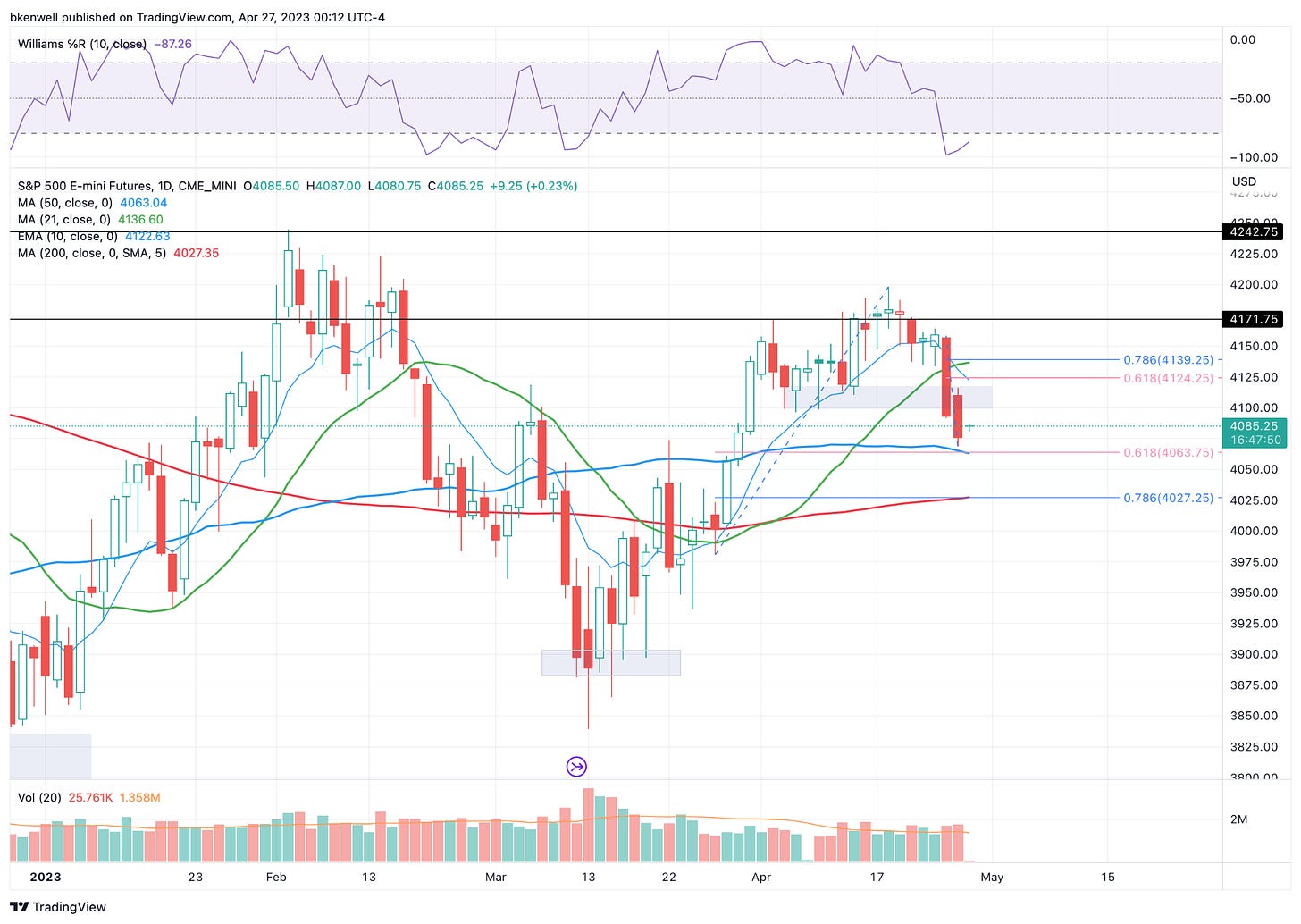

S&P 500 — ES

The S&P broke its three-day low on Thursday, bounced back to the “half-back” area — aka the 50% retracement — and faded again on Thursday.

Upside Levels: 4120-25, 4140, 4160

Downside levels: 4060-65, 4025

SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.