Monday's Gap Down Puts 2022 Lows at Risk

Despite the action, today's setup is one of the simplest of the year.

Technical Edge —

NYSE Breadth: 89% Downside Volume (!)

NASDAQ Breadth: 79% Downside Volume

VIX: ~$32.75

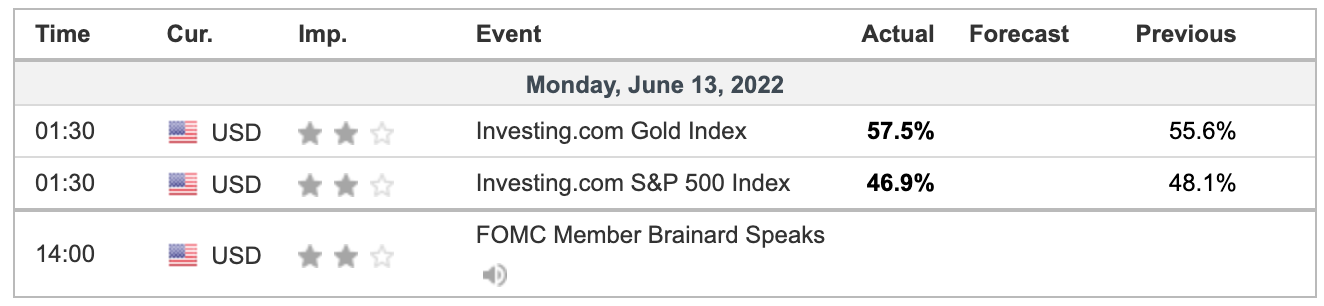

We do not have an easy line-up this week. Some of the key events still include the PPI report on Tuesday, retail sales and the Fed’s rate decision on Wednesday, and quad-witch expiration on Friday.

I will only be writing up the S&P today. Due to a family death over the weekend, I just don’t have the energy to write up anything else. The dollar looks set for a strong open, if longs want to trim some of their exposure into the pop.

Game Plan — S&P 500 (ES and SPY)

S&P 500 — ES

The ES is marked about 100 handles lower in the Globex session as I type, setting us up for a gap-down open. In the last four sessions, the S&P has coughed up 366 points.

Trading right near the 3807.50 low, we’ll need to see how it responds here. Does the ES undercut this level and bounce? Or will the next leg lower begin?

I can’t help but think about how poor sentiment is right now and the back-to-back 89%+ downside days on the NYSE.

3800 to 3807 is obviously pivotal. A break of that area and failure to regain it opens up considerable downside exposure, potentially all the way down to 3500 area.

If we get a break of 3807.50 and a reversal, the gap-fill level could be in play in the 3890s.

S&P 500 — SPY

The ES cracked to new lows, but the SPY isn’t there — yet.

Keep an eye on $380.50.

On such a high-octane day, I hate to make it sound so simple, but the reality is that it is. Either $380.50 in the SPY and ~3800 in ES is going to hold or it’s not.

We are either going to trade below the May low and break down even further or — like forcing a basketball under water and letting it go — we are going to bounce hard out of this pocket.

If we don’t bounce, we risk $380/3800 turning into resistance and opening up more downside. If we do bounce, it cements the importance of this price level as support and we figure out the upside.

$389 to $390 would be the first area to watch on the upside.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

DXY / UUP — Hit our second trim zone on Friday → Now looking for $28 to $28.10 on UUP and $105 on DXY. In a sea of red, the strong dollar trade has been a positive for us. Cheers

Relative strength leaders (List is cleaned up and shorter!) →

These are on watch for dip-buys:

XLE

AR

XOM

TECK

DLTR

AMD — watch $104.55 (monthly-up)

IBM (of all names)

DOW

ARCH

NVA

XLU

TMST

VRTX — trying for weekly-up this a.m.

AMGN

MRK

MCK

BMY