Technical Edge

NYSE Breadth: 81% Upside Volume (!)

Advance/Decline: 86% Advance (!)

VIX: ~$15 (On Friday it hit the lowest level since June 2021)

It’s hard to rush out and be a full-on bull on the open and through the day, particularly given the strong action we saw on Friday. A move above Friday’s high and a flush below it could put some short-term “risk-off” in play as we did have a strong finish on Friday. That said, I expect somewhat quiet action today.

This morning’s push looks like we should be able to make a small trim in SBUX. Our setup in bonds/TLT is still in play from last week (under “Open Positions”).

S&P 500 — ES

The ES burst over the 4242 area, which was major resistance since October. Bulls now want to see this level hold. On an intraday basis, we want to see 4275-ish hold as support.

Upside Levels: 4300, 4310, 4336, 4382

Downside levels: 4267-75. I would really like to see this area hold on the dip.

SPY

How do we like that $427.50 extension? From here, keep an eye on Friday’s high. Above it puts the 61.8% retrace of the bear-market range in play at $429.61.

Upside Levels: $428.75, $429.50 to $430

Downside Levels: $425.75 to $426.25, $425

Those are the downside levels in the SPY. The first levels is the H1 10-ema and the 50% to 61.8% retrace zone. The second level is the 78.6% retrace, one of my favorites, (but I doubt to see that today).

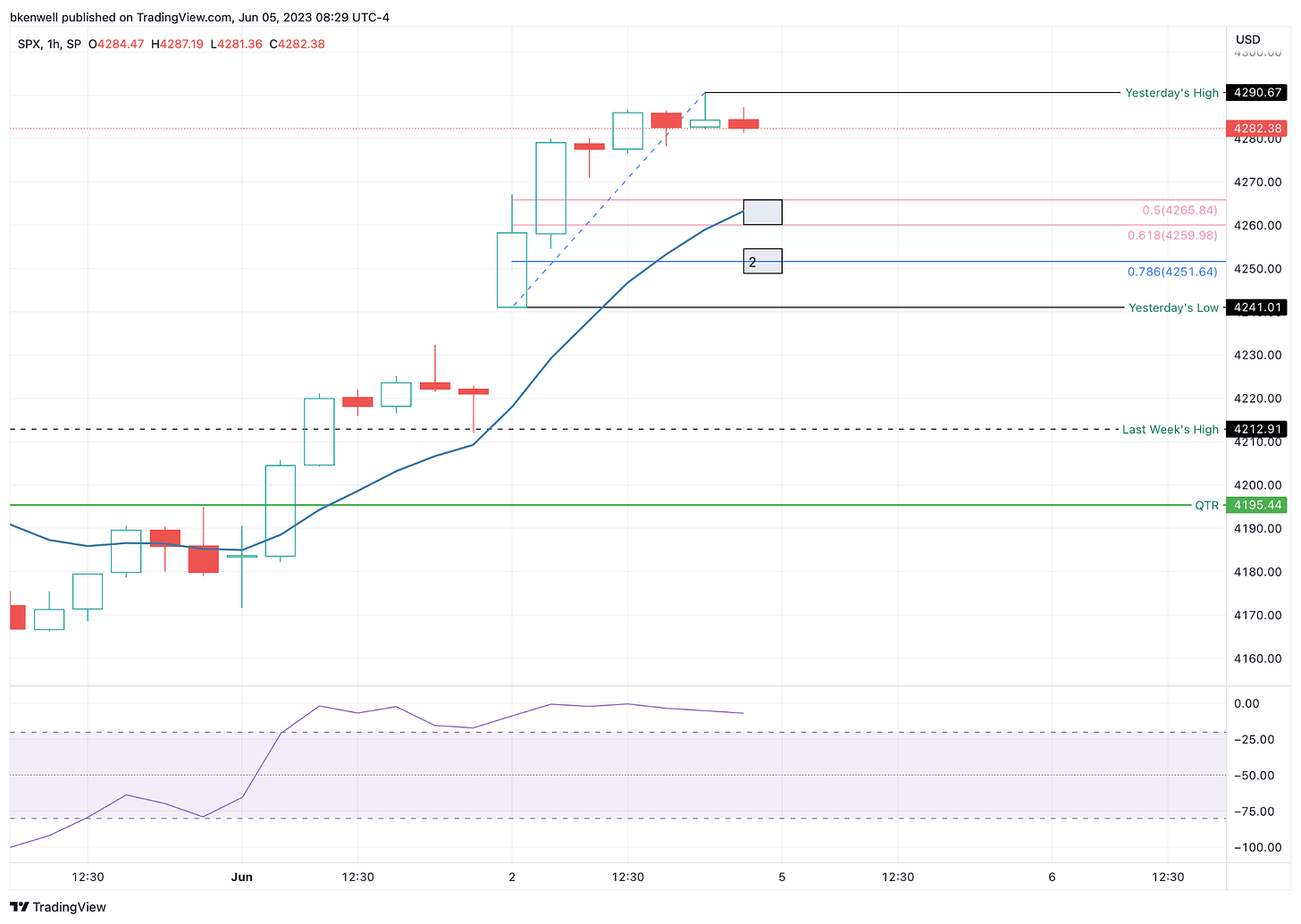

Here’s what it’s like for the SPX:

SPX

Upside Levels: 4290, 4311, 4321

Downside Levels: 4260-4266, 4250

NQ

I would like that 14,200 to 14,250 area on the NQ. AKA prior support + the 10-day ema. Friday’s range could contain any meaningful move today, so watch 14,628 on the upside and 14,468 on the downside.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.