Technical Edge —

NYSE Breadth: 44% Upside Volume

Advance/Decline: 40% Advance

VIX: ~$22.85

Folks, I know the action has been boring as of late, but it’s better to be milking modest gains out of the UUP/DXY and TLT than chalking up chop-losses left and right…right?

I think so. Our jobs as traders is to make money, not to stay busy.

Also, apologies on the late post. I had some trouble getting my charts in place today. Hope these are still able to help.

S&P 500 — ES

The ES is trapped in a box — or the penalty box — as the ranges continue to hold.

Keep 3803 written down. That’s last week’s low. So far, the bulls have kept the market from breaking down. Maybe it’s all the new-year flows keeping it up.

In any regard, the daily ranges have been key, so the weekly ranges will likely matter too. If we trade down to 3803, see if we can dance around it and bounce.

If we get a clean weekly-down rotation, it opens the door down to 3760.

On the upside, bulls need to clear 3849 — the Globex high — and the declining 10-day. That will put 3900 in play.

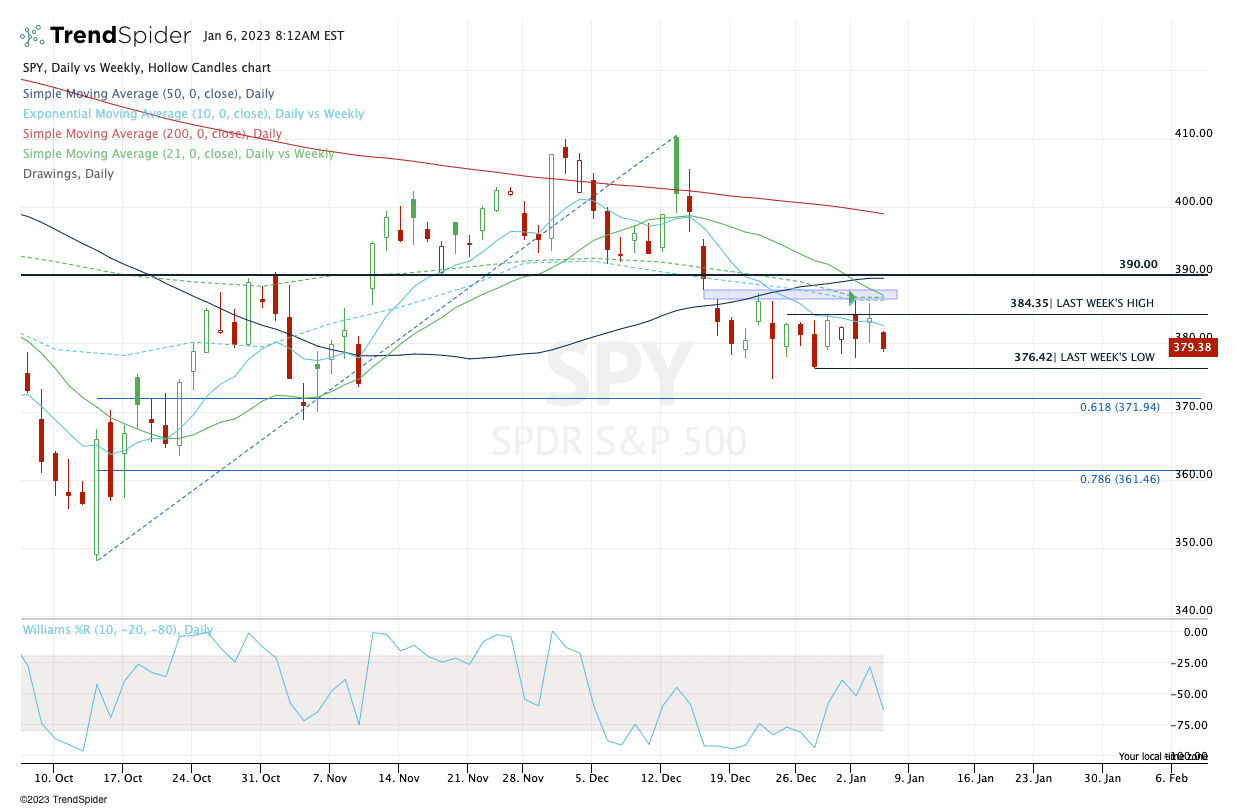

SPY

SPY closed daily-down yesterday and near the low of day.

On the upside, bulls want to clear $381.84 and the 10-day. That opens the door to last week’s high of $384.35, which so far is acting like a lid. So are the 10-week and 21-week moving averages.

On the downside, last week’s low of $376.42 is important. A gap-down open to this area could give us a cash-flow long, but if it’s a clean weekly-down rotation, $370 to $372 could be in play.

Individual Trades

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.