Technical Edge

NYSE Breadth: 54.5% Downside Volume

NASDAQ Breadth: 53.2% Upside Volume

Man, what the hell do we say about that session?! The market was puking lower and lower and lower and…

Then finished green?

That’s so incredible — so incredible in fact:

Yesterday, I said:

“A gap-down open at least gives bulls a chance to push the momentum back the other way. That’s rarely the case on a gap-up, as the sellers really lean into the indices and erase the gains.”

That being said, yesterday’s action is not exactly what I had in mind when I wrote that — I absolutely did not expect the market to finish green on Monday. Not a chance. Downside breadth was running at about 94% downside volume on the NYSE shortly after 12 p.m. on the day.

The question now becomes, how much of this rally sticks? The S&P and Nasdaq futures are down about 1.5% as of 9:30 p.m., but we’ll have to see how they’re trading in the morning. UPDATE: About the same to slightly worse (7:00 a.m.)

At Monday’s low, the Nasdaq was down about 18.5% from the highs and the S&P was down 12.4%. In my opinion, the markets are adjusting to the Fed’s planned rate hikes and more hawkish stance.

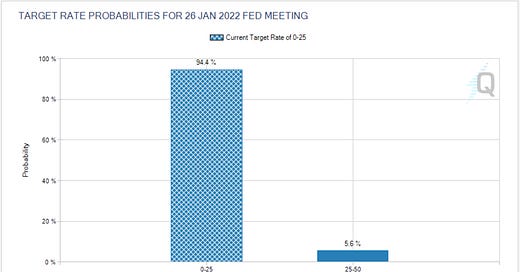

For what it’s worth, the expectations are not for a hike on Wednesday, but for a hike in March.

Game Plan

“The further the S&P goes in one direction, the tighter the rubberband gets — eventually we’ll likely see a snap-back rally.”

That was from yesterday and it absolutely proved true. Again, I’m not pounding my chest and saying I expected a green finish in the market — I didn’t — but I can’t say I’m surprised by a face-ripping rally.

I hate saying this — I really do — but today’s action makes it tough to navigate, because the risk levels are now so wide vs. the recent lows in most assets. A gap-down doesn’t make it easier.

We are in the reaction business, not the prediction business. If a trade comes across that’s a juicy R/R with reasonable odds, by all means give it a try (especially with a smaller position size!) But now is not the time to force trades if they’re not there. I have no shame in saying I’m sitting twice as long, passing on twice as many trades and only looking for the good ones that come by.

If we had a gap-up, we could honestly start sniffing for some short trades into resistance. But so far we have a massive rally off the lows and now a big gap down. Not easy.

I was hoping the market would be somewhat calm as I came to visit with @MrTopStep but clearly the ES and SPY couldn’t contain themselves.

S&P 500

Yesterday we were looking for the SPY to find support somewhere between the Q4 low and the 50-week moving average. While it overshot these levels intraday, it ended up holding by the close.

As for the SPY, I’m still keeping an eye on last week’s low at ~$438. If we happen to open above that level (not looking likely as of now) and lose it, it could open up the SPY for more downside.

Below last week’s low (and the 50-week), and I think the Q4 low at $426.36 has to be on our radar. Below it puts Monday’s back low in play.

When levels break in this type of tape, there is only one way to play: Buy the reversal if we get a quick reclaim or get the hell out of the way.

On the upside, I’m watching the 200-day. If we can go daily-up and reclaim the 200-day, it becomes a question of how far can we go?

$450 sounds like it might be a stretch, but it would send the SPY back to its prior support zone from November and December and it’s the 50% retracement of the current range.

Nasdaq

As for the Nasdaq, you can see how Monday’s rally is being greeted. Back below the Q4 low now, we have to see if it can reclaim this level.

On the upside, a daily-up move could put the declining 10-day and 200-day back in play, and/or the ~15K level. If the Q4 low is resistance on the upside, it could set us up for more downside.

The risk range here is incredibly wide thus far.

Individual Stocks

XOM gave us a decent trade off the open, going 2:1 on our R/R, but soon rolled over with the rest of the market. Energy overall did pretty good in the afternoon, but what didn’t do good yesterday?

I want to keep an eye on

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.