Mixed Jobs Report Following a 90% Downside Day

Technical Edge

NYSE Breadth: 10% Upside Volume (!!)

Advance/Decline: 14% Advance

VIX: ~$16

I can’t emphasize rates and yields enough. That’s as expectations continue to climb for a rate hike at the Fed’s July meeting, which is now north of a 92% probability. While the market is not panicking on that news, the fact that 10-year yields have rallied almost 6% in two days and are back above 4% should be a warning sign.

Coupled with yesterday’s 90% downside volume day and that may be a sign for bulls to ease off the gas a bit.

A 90%+ volume day always has me taking notice. Had the Advance/Decliners been 90% to the downside, that’d be our 90/90 downside days and would really have me shifting perspective a bit.

On its own, it’s not a big deal, but as we covered the other day, TNX (yields) are breaking out and are now above 4.00. Today will be dominated by other factors, but this is something to take note of if 10-year yields stay above 4%.

SPY

The jobs reaction will either have the SPY pushing yesterday’s high and the gap-fill near $442 or probing yesterday’s lows. If it’s the latter, we’ll have to see how the 61.8% and 21-day sma hold up.

Upside Levels: $440, $442 gap fill, ~$444 resistance

Downside Levels: $436, $434, $431.50

S&P 500 — ES Futures

Held that 4415-20 zone perfectly. Now the jobs report runs the show.

Upside Levels: 4466-68, 4480-85, 4490-93, 4520

Downside levels: 4415-20, 4395-4400, 4370

SPX

Upside Levels: 4436, 4450-60

Downside Levels: 4385, 4375-77, 4350-55, 4325-30

NQ

Our pivot remains the same based on the close, while 15,360 held within a few points as Thursday’ high, so it remains relevant today as well.

Pivot: 15,250 (same as yesterday)

Upside Levels: 15,360, 15,425

Downside Levels: 15,075-100 (61.8% + 21-day sma + y’day low), 14,975 - 15,000, 14,850

QQQ

Traders who bought the gap-fill and 50% retrace yesterday only took about 30-40 cents of heat before a nice bounce propelled the Qs higher. That was a great R/R buy, particularly as the Nasdaq breadth was tracking considerably higher than the NYSE (50% upside vs. just 10% upside, respectively).

Now let’s see what side of yesterday’s range they push.

Upside Levels: $368-68.50, $370-$371, $373

Downside Levels: $364.50, $363, $360.50

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B. Now Add META, AVGO, UBER, CRM, AMZN, CVS and AMD.

INTC — Long from $33.75-ish, added at $32.10. We rarely add, but as mentioned on Friday, “In hindsight, ~$32 was a better buy spot than $33.50 to $34.”

Cost basis: ~$33

Have had several trims above our basis. Stops at Break-even or $31.75 hard. Those who stick with it, $34.50 to $35 is the next profit target.

DOCN — ½ position* at $38.25 — Able to make small trim at $39.75 to $40 and a second trim above $40.75 (near gap-fill and declining 10-ema).

Should be down to about a 50% to 60% position. Break-even stop.

13% pop yesterday, should have gotten investors another trim or two. $43.50+ and ideally, $45+

JPM — Retested the breakout zone — bulls can wait for a test of the 10-day before getting long. This is a long-term swing.

TLT — gap-filled at $99.65 — first trim is $100.75+, then $101.50 to $102. Can run a tight stop on this if desired, ~$98.

We are playing the support area & the gap-fill. If it doesn’t hold, the $95s, then $92s could be in play and we don’t want to get trapped in the pain trade.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders → (List is growing long!)

Growth stocks ARKK — DOCN, SOFI, UPST, SHOP

LLY, CAH

AI stocks — NVDA, AMD, AVGO, ADBE, SMCI

Mega cap tech — MSFT, AAPL, META, CRM

Select retail — CMG, ELF, LULU

Homebuilders ITB — TOL, KBH, DHI

BRK.B

ABEV, DXCM (nice breakouts)

Cruise stocks — RCL, CCL, NCLH

DAL, DT, AMAT

Relative weakness leaders →

PYPL

MET

CF, MOS

PFE

EL, FL, DG

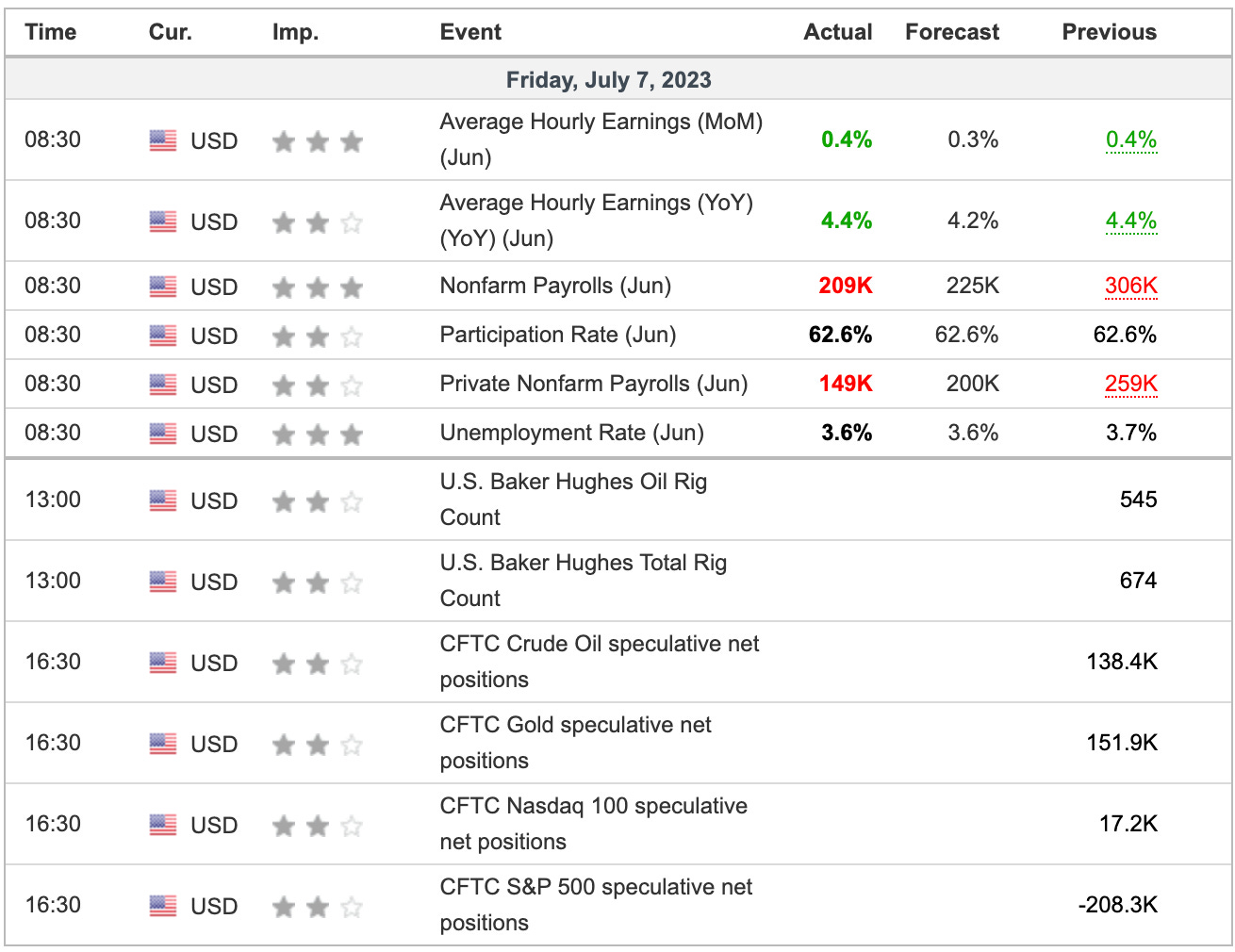

Economic Calendar

A mixed jobs report, as payrolls slightly missed expectations, but earnings were higher than expected.